This article first appeared on the BNEF mobile app and the Bloomberg Terminal.

- Producers made drastic cost cuts to adjust to new oil world

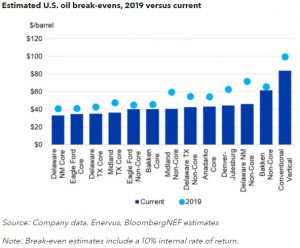

- Break-evens declined an average of $11.50 per barrel

This year has been rough for U.S. oil producers, with market prices declining by over $15 per barrel. In an effort to stay economically viable, they have managed to reduce break-even costs by an average of $11.50 per barrel in 2020 compared to last year, BNEF estimates.

Producers renegotiated contracts, optimized field operations and improved efficiencies to cut costs. Diamondback Energy’s well costs fell from an average of $1,100 per lateral foot in 2019 to $800, a 27% drop. Pioneer Resources’ lease operating expense dropped 22%, from $4.90 per barrel in 3Q 2019 to $3.80. Meanwhile, QEP Resources’ general and administrative expense declined 14%, from $3.50 last year to $3 in 3Q 2020.

Break-evens for new supply plunged on the back of these cost savings. BloombergNEF estimates producers lowered their average break-evens by almost 20% – from $56.50 per barrel in 2019 to $45 today. In the most productive oil regions (the core of the Permian and Eagle Ford plays), break-evens declined from an average of $44 per barrel to $36.50.

BNEF Shorts are research excerpts available only on the BNEF mobile app and the Bloomberg Terminal, highlighting key findings from our reports. If you would like to learn more about our services, please contact us.