This Factbook was commissioned by the Dutch Ministry of Infrastructure and Water Management in partnership with the Smart Freight Centre and BloombergNEF.

By Colin McKerracher, Head of Advanced Transport, BloombergNEF with assistance from Nikolas Soulopoulos, Head of Commercial Transport, BloombergNEF

Global sales of battery-electric and fuel-cell trucks are getting into gear. That’s a crucial step on the road to net zero, as emissions from commercial vehicles are set to become the largest contributor to road transport’s CO2 footprint in the coming years. Fortunately, the economics for e-trucks are steadily improving as battery prices fall, and there is a growing opportunity for creative financing and business models to help this market scale up.

This week, the BloomergNEF commercial transport team published a new factbook looking at the state of the electric and fuel-cell heavy truck market. The report digs into lots of details on sales, adoption rates, policies, truckmaker strategies, technology changes and more.

Below are six key findings. Readers can find the full publicly available report here, and BNEF clients can download all the supporting data here.

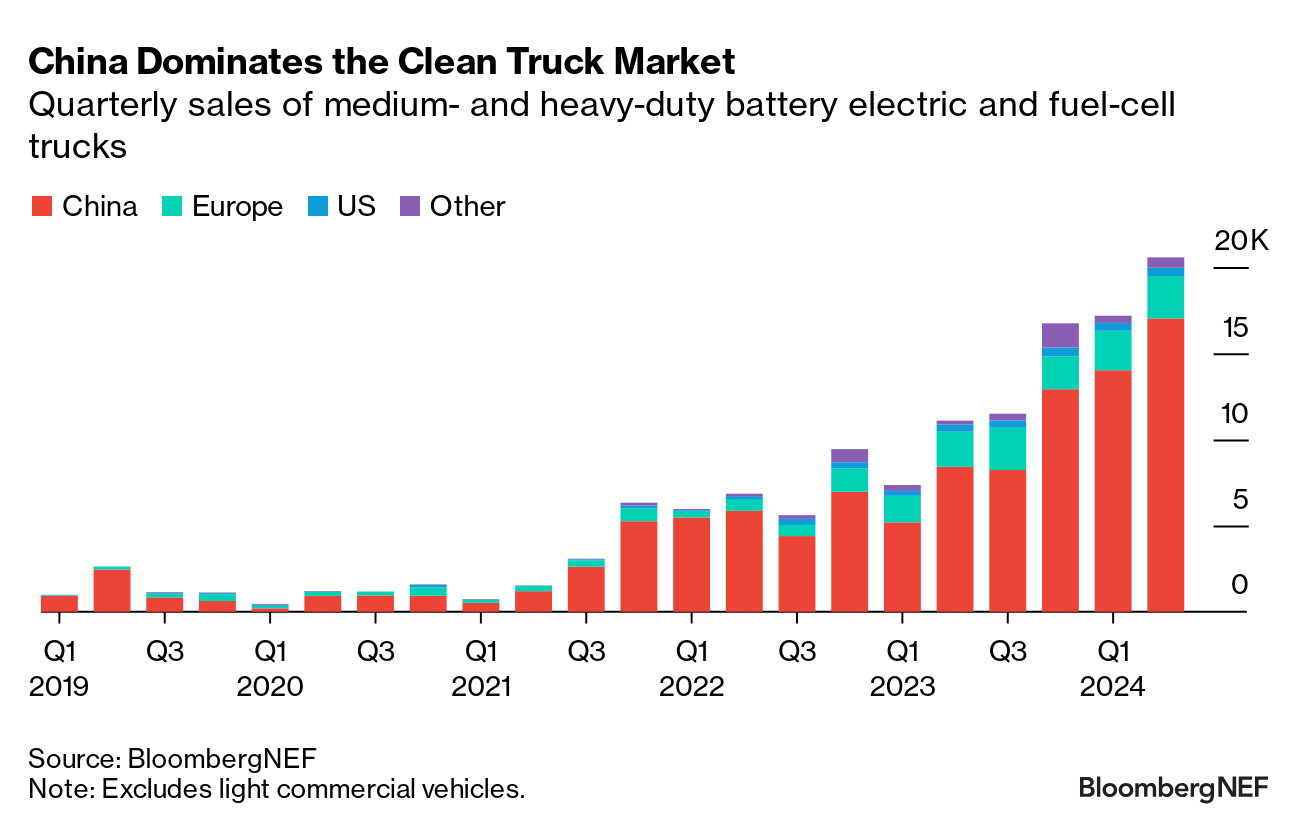

1. China is winning the clean-truck race

As with other parts of the EV story, China is way out in front of other countries. The Asian behemoth accounts for 82% of all fuel-cell and electric trucks sold so far this year. That dominance looks likely to continue in the coming years, as zero-emission trucking has become the next big segment of focus for policymakers in the country.

Most of the heavy electric trucks sold so far in China are being used in ports, industrial facilities and within cities, and about half of the trucks sold this year are capable of battery swapping in addition to standard direct-current (DC) fast charging. Battery swapping has struggled to gain a toehold in other markets, but China is making it work.

Still, it’s not only a China story. With tightening fuel efficiency and emissions regulations coming in markets like Europe and California, and growing interest from fleet operators, activity in those markets is also picking up.

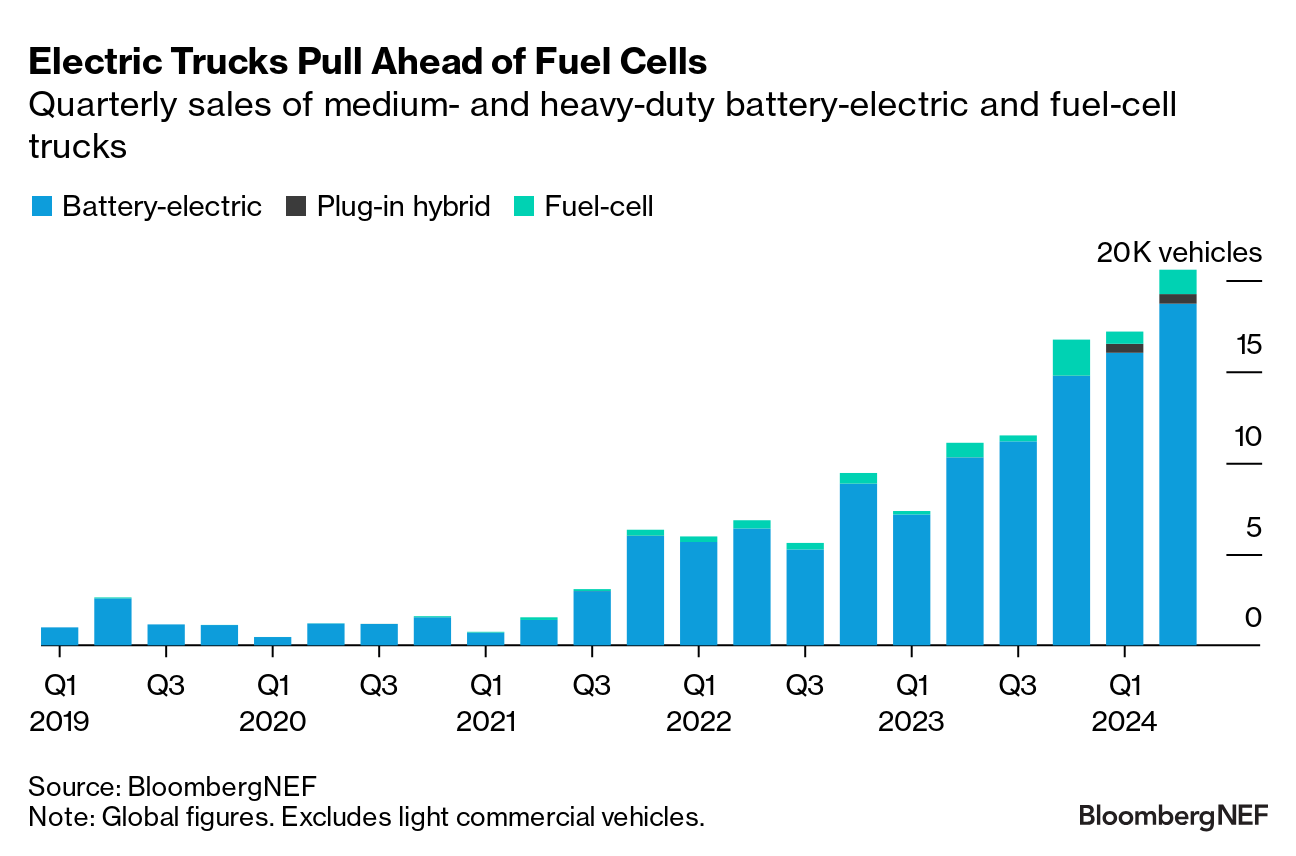

2. Electric trucks are winning out over fuel-cell vehicles

Proponents of fuel-cell vehicles have shifted tack over the last few years as cars like the Toyota Mirai dramatically missed sales targets and global sales declined sharply. Many proponents now argue that heavy trucks are where fuel cells will win due to weight and refueling concerns.

That hasn’t played out, at least not yet. The vast majority of clean heavy trucks being sold are electric, with fuel-cell trucks capturing just a sliver of the market. It’s still early days, but electric drivetrains are already out to a commanding lead in the race.

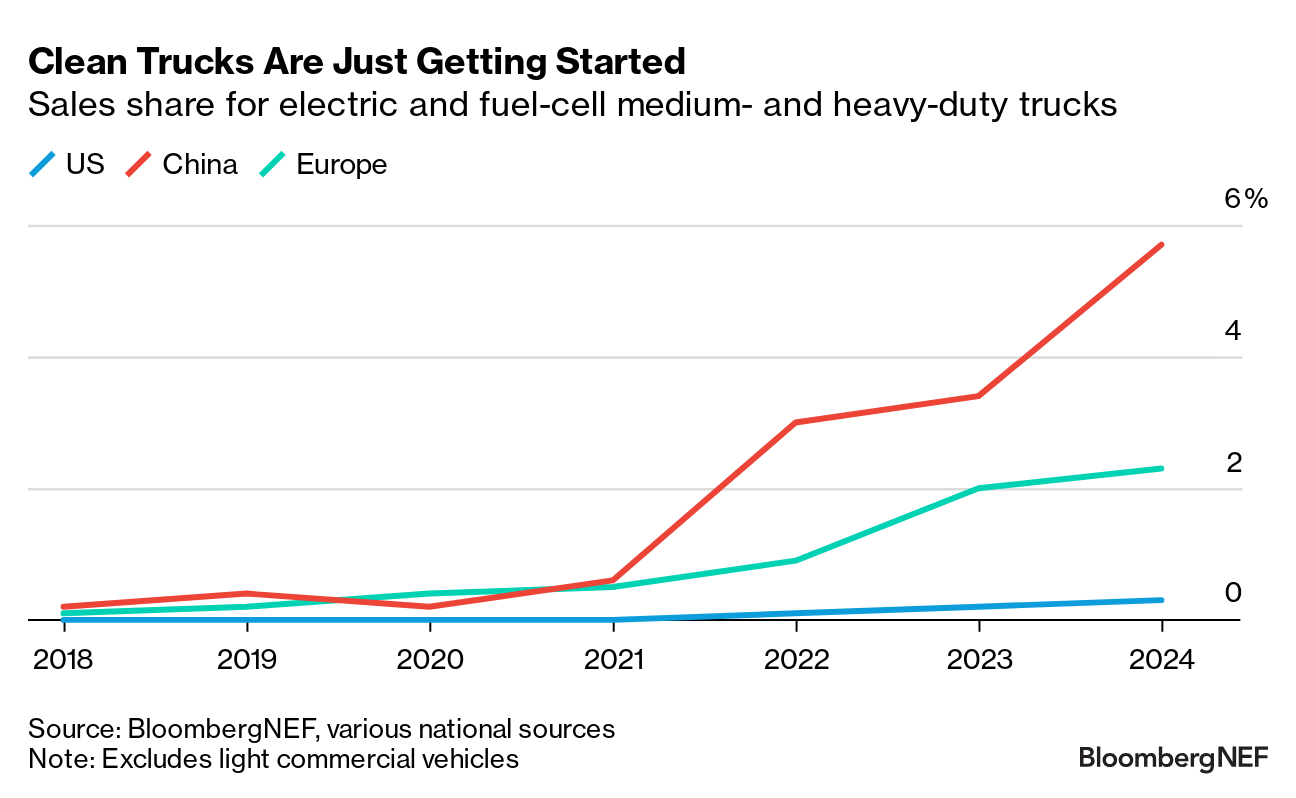

3. Adoption rates are just starting to pick up

Electric and fuel-cell vehicles were just under 2% of global heavy truck sales in the second quarter of 2024. That leaves a long way to go for countries to hit the various climate targets they have set. Still, adoption has accelerated in the last two years, especially in China, where these trucks are likely to cross 6% of total sales this year. Norway is the standout leader on clean truck adoption in the heavy segment, at over 10% of sales so far in 2024. A lack of available models, high costs and limited charging infrastructure are holding the market back elsewhere.

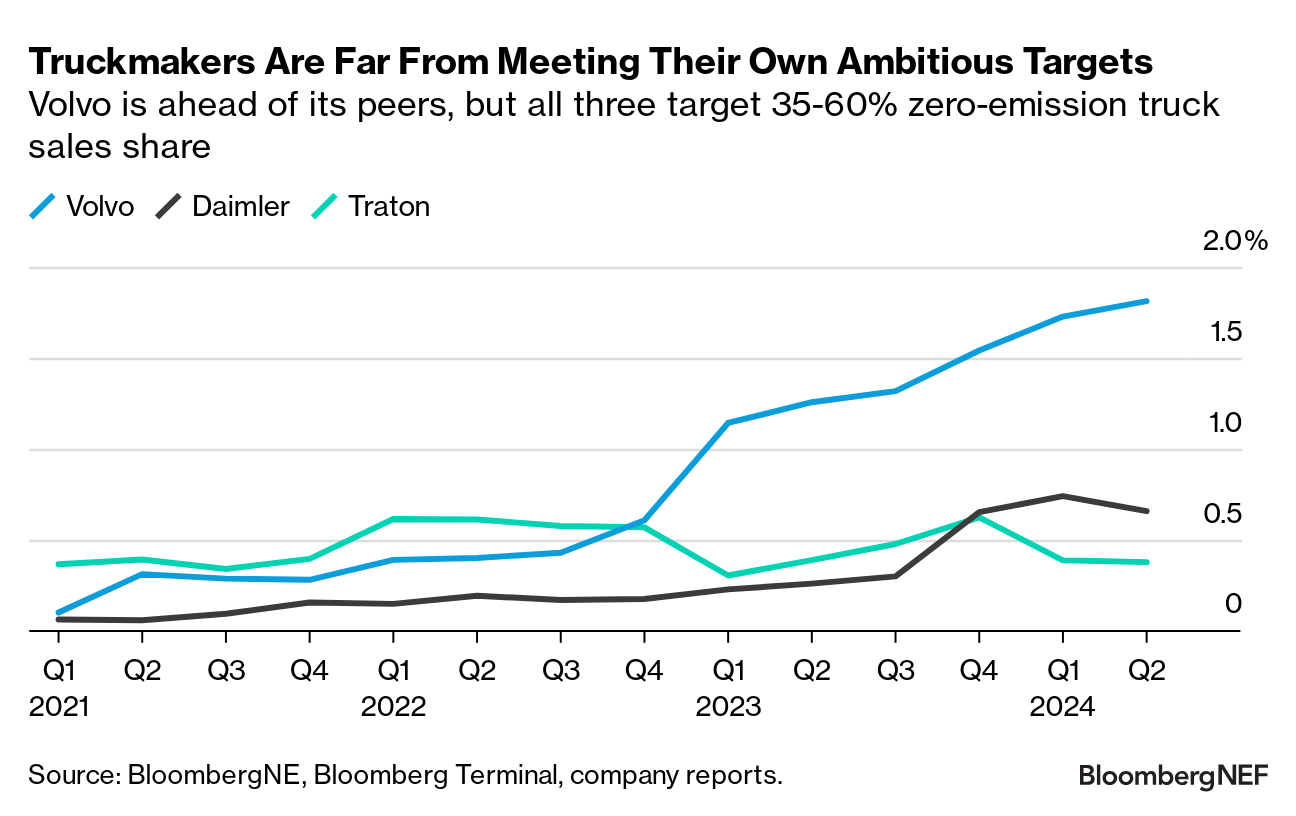

4. Truckmakers have a long way to go

Established truckmakers like Volvo, Daimler and Traton have all set aggressive targets – ranging from 35% to 60% of sales – for their e-trucks. Yet despite their big investments in the drivetrain, none of them are anywhere near target levels. They will need a concerted push in the years ahead to meet their own targets, and to stay onside with more aggressive rules coming from regulators in Europe and markets like California.

On the passenger vehicle side, automakers have been steadily pushing back their EV targets over the last year. The same could be coming for trucking as these dates get closer.

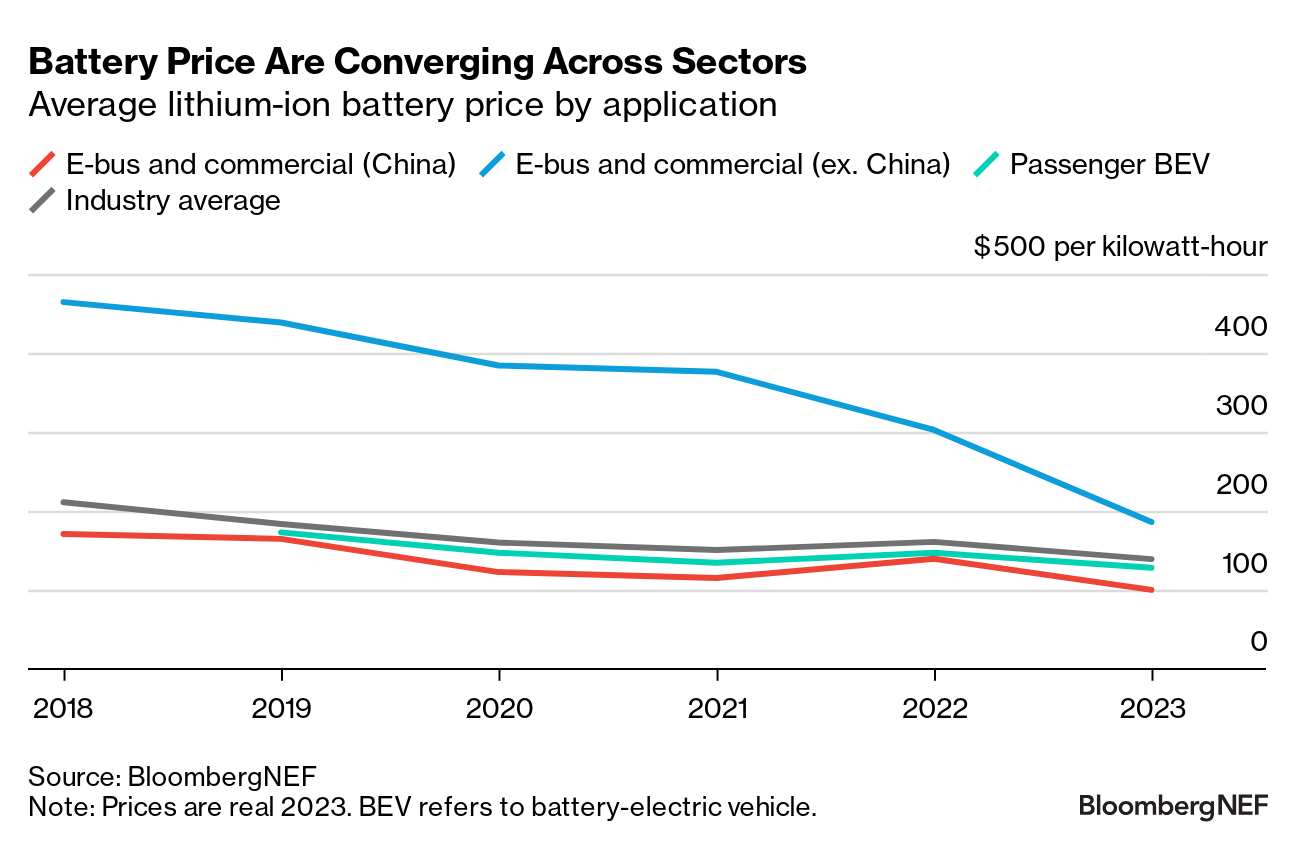

5. Truck batteries are getting cheaper

Truckmakers still pay a higher price for batteries than manufacturers of passenger cars, but that premium is shrinking rapidly. Prices have been converging across sectors as the industry grows and battery manufacturers grapple with oversupply. Falling prices for battery metals, the turn to cheaper lithium-iron phosphate (LFP) chemistries, and growing order volumes pushed truck battery prices steeply down in 2023.

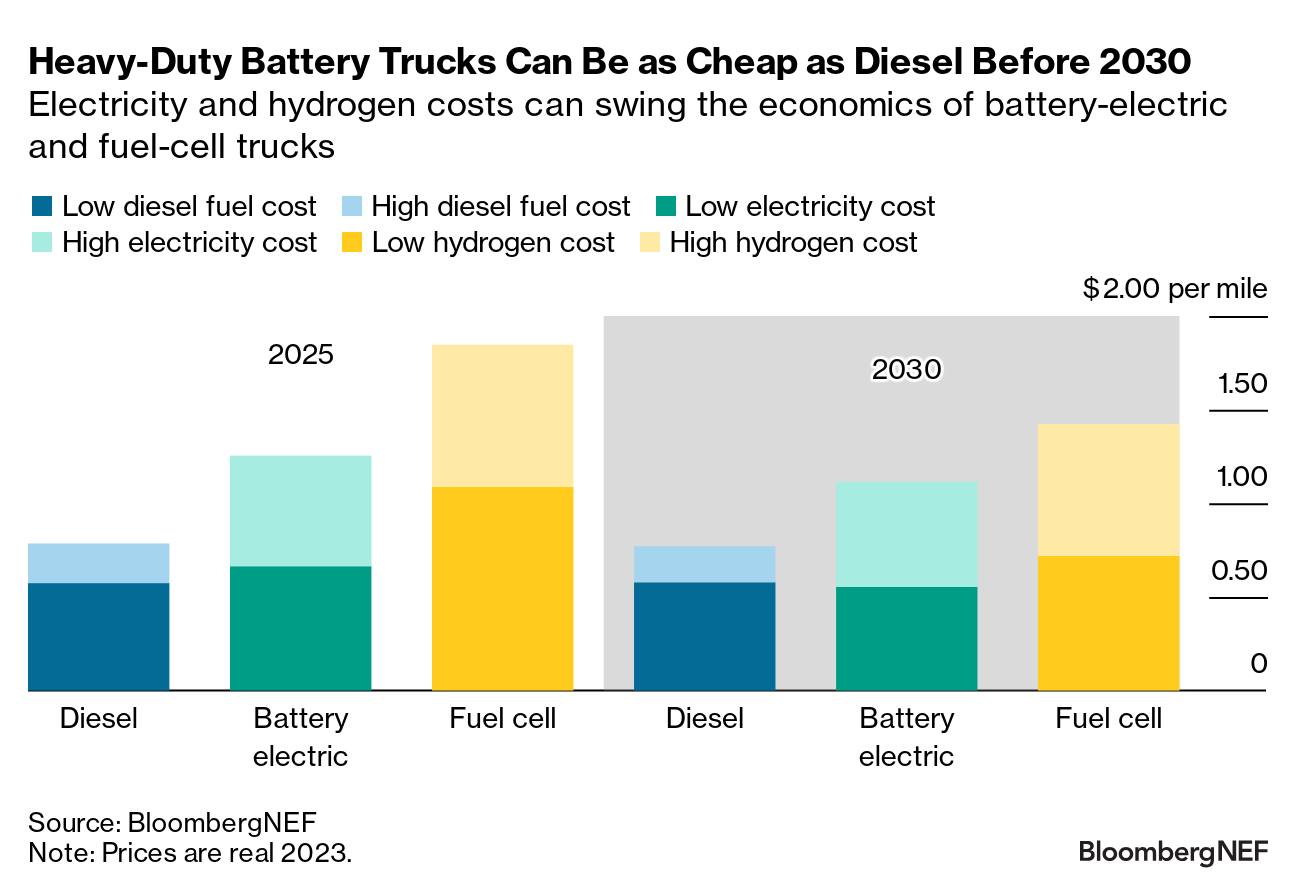

All this is quickly improving the economics of heavy electric trucks. Lighter commercial trucks are already competitive in urban-duty cycles on a total cost of ownership basis in many locations. Further declines in truck battery prices will bring cost competitiveness in the heavy-duty long-haul segment by 2030, but not in all locations.

Fuel-cell trucks have a much narrower window of competitiveness than diesel and all-battery vehicles, requiring very low hydrogen costs (around $5 per kilogram) to coincide with high diesel and mid-range electricity prices.

6. Many new business models are emerging

High up-front cost for e-trucks, technology maturity and fuel availability may still be hurdles for manufacturers and fleet owners interested in adopting electric trucks. But several companies have started to successfully address at least some of these challenges, attracting financing from large infrastructure funds, banks and other investors.

Operators such as Zenobe and Forum Mobility – both of which are featured as case studies in the report – as well as WattEV, Terrawatt and others build and manage complex megawatt-level truck and bus charging stations. They may also offer electric truck financing or make vehicles available on a pay-as-you-use model.

Part of the innovation here is making these projects viable by combining a multitude of approaches. These can range from building on-site generation and energy storage to signing power purchase agreements, stacking up regulatory credits and entering into utilization agreements with fleets.

Digital businesses, such as Zeti’s financing and data platform (also a case study in the report), second-life battery use and other innovations are also helping pave the way for widespread adoption of these vehicles.