London, December 3, 2024 – European governments face an uphill battle if they are to deliver rapidly approaching and legally binding 2030 climate goals, according to New Energy Outlook: Europe, a new report published today by research provider BloombergNEF (BNEF).

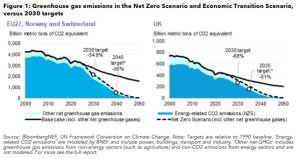

BNEF’s base-case ‘Economic Transition Scenario’, which describes how the energy sector evolves as a result of cost-based technology changes, assuming no additional policy interventions are made, sees the European Union and UK both widely overshooting their end-of-decade emission goals. Energy-related CO2 emissions breach 2030 targets for all sectors by over 200 metric million tons, or a 9% overshoot across the region.

“To avoid blowing past its climate goals, Europe will also need to make progress in tackling other net greenhouse gas emissions, from sectors like agriculture, land-use change and waste,” said Emma Champion, lead author of the report. “When we account for emissions beyond CO2 from the energy sector, the overshoot risk for 2030 climate goals is even larger, potentially as much as a 29% overshoot.”

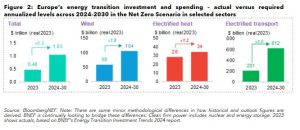

Europe has made some of the strongest progress among major economies to date in reducing energy-related emissions from their peak. But it still needs to more than double investment in energy transition-related activities to an average of $1 trillion every year until 2030, to close the gap to its targets and be on track for net-zero emissions by 2050.

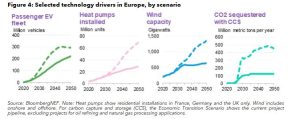

Under BNEF’s Net Zero Scenario, in which the energy economy fully decarbonizes by 2050 and aligns with the climate goals of the region, renewable energy investment must rise 23% from 2023 levels, while electric vehicle sales and charging infrastructure spending has to triple.

Major changes are underway in European energy markets, regardless of climate goals

Disruptive changes, driven by economics and policy, are already underway across European energy markets. The region saw record levels of investment in the energy transition in 2023 in the wake of the energy crisis, boosting the outlook for clean technology deployments.

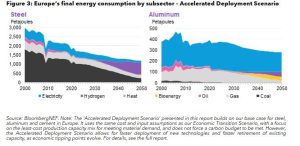

In BNEF’s base case, installed wind and solar capacity more than double by 2030, reaching 50% of total power supply. Meanwhile, coal collapses to just 1% of the generation mix by 2028, from around 11% today. Strong sales in BNEF’s outlook also drive EVs to comprise more than half of Europe’s total passenger vehicle fleet by 2040, and these vehicles increase Europe’s electricity demand by 30% by 2050 from 2024 levels. These changes drive over 90% of cumulative emissions abatement through mid-century in BNEF’s base case.

New regulations and carbon market reforms have also improved the outlook for cleaner fuels in Europe’s transport sector and for clean production capacity in industry. For example, emissions standards under the FuelEU Maritime regulation, alongside carbon pricing, increases the use of lower-carbon marine fuels in BNEF’s base case, with methanol derived from low-carbon hydrogen becoming the least-cost option for routes within Europe from the early 2030s.

Rising carbon prices also shift European steel production away from blast furnaces towards hydrogen-based direct reduction and electric arc furnaces. In addition, they support the case for aluminum recycling capacity to switch to low-carbon hydrogen, and even for cement producers to use either biomass or clean electricity coupled with carbon capture and storage, according to BNEF modeling.

Fully decarbonizing the energy system by 2050 is the bigger lift

In BNEF’s Net Zero Scenario, electrification of the end-use economy is crucial and, together with clean power, drives two-thirds of total emissions abatement across the region over 2024-2050. This is because much of Europe’s emissions today come from fueling cars and trucks, and heating buildings, which can most economically be decarbonized by switching to clean electricity.

However, carbon capture and storage is also a critical driver, with capacity ramping up more than 100-fold to over 360 million tons per year by 2035, and providing 14% of cumulative emissions abatement until 2050, especially helping decarbonize the backup power mix and some industry.

There is still a disconnect between what is needed in terms of technology deployment and real-world bottlenecks. Europe’s wind capacity exceeds 1.3 terawatts by 2050 in the Net Zero Scenario, double that of the base case. But the sector faces heavy challenges with permitting delays in key markets, including Italy, which may limit the delivery of scale needed, even if the technology is one of the cheapest options for decarbonizing power supply.

Carbon capture and storage faces similar challenges. The capacity required in the Net Zero Scenario would require an 8.5-fold increase in investment in the technology from 2023 levels for the rest of this decade, backed by a solid enabling environment to drive up commercialization and deployment.

This research forms part of a series of regional and sector reports diving deeper into results from BloombergNEF’s global New Energy Outlook report. Reports summaries are available at about.bnef.com/new-energy-outlook-series.

Contact

Oktavia Catsaros

BloombergNEF

+1-212-617-9209

ocatsaros@bloomberg.net

About Bloomberg

Bloomberg is a global leader in business and financial information, delivering trusted data, news, and insights that bring transparency, efficiency, and fairness to markets. The company helps connect influential communities across the global financial ecosystem via reliable technology solutions that enable our customers to make more informed decisions and foster better collaboration. For more information, visit Bloomberg.com/company or request a demo.