This article first appeared on the BNEF mobile app and the Bloomberg Terminal.

- Resource adequacy accounted for 48% of revenue in 2017

- Coal supplied 2% of region’s power versus 12% in 2005-2010

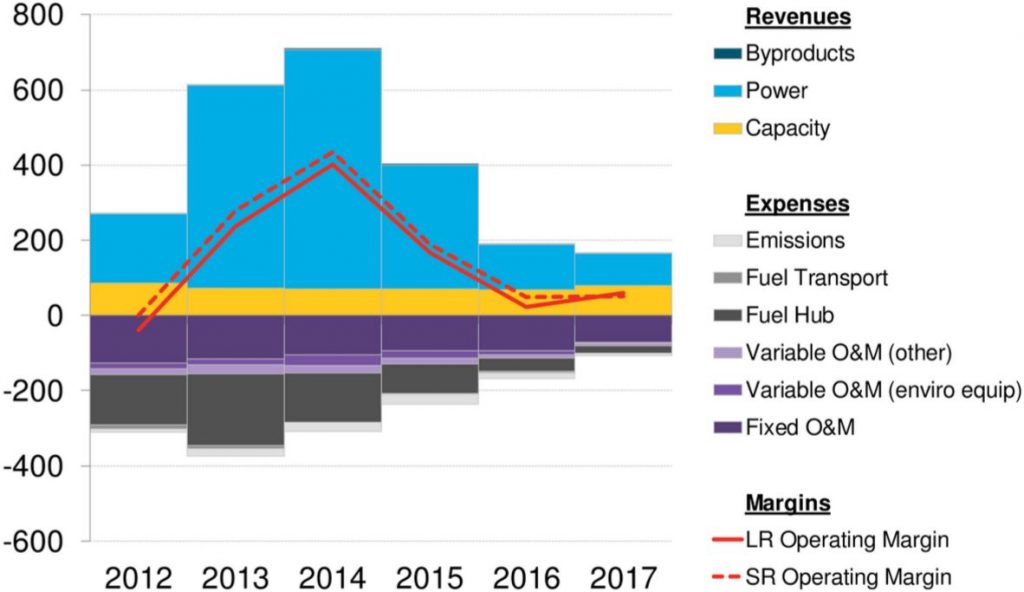

New England coal revenues, costs and operating margins ($/MW-day)

Source: Bloomberg New Energy Finance

Falling power prices in the U.S. have furthered coal plants’ reliance on Resource Adequacy payments to turn a profit. This trend is most apparent in New England, where capacity payments made up 48% of total revenue to coal in 2017. Diminishing profitable generating opportunities force New England coal to rear its head only for brief spurts of high prices. Coal supplied just 2% of the region’s electricity in 2017, down from pre-shale era averages of 12% (2005-10). New England coal posted positive short-run operating margins in 2017 ($51/MW-day) by virtue of power price spikes and capacity earnings. This reflects a 5% growth in margins from 2016, driven entirely by capacity revenue.

BNEF clients can see the full report, “Half of U.S. Coal Fleet on Shaky Economic Footing”, on the Terminal or on web.

BNEF Shorts are research excerpts available only on the BNEF mobile app and the Bloomberg Terminal, highlighting key findings from our reports. If you would like to learn more about our services, please contact us.