By Tifenn Brandily, Head of Transition Risk, BloombergNEF and Anni Kortesmaa, Transition Risk, BloombergNEF

In its early stages, the low-carbon transition has tended to concentrate market share in the hands of a handful of early movers rather than distributing benefits equally across legacy players. This is because in manufacturing, like in infrastructure development, economies of scale are a top determinant of costs and, by extension, of company competitiveness.

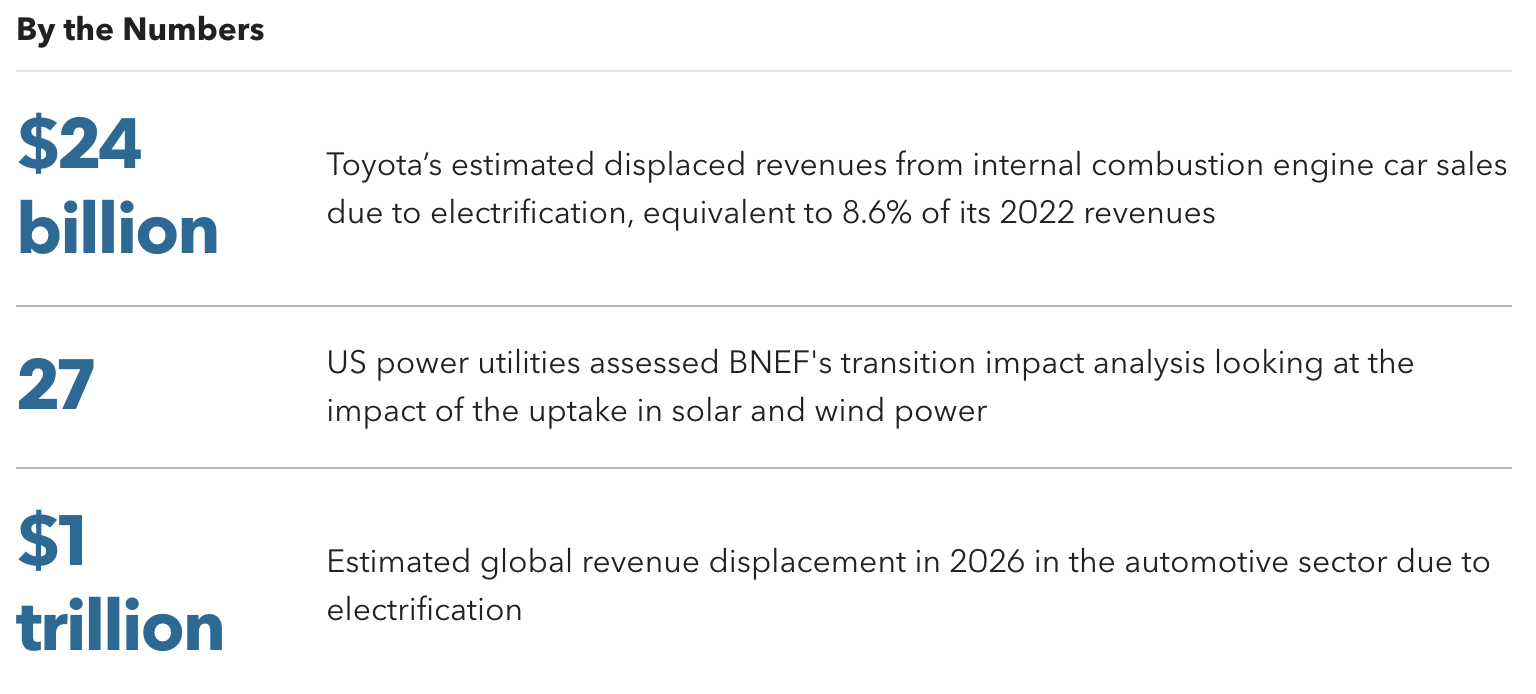

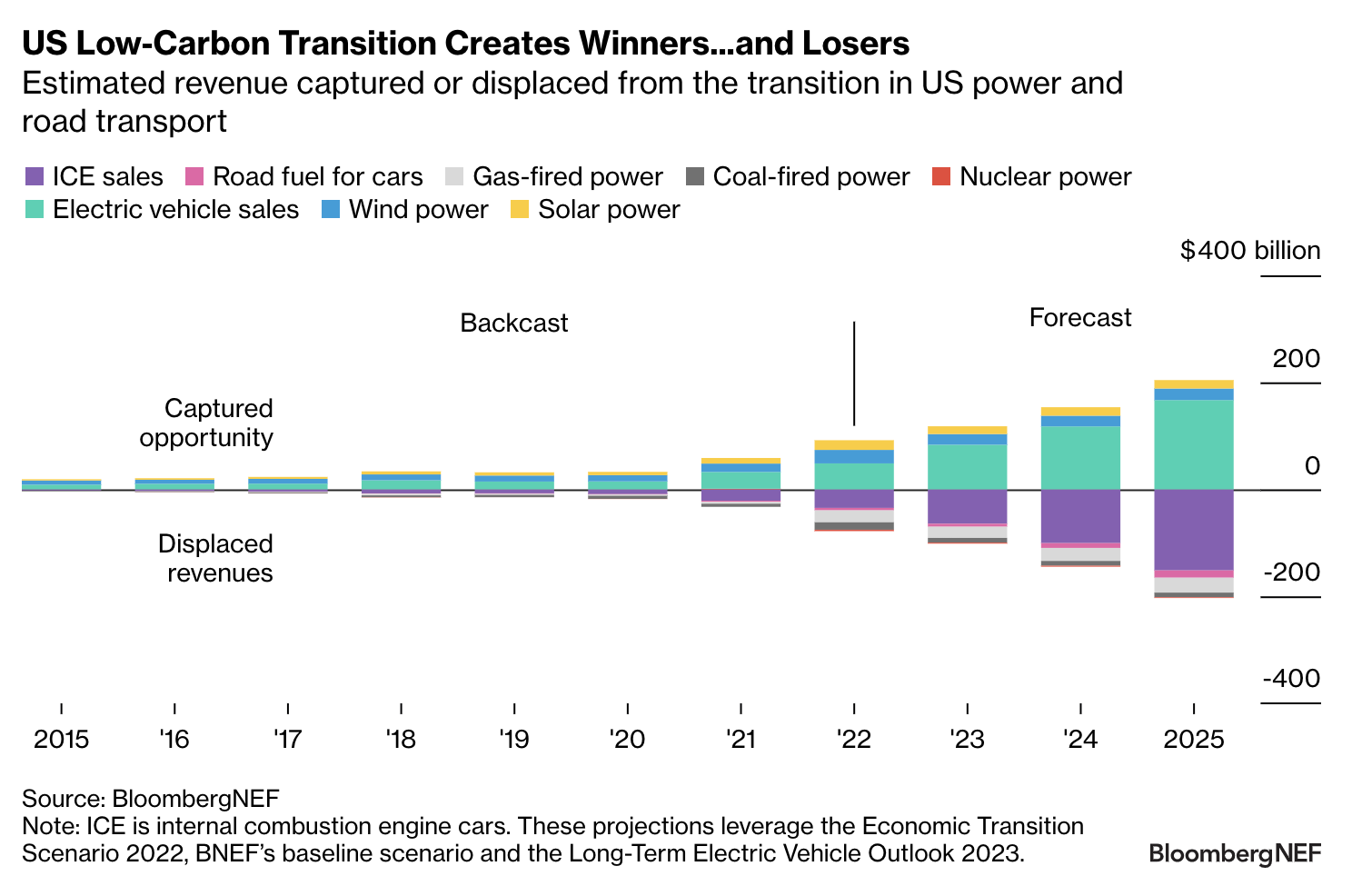

With the low-carbon transition now underway, incumbent firms face a tough choice: preserve short-term stability by sticking to existing business models or embark on a long capital-intensive transition to play catch-up with early movers. This research note leverages historic and backcasted data to quantify displaced and captured revenues of 28 automakers and 27 US power utilities, due to the deployment of low-carbon products between 2015 and 2022.

- BloombergNEF developed counterfactual scenarios representing what would have happened to global automotive markets and US power markets had electric vehicles, wind power, and solar power never reached commercial maturity. We compare these backcasted outcomes to actual historic data from 2015-2022 to reveal transition impacts on company revenues.

- For the global automotive sector, we estimate the uptake in electric cars, e-bikes and tougher fuel economy standards displaced an aggregated $330 billion in revenues in 2022. This breaks down into displaced sales for internal combustion engine (ICE) carmakers at $203 billion (61% of the total), lower sales of ICE two- and three-wheelers at $41 billion (13%), and finally the erosion of road fuel demand, mainly gasoline, at $85 billion (26%).

- Three groups of automakers are experiencing growing revenues as vehicle electrification progresses: first, ‘disruptors’, including Tesla and BYD, which captured $71 and $41 billion respectively in 2022 from their electric car manufacturing business, while incurring virtually no opportunity losses; second, ‘transitioners’, like BMW, Geely, Mercedes-Benz, Stellantis that generate a lot more revenues today than they would have in a world where electrification did not scale. This group leverages electrification as a springboard; third, adapters with near-zero revenue impact, including Hyundai, SAIC, Renault, and Dongfeng. On the other end of the spectrum, electrification has eroded the revenue generation capacity of ‘laggards’ such as General Motors, Suzuki, Honda, and Toyota. The latter would have gained $20 billion in 2022 in a world where EV sales remained marginal.

- BNEF’s transition impact assessment for US power utilities suggests that in 2022 wind and solar displaced an estimated $22 billion of revenues from the gas-fired power plant fleet, $14 billion from the coal fleet and $2.6 billion from the nuclear fleet. Across US utilities, we estimate this net revenue displacement represents a $2.2 billion hit for Vistra, $1.2 billion for both Duke Energy and Entergy, and $1.1 billion for The Southern Company. On the flip side, the transition benefitted NextEra, Edison and Avangrid materially, with a net opportunity capture estimated at $1.7 billion, $732 and $623 million, respectively.

- The revenue shifts between incumbents and disruptors are likely to accelerate as wind, solar power and EVs become mainstream. In the US, we estimate low-carbon solutions displaced $78 billion in revenues away from incumbent power and automotive firms in 2022. By 2025, this revenue displacement more than doubles, reaching $203 billion.

- In 2023, global low-carbon transition investments reached $1.8 trillion, solar and wind represented 14% of global electricity generation, and 18% of cars sold were electric.

BNEF clients can access the full report here.