Outnumbered and outflanked, Freeport-McMoRan Inc. Chief Executive Officer Richard Adkerson made an about-face.

Only months before, Adkerson had dismissed the idea of selling a majority stake in the Phoenix-based company’s flagship Indonesian copper-and-gold mine to local investors. But, seated beside government officials in Jakarta last week, the veteran executive told reporters he planned to do just that.

Richard Adkerson

“Freeport caves to govt demands” headlined The Jakarta Post while the Indonesian Energy and Mineral Resources Ministry tweeted its glee: “Freeport obedient, Indonesia is sovereign” and posted pictures of Adkerson, conspicuous in gold-and-black batik alongside triumphant local officials.

That image — a red-faced American CEO in a tropical shirt furiously back peddling — may come to haunt not just Adkerson but his cohort of multinational CEOs. Freeport’s loosening grip on its Indonesian crown jewel illustrates a larger challenge facing the global mining industry: In a surge of economic nationalism, local governments and unions are pushing back against Western dominance of the world’s natural resources.

“We’re seeing the rise of more nationalistic governments everywhere,” said Paul Mitchell, a partner at Ernst & Young’s mining and metals practice. “That desire to hold the assets of a nation and work on them themselves, I think is only going to rise as we realize they’re becoming scarce, and are only going to become more scarce.”

Mongolia to Zambia

In the past year, a merger between Harmony Gold Mining Co. and AngloGold Ashanti Ltd. stalled in South Africa because of regulations meant to increase black ownership of natural resources.

In Mongolia, calls for greater control of such valuable commodities have dominated the national election, while an attempt to force foreign miners to channel sales revenue through local banks threatened Rio Tinto Group’s operations and almost derailed an IMF bailout.

Last year, Freeport’s attempts to sell its share of a copper-and-cobalt mine in the Democratic Republic of Congo were stalled for eight months, ending only when the company made a $33 million exit payment to the government, a third of a settlement involving several companies.

In Zambia, Glencore Plc, a Baar, Switzerland-based miner and commodities trader, threatened to fire 4,700 workers after the government raised power prices — and then turned off the switch — before agreeing to pay, the president’s office said. First Quantum Minerals Ltd. had earlier agreed to higher tariffs, according to the government.

In Tanzania, gold miner Acacia Mining Plc., majority owned by the world’s largest gold producer, Canada’s Barrick Gold Corp., is facing a tax bill on its gold mines equal to four times the country’s GDP and a demand from the president that it “seek forgiveness in front of God and the angels.”

Super Charged

“Governments start seeing companies making more money and, around the world, start seeing other ways of getting more out of it,” Adkerson told analysts during Freeport’s second quarter earnings call in July. Those government disputes, as well as more strikes and aging mining equipment, will disrupt metal supplies and “super charge” prices, he said.

To be sure, some developing nations are becoming more welcoming of foreign mining companies. In Latin America, for example, Argentina and Ecuador have adopted more investor-friendly rules in a bid to exploit their vast mineral potential.

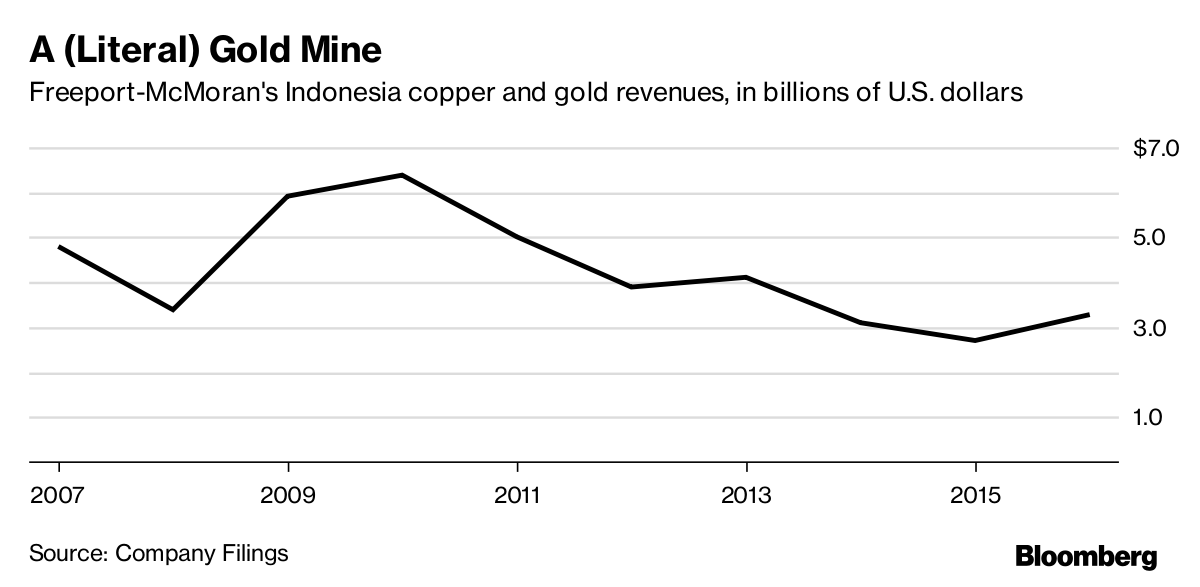

Still, a decade-long boom in copper prices, which peaked in 2011, has made many governments increasingly eager for a piece of the mining action. Prices retreated, reaching their low in early 2016 and have since partly rebounded. Copper on the London Metal Exchange traded Tuesday at a three-year high, and advanced 0.5 percent to $6,958.50 a ton at 4:59 p.m. in Sydney.

“People perceived companies to be making very large windfall profits, notwithstanding the fact that many companies’ costs also increased amid higher commodity prices,” said Gus MacFarlane, vice president of mining and metals at Verisk Maplecroft, a research firm that focuses on reducing corporate risk.

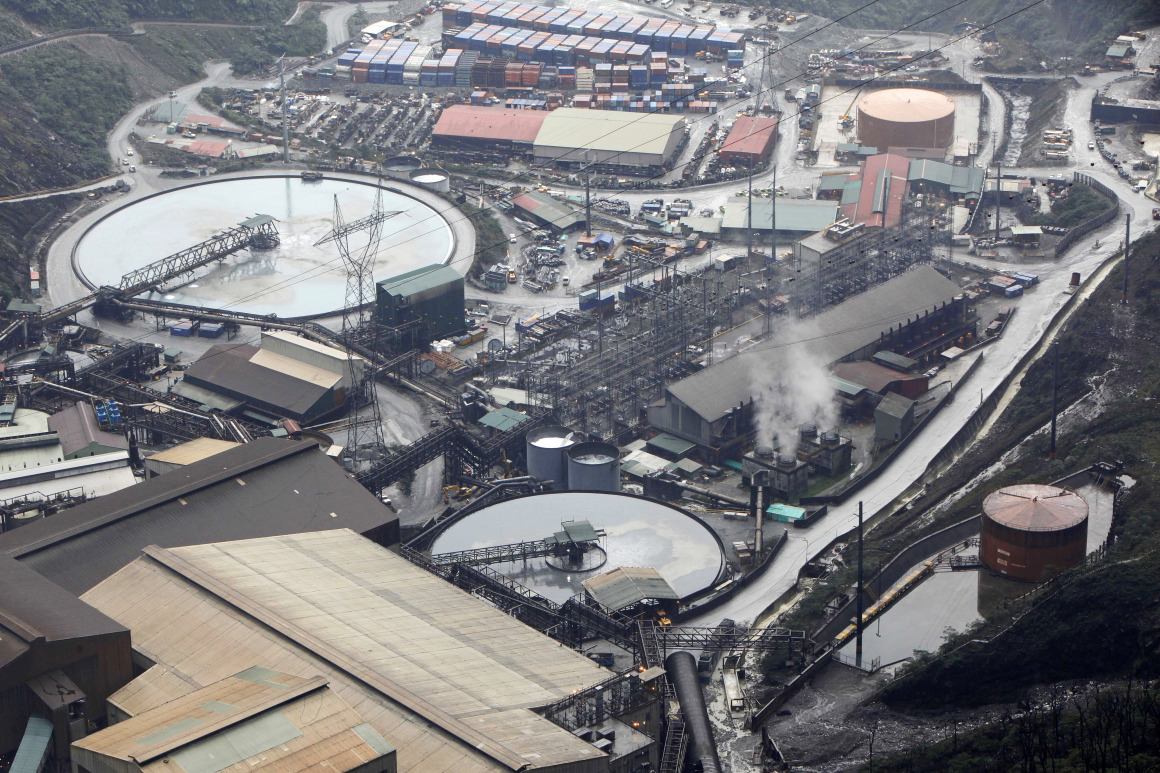

Freeport McMoRan’s Grasberg copper and gold mining complex in Papua province, Indonesia.

Freeport’s Indonesian operations have always been lucrative and tough to manage. Rain forests surround its flagship property in Papua, the largest and most remote province in Indonesia. Grasberg means “grass mountain” in Dutch. (The Netherlands colonized much of Indonesia.)

Viewed from above, Grasberg’s gaping maw dwarfs nearby Puncak Jaya, the highest mountain in Indonesia. Freeport’s largest mine, it represented roughly a fifth of the company’s $14.8 billion revenue last year and produced more than a billion pounds of copper and a million ounces of gold.

Since its early dealings with President Suharto, the company has been the target of local separatist and indigenous groups, as well as international environmental and human rights organizations. Freeport has relied on the military to protect operations from riots and violent protests. In 2011, the authorities fired on striking workers, killing one.

“Since then, the union has not been shy about making strong demands and backing it up with industrial action,” said Adam Lee, director for campaigns for Geneva-based IndustriAll, an umbrella group for unions.

Today, workers at Grasberg are entering month five of what they consider a strike. Freeport describes it differently, saying that 4,000 workers have “voluntarily resigned” after being asked to refrain from high rates of “absenteeism.”

Given this environment, Fraser Institute, a Canadian think tank, ranked Indonesia 99th out of 104 mining jurisdictions in terms of investor perception of the favorability of government policies.

Adkerson, who is 70 and has worked for the company’s various incarnations for more than two decades, must now negotiate the terms of Grasberg’s divestment with the Indonesian government. The two sides still need to agree on the price that local investors will pay Freeport to reduce its stake from 81 percent to 49 percent.

For now at least, Freeport intends to keep operating the mine. But, someday, improved technology may let national governments run mines essentially on their own, cutting out the Freeports of the world almost entirely, according to Ernst & Young’s Mitchell.

“I wonder if what we’re starting to see is governments realizing that, and starting to agitate in preparation,” he said. “Is the increase in nationalism just nationalism or is it governments thinking: we don’t actually need the mining companies anymore?”