This article first appeared on the BNEF mobile app and the Bloomberg Terminal.

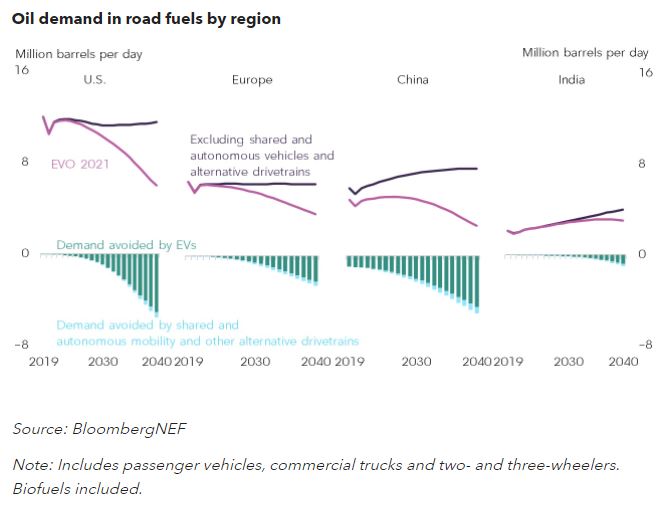

- U.S. and Europe lose over 8 million b/d of existing demand

- India and China miss out on over 6 million b/d of growth

The rollout of EVs will profoundly affect the oil market, but not equally.

Producers with exposure to markets like the U.S. or Europe are poised to see sales of the prime products – diesel and gasoline – decline significantly from current levels over the next decade. On the other side of the world, in markets like India and China, oil companies will see demand growth that ‘could have been’ fail to materialize, a key difference.

Refiners like Phillips 66 or Marathon Petroleum, which have invested over decades to meet this existing demand in places like the U.S., now need to assess the long-term viability of assets. The goal is to extend the life of these complexes and avoid stranded assets or dollar write-downs.

Producers like Petronas who are more exposed to Asia Pacific – a growth center – can configure new assets to produce jet fuel or petrochemical feedstocks. These products are likely to increase in future.

So, while EVs undoubtedly impact the oil market as a whole, some producers are likely to fare better than others.

BNEF Shorts are research excerpts available only on the BNEF mobile app and the Bloomberg Terminal, highlighting key findings from our reports. If you would like to learn more about our services, please contact us.