The first auction of the year for the multistate US Regional Greenhouse Gas Initiative saw all carbon allowances snapped up. But a lower clearing price and fewer bidders point to a softening of demand.

The cap-and-trade RGGI market covers power sector emissions across the Northeastern US. The quarterly auction held on March 8 sold all the 21.5 million allowances on offer, raising $269 million, according to the results announced a couple of days later.

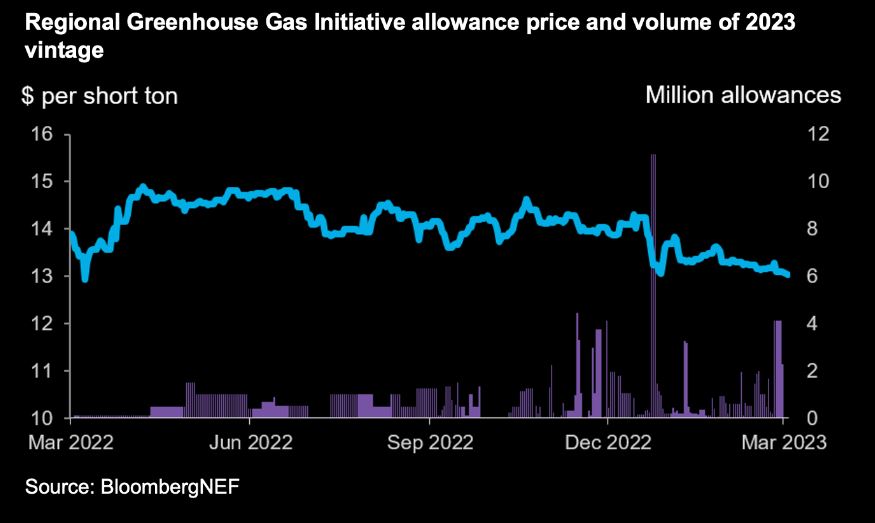

Yet, the allowance price slid 3.8% from the December auction to $12.50 per short ton, marking the third consecutive decline. The front-year settlement price was slightly above the secondary market, which traded at $12.49 per ton on the day of the auction.

The price drop contrasts the recent inaugural auction of the new carbon market in the state of Washington, which set a US record of almost $50 per ton.

The price of allowances, each of which permits the holder to emit one ton of carbon emissions, is generally rising across the globe as climate ambitions increase. In the European Union, the world’s largest carbon market by traded value, prices breached the €100 per ton ($106 per ton) mark on Feb. 21.

The carbon price for RGGI is supported by high emissions in 2022 and low levels of allowances being distributed for free. But a decline in expected emissions from less heating demand during a mild winter and falling speculator interest pose bearish risks.

The market reform planned for this year will be the ultimate price driver for the program. Whether Pennsylvania and Virginia remain members of RGGI amid legal wrangling will also impact prices.

Falling demand

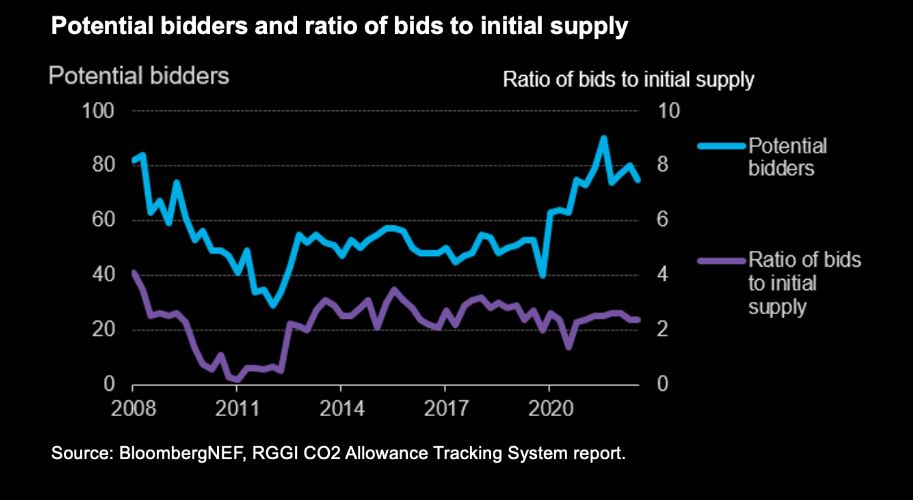

The number of potential bidders in RGGI’s latest auction amounted to 75, down 17% year-on-year. Meanwhile, the total qualified bids compared to allowances available for sale, known as the auction cover ratio, slid 4% to 2.4. The maximum bid price also plunged 41% from $30 per ton to $17.57 per ton. All these indicators signal falling demand.

Bull: Compliance emissions in 2022

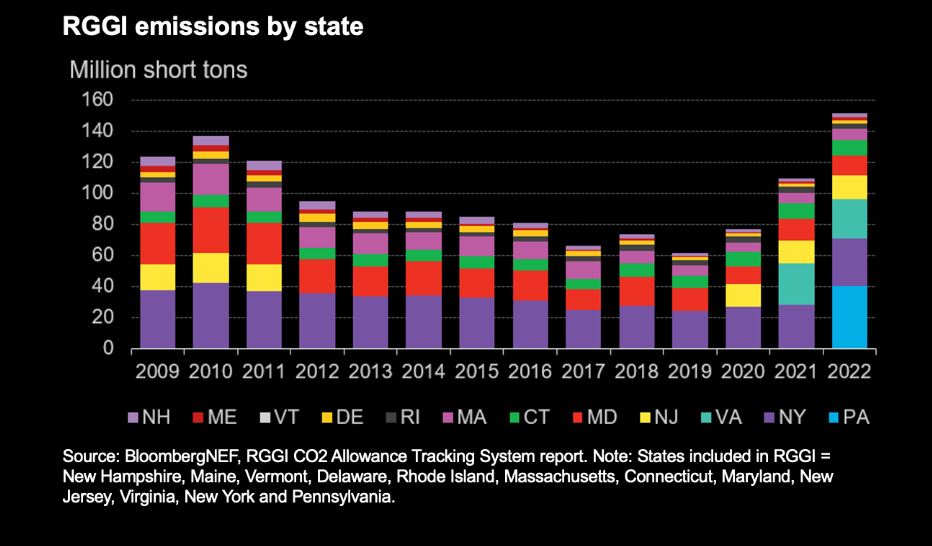

Power sector emissions in states covered by RGGI saw marginal growth in 2022, rising by 1% (excluding Pennsylvania, which still sits out auctions due to legal challenges). Persistent emissions cement demand for carbon allowances.

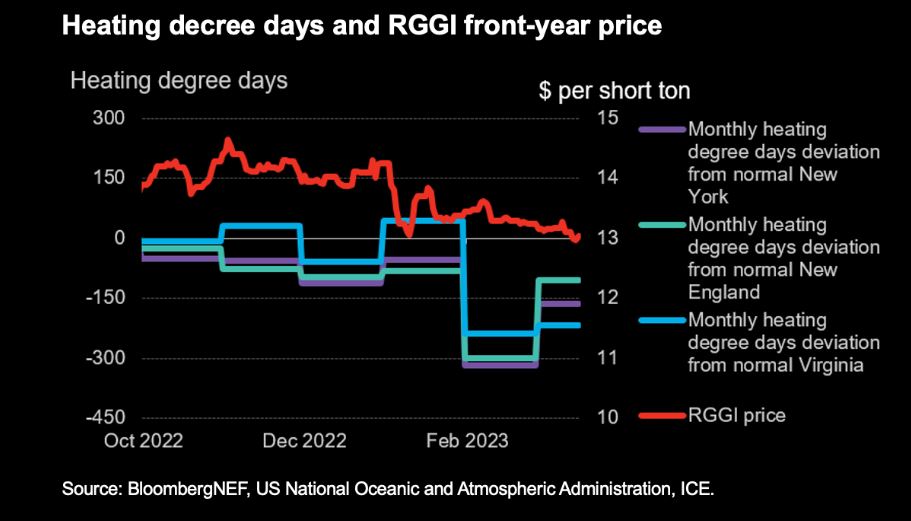

Bear: Mild winter so far in 2023

A warmer-than-normal January and February in the Northeast US has lowered demand for RGGI allowances. The monthly deviation of heating degree days from normal shows a plunge for the New York area. Heating degree day deviation measures how much (in degrees) and for how long (in days) the outside air temperature was below normal, where normal is a 30-year degree day average value for the period 1981 to 2010.

As a result, gas-fired generation in the New York Independent System Operator region, known as NYISO, fell 18% in January and 7% in February compared to the previous year. New York is the largest emitter in RGGI excluding Pennsylvania.

Bear: Speculators

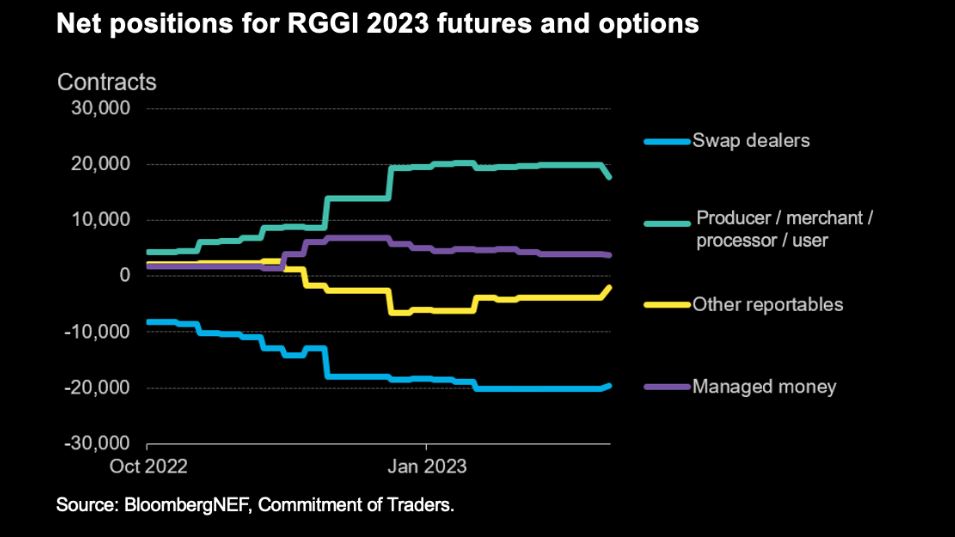

Investors have been shunning the RGGI futures market. Managed money groups have reduced their holdings to almost 4 million allowance futures of the 2023 vintage, from nearly 7 million last December, according to Commitment of Traders data.

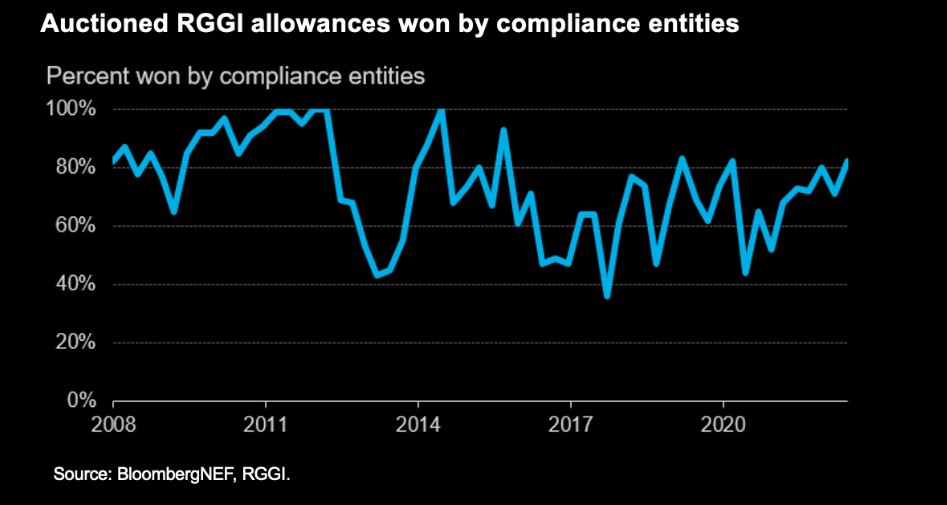

The primary market confirms the story playing out in the secondary market. Some 82% of allowances in the latest auction were won by compliance entities.

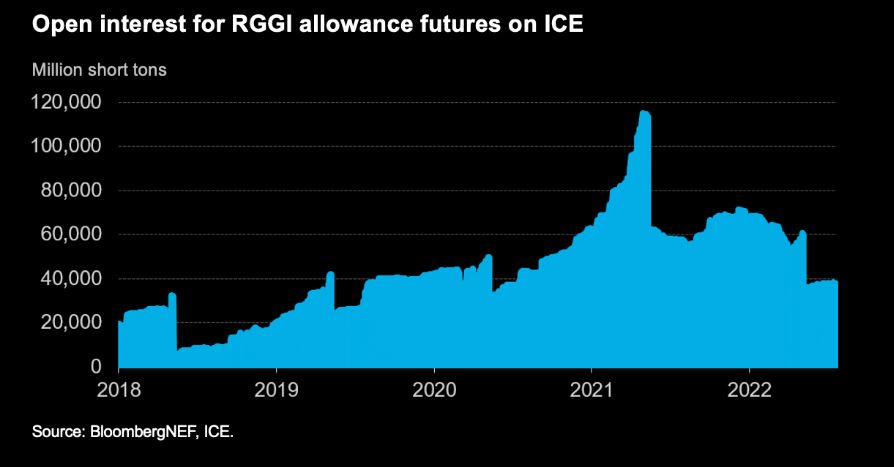

Bear: Open interest falling

The future open interest is falling for the RGGI market. This could mean less hedging, indicating lower expected emissions in the future, and could also suggest weaker price support for carbon allowances.

Bear: Next compliance deadline is far away

The March compliance deadline, when covered entities needed to surrender allowances worth 50% of their emissions from 2022, has just passed and had a minimal impact on RGGI prices. The next compliance deadline is March 1, 2024.

RGGI has both annual and compliance period deadlines. Compliance periods last three years, while annual deadlines occur each year in March, except for the year of a compliance period deadline.

Annual deadlines require entities to surrender compliance instruments equal to 50% of their emissions from the prior year. For a compliance period deadline, entities must surrender the remaining 50% of emissions not submitted during annual deadlines, as well as 100% of emissions from the year immediately preceding the new compliance period.

For example, in 2024, entities must surrender compliance instruments equal to 50% of emissions from 2021 and 2022, and 100% of emissions from 2023. Entities failing to meet their compliance obligation on time must surrender allowances equal to three times their excess emissions.

Policy uncertainties cloud the market

The RGGI states will meet on March 29 to review the design of the program. They will confirm the linear reduction factor (how much the emissions cap declines each year), as well as adjustments to price stability tools and offset protocols – among other things.

The reforms would be bullish for allowance prices if RGGI increases the price floor and embeds an inflation-pegged design, or establishes a more ambitious linear reduction rate reducing future supply.

The inclusion of Pennsylvania and Virginia in the program also remains unresolved. Pennsylvania has the highest emissions in RGGI but has been sitting out permit auctions due to legal challenges, while Virginia, which has the third-highest emissions, is on the brink of leaving the market.