This article first appeared on the BNEF mobile app and the Bloomberg Terminal.

- Fossil hydrogen with CCS currently cheaper than ‘green

- The opposite should be true by 2030 in all major markets

‘Blue’ hydrogen production facilities — those that use fossil fuels with carbon capture and storage (CCS) — may be cost-competitive for only a limited period of time.

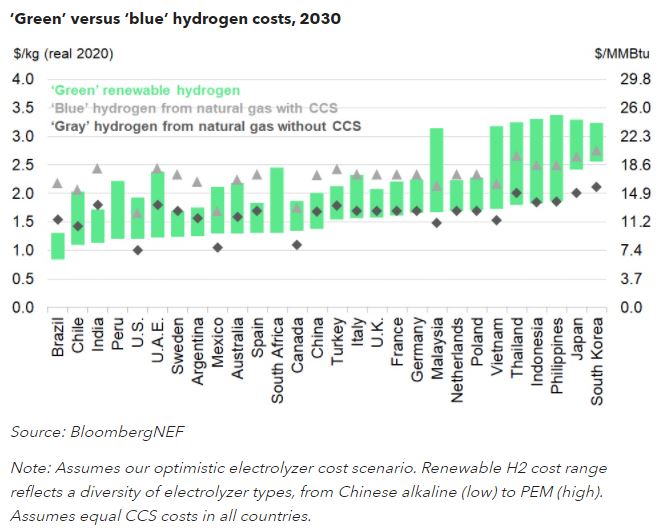

While blue hydrogen is cheaper today than ‘green’ hydrogen made from solar or wind electricity, the situation should reverse by 2030. BloombergNEF expects renewable hydrogen to be cheaper by 2030 in all modeled countries, even those with cheap gas (such as the U.S.) and those with pricy renewable power (such as Japan and South Korea).

Oil and gas companies including Equinor ASA and Royal Dutch Shell PLC plan to build blue hydrogen facilities in countries such as the U.K., Netherlands and Germany. Projects with expected start dates closer to 2030, such as Equinor’s H2Morrow plant in Germany, risk becoming uncompetitive against green hydrogen.

Even ‘gray’ hydrogen — today’s dominant form, made using fossil fuels without CCS — could cost more than green hydrogen by 2030 in 16 of the 28 countries BNEF modeled. This will unleash a tectonic shift in the hydrogen market.

BNEF Shorts are research excerpts available only on the BNEF mobile app and the Bloomberg Terminal, highlighting key findings from our reports. If you would like to learn more about our services, please contact us.