By Yuchen Tang, Sustainable Materials, BloombergNEF

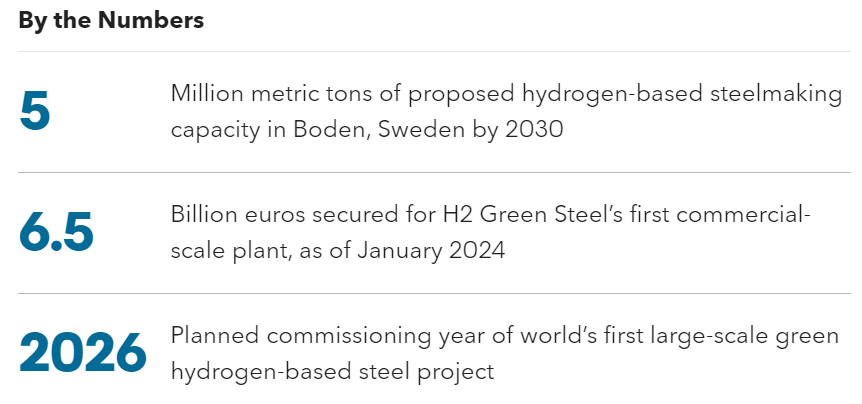

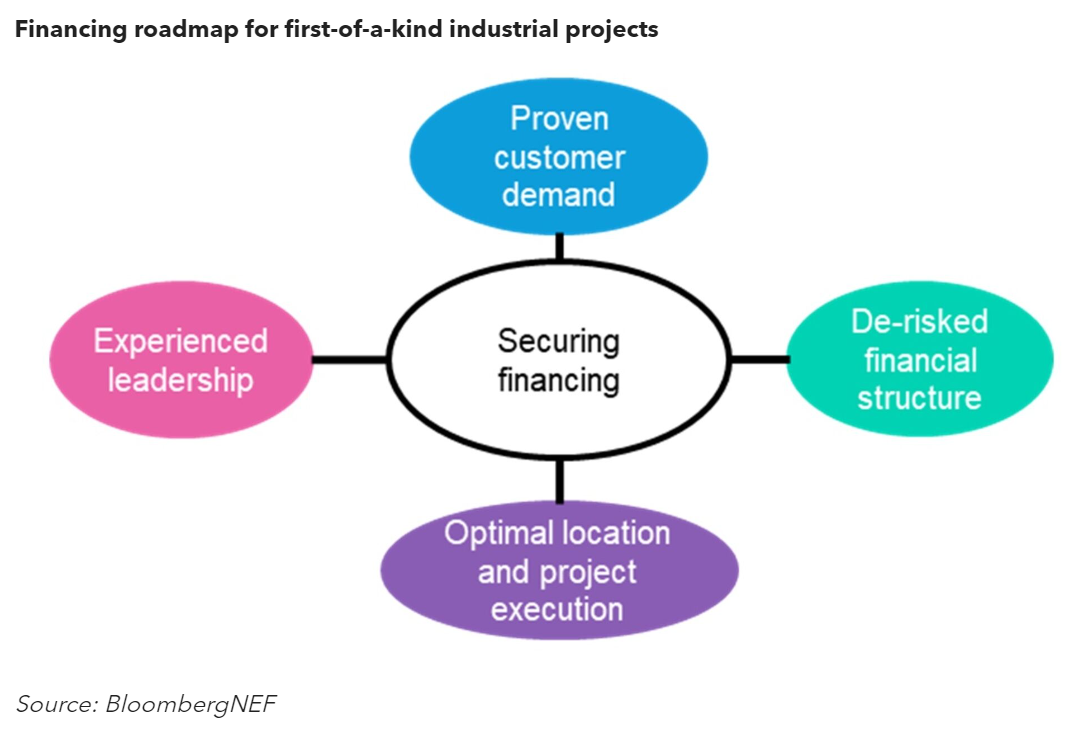

Securing financing for a first-of-a-kind green industry project can be difficult due to the long investment cycle, capital intensity and technology risk. But H2 Green Steel (H2GS), a Swedish startup with no prior operations, has successfully raised €6.5 billion in project finance for its hydrogen-based steelmaking project in Boden, Sweden. Lessons from H2GS’s experience could guide future green industry projects, though some may not be fully replicable elsewhere.

- Proven customer demand: Securing long-term offtake contracts with customers willing to pay a green premium is the key for raising project finance. This is easier when clients, such as the automotive sector, have Scope 3 emission targets and are familiar with long-term contracts.

- De-risked financial structure: Securing senior debt and credit guarantees from government agencies is a crucial factor to bringing commercial lenders on board. For de-risking equity raising, institutional investors may be more comfortable if the company’s customers and suppliers have already invested. Reserving a financial contingency fund may also help to make lenders more comfortable. These financing practices could apply to almost all projects.

- Optimal location and project execution: To deliver ideal returns, developers should pick a site optimized for the project’s production cost and resource access. The specific resource to optimize for might vary depending on projects – for hydrogen-based steel projects that would be access to cheap clean power, followed by grid and transportation infrastructure. This, coupled with a strong execution capability to push ahead project development and assemble technical expertise, could present a strong economic case with minimized risks for commercial investors.

- Experienced leadership: A company or project’s success can always be traced back to its people. Having an experienced leadership team that can bring in customer connections and execute the optimal financing and project development plan is what ultimately convinces investors to come on board.

BNEF clients can access the full report here.