Coal-fired generation to get squeezed from the country’s power system by 2032 thanks to lower-cost renewables and carbon costs: BloombergNEF

London, February 6, 2023 – Coal burn in Poland’s power system is poised to drop to negligible levels by 2032 thanks to the fuel’s deteriorating economics and the effects of Europe’s carbon-emissions trading scheme, according to a new BloombergNEF report. The Poland Power Transition Outlook 2023 also highlights the prominent role renewables are poised to play in the country’s power mix over the next decade.

Poland is one of Europe’s most polluting and coal-heavy electricity markets, and the current energy crisis has driven a returned reliance on the fuel, but the new report suggests this resurgence will be short-lived. The report explores multiple future scenarios and finds that even in a world where natural gas prices remain persistently high, coal generation falls rapidly, with growing electricity demand met by output from cheaper renewables and grid-scale batteries.

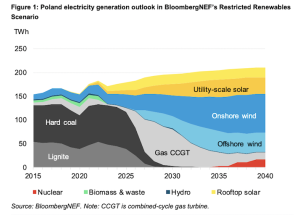

Poland’s successful clean energy transition is essential to meeting Europe’s climate goals. BNEF’s analysis finds that coal’s decline in Poland will be driven by rising carbon prices, favorable economics for renewable energy generation and gas-fired power plants, and the country’s unprofitable and aging coal fleet. Economics will drive an almost complete coal phase-out in Poland before 2038, with only one unit remaining online in 2040 as a backup to meet winter peak demand. BNEF’s “restricted renewables scenario” also projects Poland to have 3GW of nuclear power online by 2040. With one coal unit remaining, coal-fired power would meet less than 1% of annual power demand in 2040 in this scenario (Fig.1).

“Gas becomes cheaper than coal in just five years, even if carbon prices track below expectations and gas prices track above them,” said Felicia Aminoff, energy transition analyst at BNEF and lead author of the report. “Supportive policies for onshore wind and solar could lessen Poland’s reliance on natural gas by 2030. Delayed investment in zero-carbon energy sources will result in higher overall system costs in the long term as Poland advances its transition.”

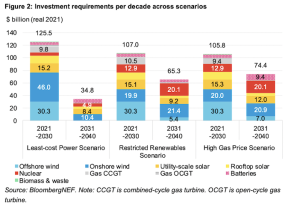

BNEF analysis highlights the enormous economic and investment opportunities Poland will reap in the transition to lower-carbon power. In BNEF’s “restricted renewables scenario”, Poland’s wind and solar capacity will more than triple to 71GW by 2030 – up from 21GW in 2022 – displacing coal and gas generation from the mix. This target far exceeds the Polish government’s current goals for clean energy deployment and presents a $160-180 billion investment opportunity for new clean power generating capacity by 2040 (Fig.2).

“Good data leads to transformative solutions, and this report shows that the transition from coal in Poland is inevitable and possible,” said Antha Williams, who leads the global climate and environment program at Bloomberg Philanthropies. “A cleaner and more sustainable energy system will address energy security challenges and present significant economic and investment opportunities for the country with the build-out of local clean, resilient, and reliable energy supplies.”

However, Poland’s transition to lower-carbon energy is hardly guaranteed. Construction of onshore wind projects there is currently restricted by the “10-H” minimum distance rule, which makes it nearly impossible to obtain wind farm build permits. Changing the 10-H could boost renewable build pre-2030 and lower overall electricity prices. As 10-H remains on the books in Poland, opportunities for onshore wind development there remain uncertain; BNEF recently lowered its central 2030 onshore wind forecast for the country to 13GW from 17GW previously on the assumption that minimum distance rules remain in place.

The new analysis also reveals the significant risks and costs Poland could face if the transition from coal is not well planned or timely managed. Amid the pressure of rising carbon prices, a slower build-out of onshore wind capacity would create greater reliance on natural gas imports. This would be more costly to Polish consumers and boost CO2 emissions. BNEF projects that by 2035 renewables, batteries, and nuclear will generate enough energy to leave gas plants underutilized. This results in gas plants having a short window of time to recoup investment costs through energy market revenues.

Growing electric vehicle and heat pump use will also impact Poland’s power sector transition with significant changes in electricity demand. Heat pump uptake in Poland reached record levels in 2022 as homes switched from coal boilers to electricity-based heating. An acceleration in this trend means the Polish grid must prepare for cold winter evenings, when wind and solar generation could be low and dispatchable generators, including coal, gas, nuclear, or energy storage, are needed.

Electricity generation accounted for 35% of Poland’s greenhouse gas emissions in 2020. BNEF’s scenarios see Polish power sector emissions fall 64-87% by 2030, depending on the evolution of gas and carbon prices and the scale-up of clean energy capacity. The government is currently preparing an update to its “PEP2040” national energy strategy, aiming for a release in 2023.

The full report is publicly available at this link.

Media Contacts

BloombergNEF: Oktavia Catsaros

ocatsaros@bloomberg.net