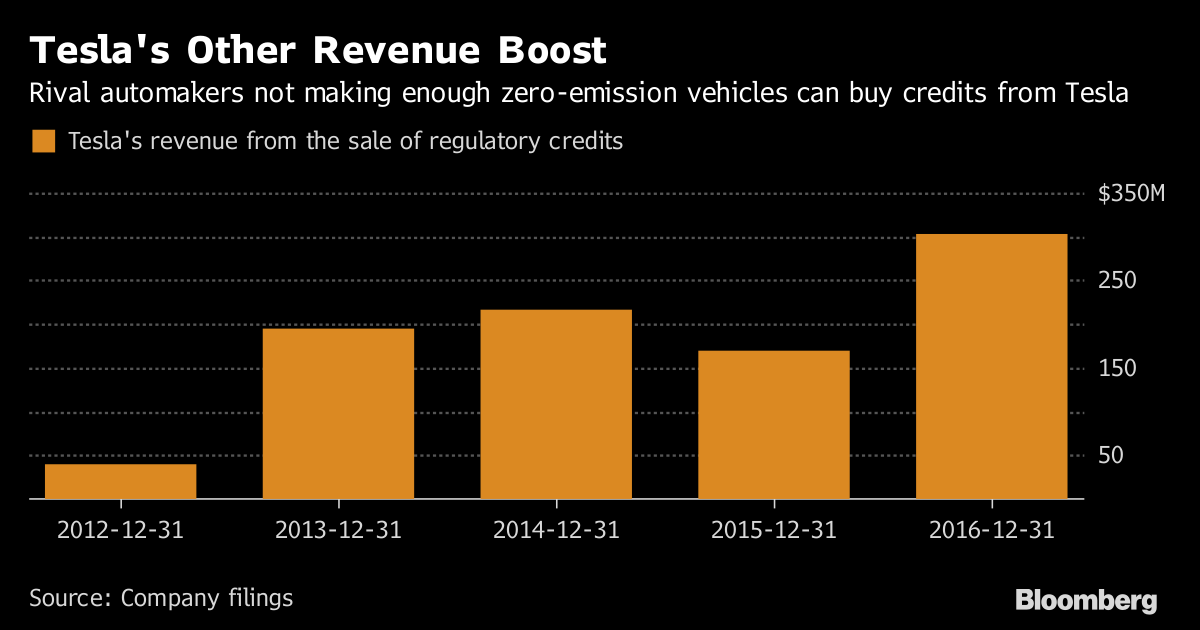

Tesla Inc. has generated nearly $1 billion in revenue the last five years from an unlikely source: Rival automakers. The payments are part of an unpopular system in California that’s poised to proliferate elsewhere.

California requires that automakers sell electric and other non-polluting vehicles in proportion to their market share. If the manufacturers don’t sell enough of them, they have to purchase credits from competitors like Tesla to make up the difference.

Tesla, which exclusively sells battery-powered models, sold $302.3 million in regulatory credits last year alone. China and the European Union — two of the world’s biggest auto markets — are considering mandates and credit systems similar to California’s. If California is any guide, automakers will resent having to buy from peers, including the electric-car maker led by Elon Musk.

“It really makes them mad that Tesla got so much of a boost out of being the only purely electric car manufacturer out there,” Mary Nichols, the chair of the California Air Resources Board, said in an interview Friday at Bloomberg’s headquarters in New York. “In effect, they helped to finance this upstart company which now has all the glamour.”

For all the flack California has taken from traditional carmakers for how its mandate system has benefited Tesla, Musk also has been a critic. Tesla’s chief executive officer last year said the Air Resources Board was being “incredibly weak” and called its standards “pathetically low.” Rules should be tougher and the credits should be worth more, he said.

“Nobody’s happy,” Nichols said. “That’s my mantra.”