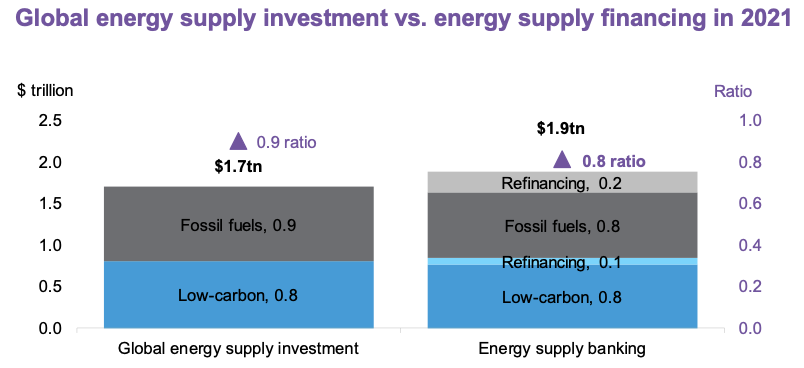

In 2021, banks financed 81% as much low-carbon energy supply as fossil fuels – for every dollar of bank financing activity supporting fossil-fuel supply, 0.8 supported low-carbon energy. While financing is a different metric to capital invested, this ratio broadly reflected real-economy investment activity at 0.9:1.

Download the summary report here.

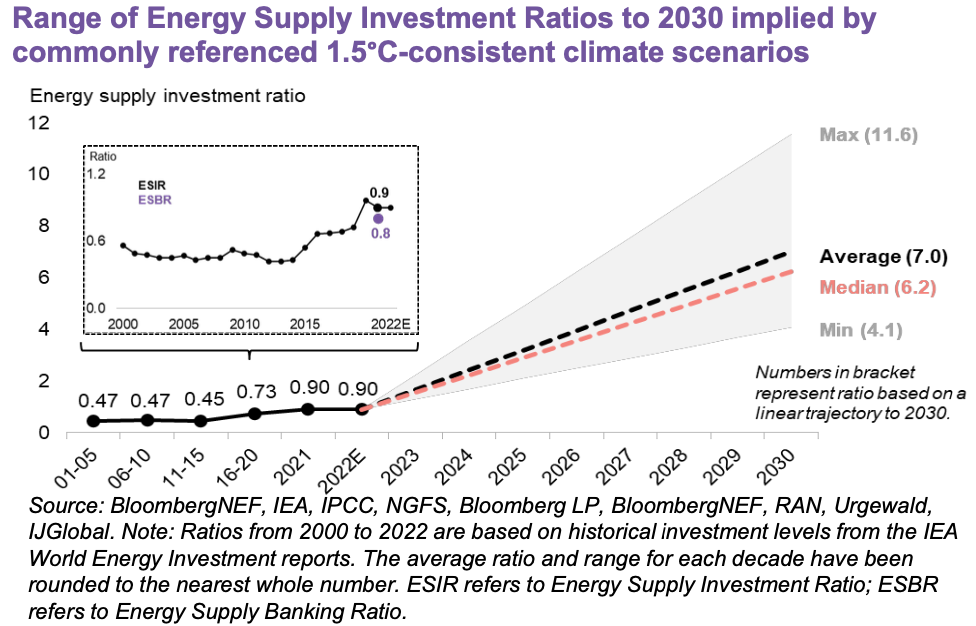

The pace at which low-carbon energy supply is scaled up will dictate the rate at which fossil fuels are phased down. The most frequently referenced climate scenarios indicate that, on average, to adequately displace fossil fuels to limit the average global temperature rise to no more than 1.5°C, we need to increase the Energy Supply Investment Ratio (new investment in low-carbon to fossil-fuel supply) from the current ~1:1 to a minimum of 4:1 by 2030. This means for every dollar invested in fossil fuel supply in 2030 this should be matched with four times as much being invested in low-carbon energy supply.

- In this analysis, we use existing public and commercially available data to assess banks’ energy sector financing activity in 2021 and its allocation between low-carbon supply and fossil fuels. By generating a ratio for this, we can approximate the extent to which banks’ financing activity is aligned to investment in the real economy and by extension to that needed by 1.5°C-aligned climate scenarios. To align the specifications across climate scenarios and financing activity, this analysis focuses on energy supply (the infrastructure built to extract, generate and distribute energy from fossil fuels or low-carbon resources) and differentiates this from energy demand (the consumption of energy through transportation, industrial or other energy use). This approach adheres to the definitions used to derive the 4:1 ESIR and enables a comparison between investment and financing. We conclude the following:

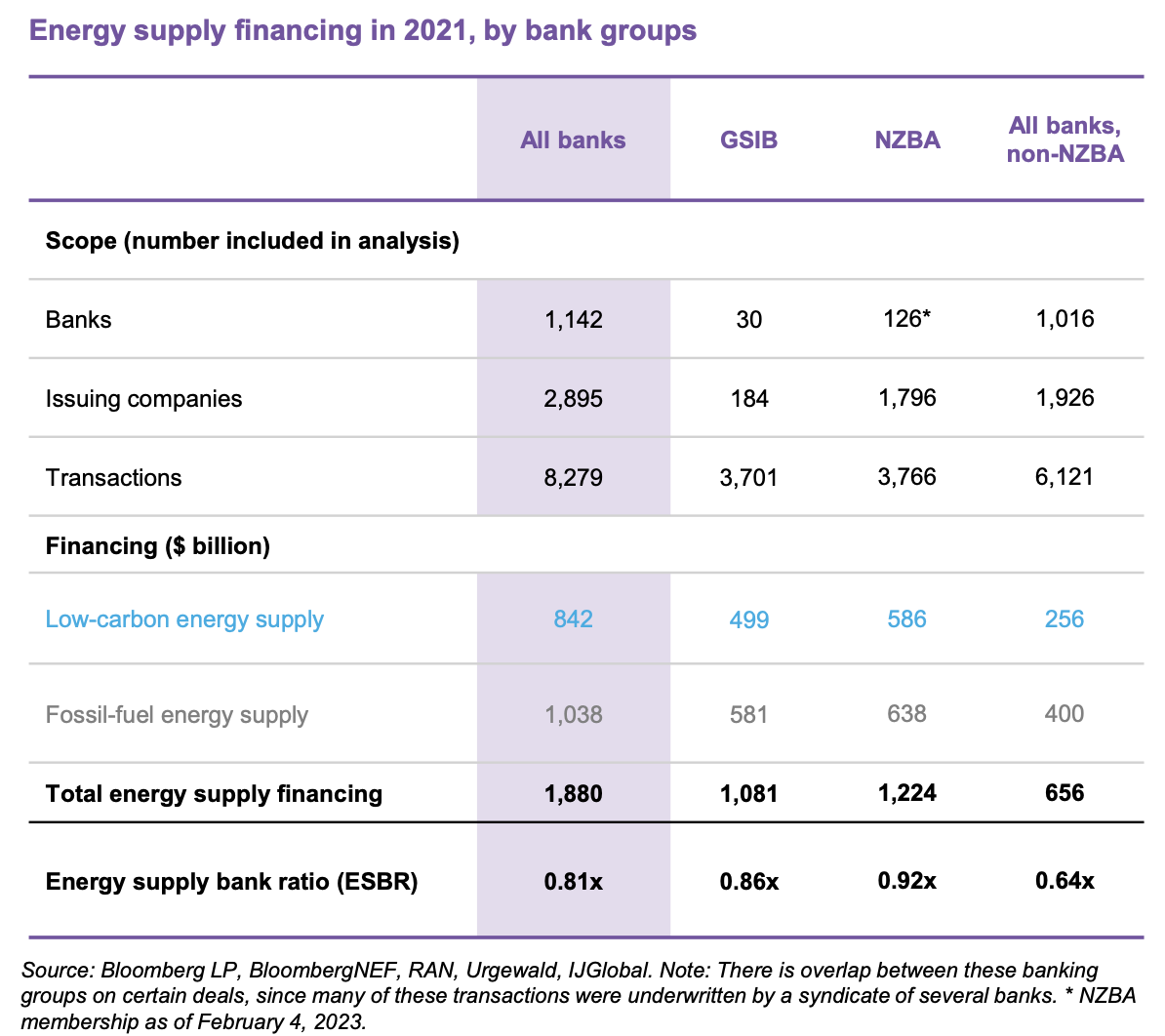

- At 0.8:1 the 2021 Energy Supply Banking Ratio, or ESBR, is broadly in line with that of the real-economy investment activity of 0.9:1. Bank financing for energy supply totalled $1.9 trillion. Of that, $842 billion went to low-carbon energy projects and companies, and $1,038 billion went to fossil fuels.

- Bank financing mainly goes to companies and projects in North America, China and Europe. The ESBR, varies between these regions with North America and China tied at 0.6:1, and Europe at 2.6:1. In part, this reflects the role that each region plays in global energy supply and consumption.

Different perspectives on the banking community

While this report aims to capture the whole universe of banking activity in 2021, several sub-groups are worth analyzing further:

- Global Systemically Important Banks (GSIB): This includes the 30 banks determined by the international Financial Stability Board to be of such “size, interconnectedness, complexity or lack of substitutability” that they are economically too big to fail. In 2021, GSIBs underwrote $1.1 trillion of energy supply transactions, with $499 billion being low-carbon and $581 billion for fossil fuels. This translates to an ESBR of 0.86:1.

- Net-Zero Banking Alliance (NZBA): This includes 126 banks* committed to reaching net-zero financed emissions by 2050 under the wider umbrella of the Glasgow Financial Alliance for Net Zero (GFANZ). In 2021, the NZBA collectively underwrote $1.2 trillion of energy supply financing, of which $586 billion was low-carbon and $638 billion for fossil fuels – an ESBR of 0.92:1.

- Banks not in the NZBA underwrote $656 billion of energy supply financing, with $256 billion being low-carbon and $400 billion for fossil fuels, giving an ESBR of 0.64:1.

Notable exclusions and uncertainties

Banks serve their clients in the energy sector in numerous ways not covered in this report. For example, tax equity (US only, ~$20bn p.a. in 2021 or ~10% of low carbon financing), serving as an arranger or agent on a debt issuance and others. Estimating adjustment factors is also constrained by data availability. We have sought to manage this through a prioritisation logic (see pages 8, 30, 31).