Geopolitical disruption dominated energy headlines in 2022, laying bare vulnerabilities in the system. The world’s search for new, cleaner and more secure sources of low-carbon power — including the use of fossil fuels fitted with carbon capture technology — may present as much as a $45.8 trillion investment opportunity by 2050.

Power generation drives net-zero supply capex

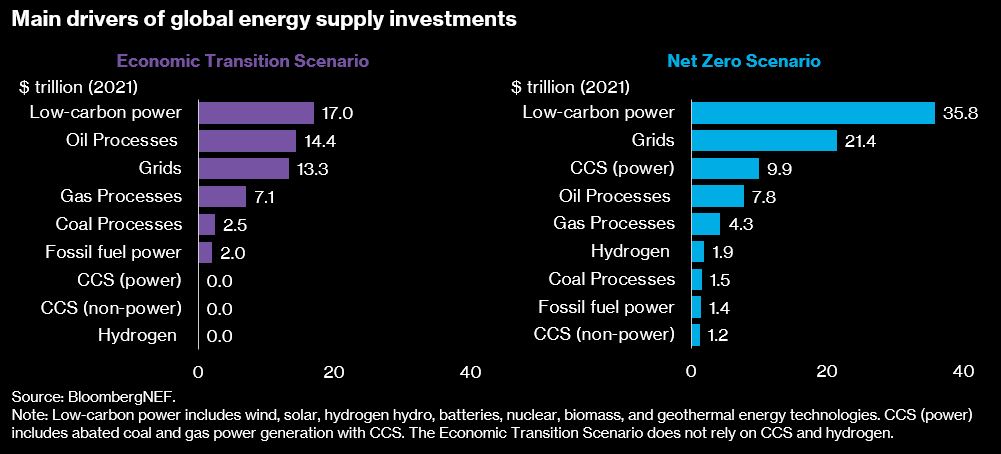

In the net-zero scenario (NZS) from BloombergNEF’s New Energy Outlook, supply-side investment in low-carbon power totals $45.8 trillion by 2050, comprising 97% of all power generation spending. Underpinning the transformation of the power system, power grids will play a pivotal role. In the NZS, BloombergNEF anticipates that $21.4 trillion of the investment will be required for grids as sectors like road transport electrify. Conversely, reliance on fossil fuel processes will decline. In 2050, investment will fall to $175 billion, compared with the $778 billion observed in 2021.

In BloombergNEF’s economic transition scenario (ETS) — an assessment of how the energy sector might evolve from today as a result of cost-based technology changes alone — quite a different investment mix materializes. Without abatement technologies, fossil fuels continue to play a large role. Oil, gas and coal collectively lead capital spending to 2050, at $23.9 trillion, 42.5% of the overall energy supply capex share. In the absence of a carbon constraint in the ETS, there are no investments in either carbon capture or storage and hydrogen technologies do not become cost-competitive.

Wind and solar power lead investment

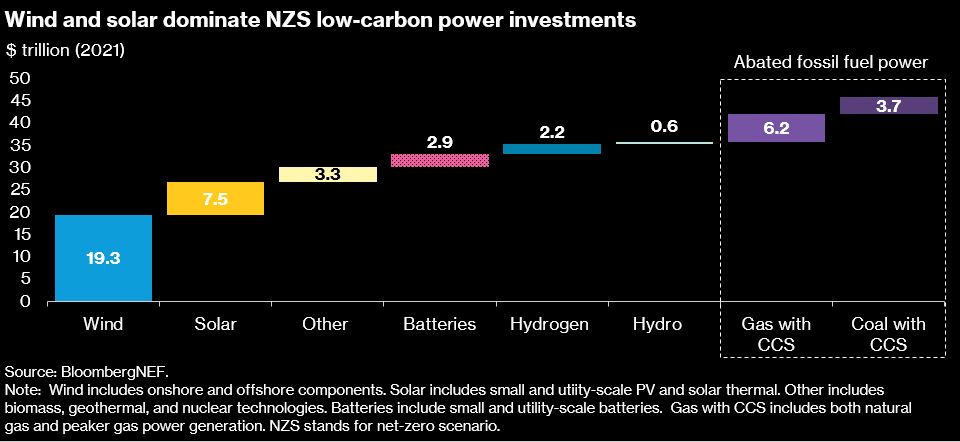

Wind and solar technologies will play a significant role in transforming the power sector to net-zero, taking the top spots of capital spend that will total $26.8 trillion and $13.7 trillion by 2050 in the NZS and ETS respectively. BloombergNEF anticipates that deployment of solar and wind supply will need to grow more than three and six times compared to current annual rates respectively in the NZS. Investment in batteries and other low-carbon power sources, such as geothermal, biomass, and nuclear, are set to total $6.2 trillion combined by 2050.

Fossil fuels also have a place in a net-zero future, supplemented with CCS abatement technologies. In the NZS, generation capacities for coal and gas with CCS grows by over 1 TW by 2050, with investment requirements of $3.7 trillion and $6.2 trillion respectively by 2050.

Capital flows need a boost this decade

Based on the NZS, annual spending in renewable power (excluding abated fossil fuels) will need to average $1.4 trillion between 2022 and 2030, far higher than current levels. Public and private entities as well as financing bodies will need to cooperate in creating an enabling investment environment, especially in developing nations and emerging markets where electricity demand will accelerate over the next decades. Multiple initiatives have emerged to mobilize capital in these regions, with some nations — including South Africa, Indonesia, and most recently Vietnam — establishing Just Energy Transition Partnerships (JETP), mobilizing funding from the public and private sources.