By Richard Chatterton, Daisy Maugouber, and Sisi Tang

Oil Demand Team

BloombergNEF

Oil refining is a key element of the global energy system. Oil demand is likely to exceed 100 million barrels per day (MMbd) in 2019, and almost all of this takes the form of refined products such as gasoline and diesel.

Refiners earn a margin from the difference between the prices of crude oil and oil products – the ‘crack spread’ – and must take a view on future oil product supply and demand trends as they plan investments in new capacity. Global refining margins have fluctuated around $5 per barrel for the past two decades, creating a value pool of up to $250 billion per year for the downstream oil sector.

Historically, downstream investment has been driven by growth in demand for road fuels. Over the past decade, such growth in Asia and China, in particular, has underpinned global refinery capacity expansion.

Looking forward, refiners are faced with a more challenging and complex market. Demand growth across different products is beginning to diverge, and significant capacity additions in Asia and the Middle East will impact margins and trade flows for fuels and petrochemicals. In addition, growth in crude supply is shifting increasingly toward lighter, sweeter grades that will impact refiners’ profitability and the investment case for plants designed to process heavy crude grades. Amid all of these uncertainties, modernization and digitalization of the sector is moving from a choice to an imperative.

BloombergNEF’s downstream oil coverage team sees the outlook for the industry being shaped by five major forces that refiners must incorporate into their strategic planning:

- Shifts in product specifications, and demand for different products: The introduction of fuel quality and emission standards, as well as shifts in demand, will require refiners to invest in upgrading and conversion units to meet changing demand trends for different oil products.

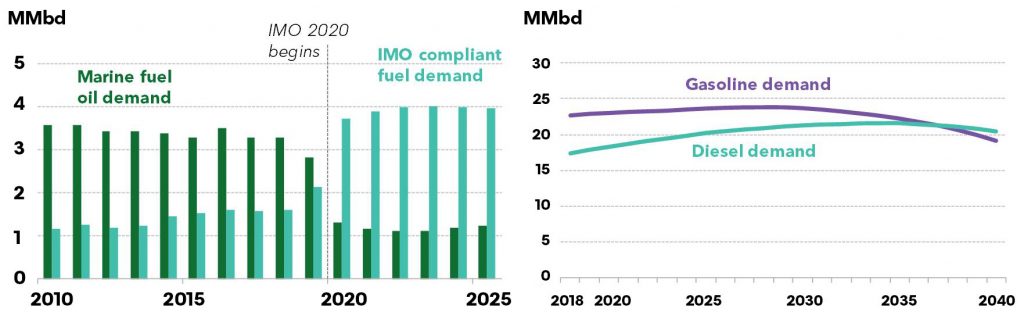

- Marine fuels: The biggest near-term uncertainty for refiners is the implementation of the IMO sulfur cap reduction on ship fuel, from 3.5% to 0.5%, which comes into force from the start of 2020. As universally used high-sulfur fuel oil will no longer be compliant, this will trigger a considerable shift in demand as the shipping market migrates to new, compliant fuels.

- Road fuels account for around half of all oil product demand. Electrification of passenger cars and increased uptake of alternative drive-train technologies for commercial vehicles (such as LNG and hydrogen) poses a risk to the demand outlook for gasoline and diesel. We expect this trend to have a growing impact on refined product demand over the next 10-20 years, forcing refiners to reduce fuel yields.

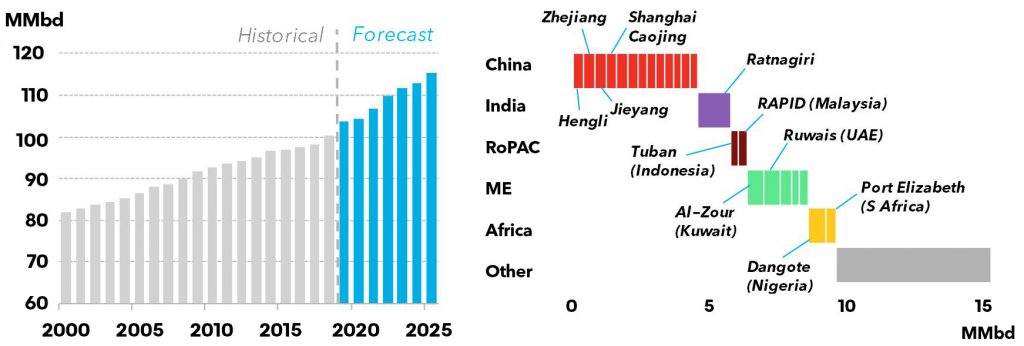

- Significant increases in capacity across Asia and the Middle-East: Major downstream capacity expansion projects are coming online around the world. We expect global oil refining capacity to increase by 15% over 2018-25, reaching 116 million barrels per day (MMbd) in 2025. Total investment to 2025 will exceed $570 billion. Some 75% of new capacity additions will be in Asia Pacific and Middle East and two-thirds of capacity additions are ‘megaprojects’ (more than 300,000 barrels per day) being financed by national oil companies (NOCs). These new refineries will affect the competitiveness of different regions and potentially lead to shifts in global product flows and the closure of uncompetitive capacity.

- A greater integration of fuels refining with petrochemicals and polymer production: A greater integration of fuels refining and petrochemical production is a key theme shaping the outlook. Petrochemicals integration provides refiners with access to fast-growing chemicals markets and a natural hedge against weakening demand growth for gasoline and diesel. Over 60% of expected investment in Chinese projects is in integrated capacity. Integration of fuels and chemicals production will impact the economics of the downstream industry and could leave less integrated players unable to respond to changing market trends.

- Projected increase in global supply of light-sweet crude and natural gas liquids, or NGLs: The International Energy Agency forecasts that almost all incremental oil supply to 2040 will come from ‘tight oil’ and NGLs. The ‘lightening of the crude slate’ toward lighter grades will impact refiners’ profitability and damage the investment case for complex heavy-crude upgrading processes.

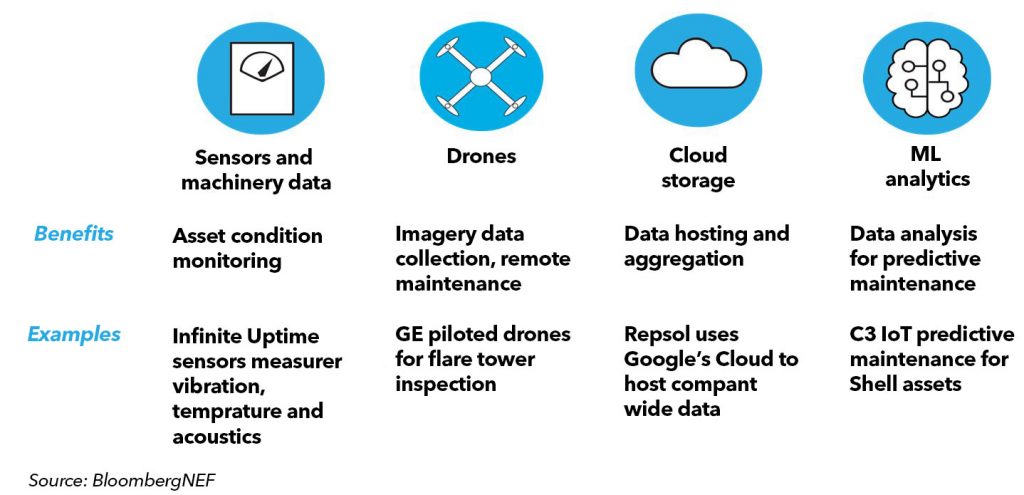

- Digitalization and modernization of the refining sector: Digital technologies are already reducing refining costs and process losses, but the modernization of the sector is moving from a strategic choice to an imperative, if players aim to remain competitive in the global market.

As demand for different oil products change, and the supply of different grades of crude becomes more abundant or scarce, refiners must adapt by upgrading their plants and investing in new conversion capacity. At the same time, refiners must stay ahead of the competition and fight for cost advantages and market position. We see the themes discussed here as creating winners and losers in refining, and shaping the future of oil markets.