By Victoria Cuming and Maia Godemer

BloombergNEF

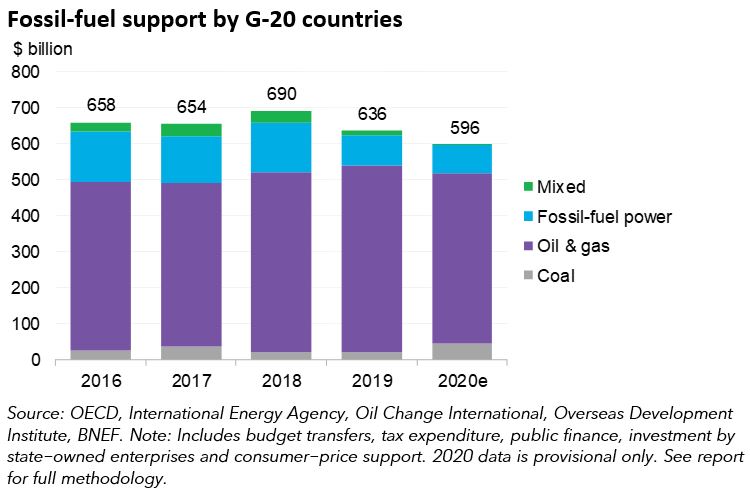

The Group-of-20 countries have made headlines in recent months with some new pledges to achieve “net-zero” CO2 emissions by 2050 or, in China’s case, by 2060. But back in the here-and-now many of these nations continue to provide major funding for the production and consumption of fossil fuels. In 2020 alone, the G-20 collectively provided nearly $600 billion in subsidies and other supports for these activities, BloombergNEF estimates.

Mobilizing public and private finance flows at scale for climate mitigation and adaptation is of course a critical topic at COP26. In an effort to look past political leaders’ rhetoric and shine a light on government actions instead, BloombergNEF has updated its Climate Policy Factbook, which it first produced in partnership with Bloomberg Philanthropies in July 2021.

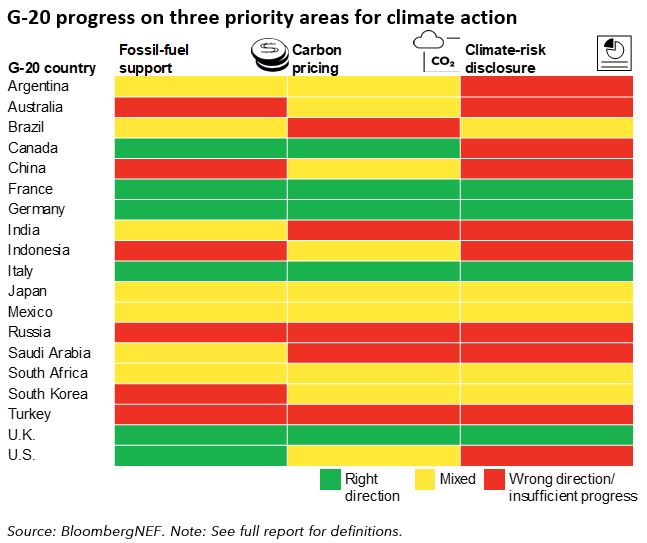

The Factbook highlights three concrete areas where governments can act today: phasing out support for fossil fuels, putting a price on carbon emissions and making companies disclose the risks they face due to climate change. The updated COP26 edition includes latest developments, new data and an updated methodology.

Financial support for fossil fuels remains considerable

Despite the nearly $600 billion figure, fossil-fuel support from G-20 countries and their state-owned companies was down slightly in 2020, driven by a 29% cut in subsidies to retail customers due to lower fuel and energy consumption during the Covid-19 pandemic. Absent the decline in subsidies for retail energy consumers, fossil-fuel support would have stayed level in 2020 due to new subsidies implemented specifically in response to the pandemic.

This type of finance encourages potentially wasteful use and production of fossil fuels, and risks locking in carbon-intensive assets for decades more. All of these factors hinder the shift to a low-carbon economy. Even consumer-targeted subsidies have been found to disproportionately benefit wealthier consumers.

In addition, efforts to ‘build back better’ from the pandemic have faltered, with G-20 governments allocating at least $104 billion in stimulus funds to coal, oil and gas, and fossil-fuel power projects. Overall, only France provided more stimulus to green sectors compared with carbon-intensive industries.

Register for our upcoming webinar: COP26 in Review: Break Through or Break Down? here.

Slow progress on mandatory climate-risk disclosure

Another area requiring immediate government action is encouraging financial players to assess and disclose the risks they face from the physical effects of climate change and impact of the transition (eg, new policies). Most G-20 members have voiced support for voluntary reporting and the G-7 backed “moving towards” mandatory climate-risk disclosure at their 2021 summit. But only the EU and the U.K. have legislated specific climate-risk regulations on investors (asset managers and pension funds) to date. While they are not perfect, these countries are deemed to be “moving in the right direction” under this study’s methodology.

The “mixed” rating only includes countries with mandatory, nationwide, generic environmental disclosure policies for investors. More than half the G-20 countries have not taken even this step, illustrating the significant room for improvement required on climate-risk disclosure. All others are deemed to be either moving in the wrong direction or have simply made insufficient progress.

CO2 pricing yet to be big decarbonization driver outside Europe

The ultimate goal is for financial institutions to price the impact of climate change into their investment or lending activities. A total of 13 G-20 countries have implemented carbon pricing and another plans to start a tax from 2022. However, only four of these nations have CO2 prices high enough to limit global warming to 2 degrees. And, even at those levels, carbon pricing alone is insufficient to achieve the long-term goals of the Paris Agreement. Other policies are needed, including measures to promote development of new technologies or to provide revenue stability for projects to secure cost-effective financing.

Nine G-20 countries have had mixed success in pricing CO2 emissions. In most of these cases, the national government has implemented a tax or market. But it will likely have little impact in terms due to low prices and/or liberal concessions such as free allocation of permits in cap-and-trade schemes.