Packaging has become a marketing liability for brand owners, who want to avoid their labels appearing among the trash polluting the world’s rivers and beaches. But while these companies are setting circular economy goals and plastic producers are making big claims about more sustainable options, not everyone is pulling their weight.

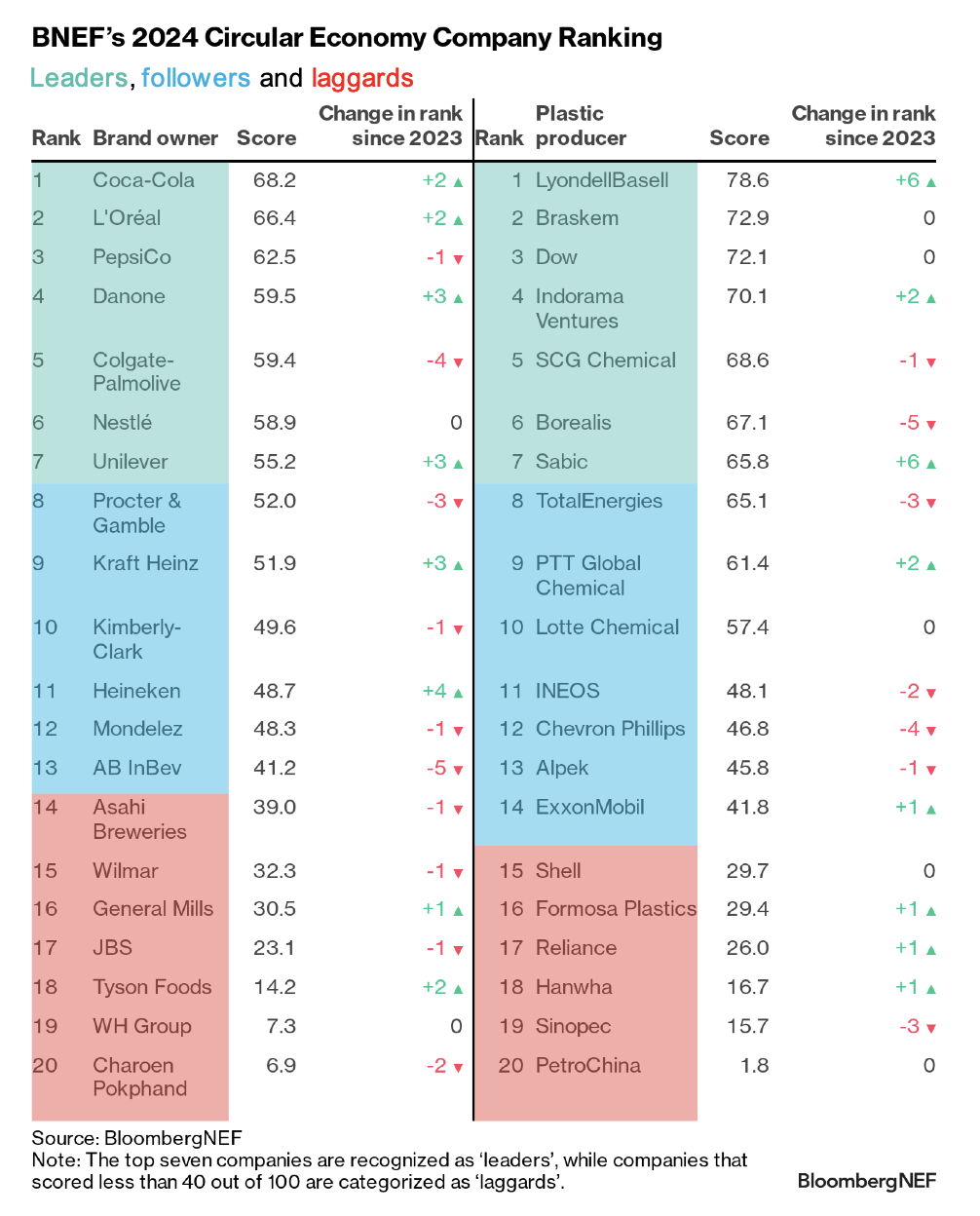

BloombergNEF has once again assessed 40 firms – 20 brand owners and 20 plastic producers – to reveal those that are leading the charge to use or develop more sustainable packaging and those that are falling behind. Our analysis reveals a slowdown in ambition to achieve a circular economy in 2023, with many companies highlighting difficulties in sourcing sustainable feedstock and materials, and a lack of infrastructure for sorting and recycling – all against the backdrop of rising costs.

Coca-Cola, L’Oréal and PepsiCo, who have been pioneers in setting circular economy strategies and investing in new forms of packaging, are the leading brand owners in this year’s Circular Economy Company Ranking. On the plastic producers’ side, LyondellBasell, Braskem and Dow took the highest three spots. These top-ranked companies have each set their own strong targets to ramp up sustainable material production, with some even pausing investment in new production units that use virgin materials.

BNEF’s Circular Economy Company Ranking measures companies’ circular economy ambition based on publicly announced targets and commitments from their 2023 company reports. Both brand owners and plastic producers are split into three tiers – leaders, followers and laggards – based on BNEF’s ranking methodology.

The companies that moved up the most in the latest ranking are:

- Danone, which is the only brand owner in this ranking with an absolute packaging reduction target beyond 2030, moved up three places to take fourth place.

- LyondellBasell and Sabic moved up six places in the plastic producer pecking order, to take first and sixth place, respectively. LyondellBasell has one of the most ambitious targets to produce 2 million metric tons of circular polymers by 2030. Sabic also announced a new circular polymer production target for 2030 at the end of 2021. Such a goal carries the highest weight in the ranking as it highlights a strong commitment towards a circular economy.

Among the companies that moved down in the ranking were:

- Colgate-Palmolive lost its top position in the ranking and dropped to fifth. Despite being a circular economy pioneer, its target only covers plastic packaging. The company’s goal for 25% recycled content in plastic packaging by 2025 also lags peers including L’Oréal and Danone, who aim to achieve 50% recycled content by the same year.

- On the plastic producer side, Borealis lost its top position in the ranking this year. It performed well overall, with a target to produce 1.8 million metric tons of recycled and renewable polymers by 2030. However, its ambition fell short of peers, who have also set targets to achieve 100% recyclable, reusable and recoverable plastics in their production.

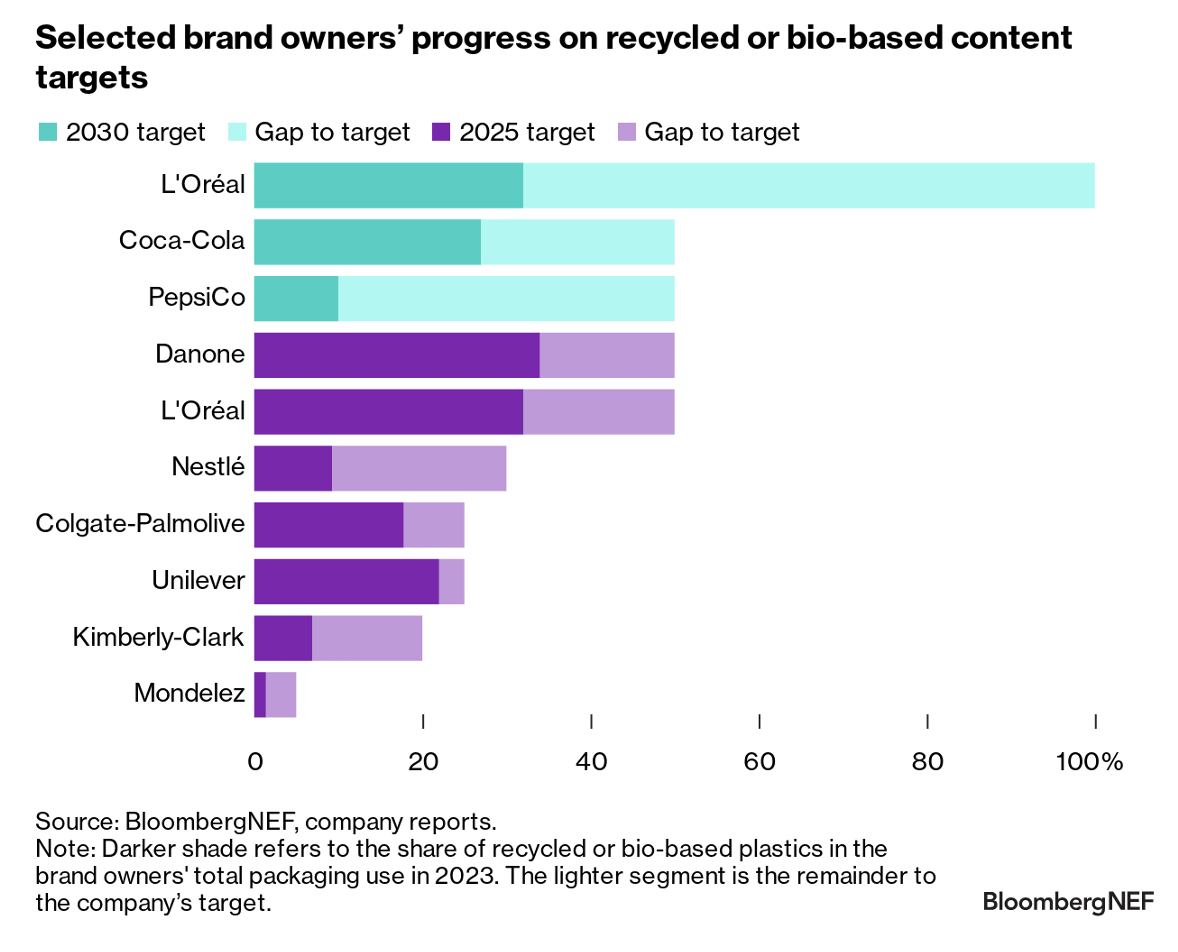

Brands face difficulties in achieving recycled content targets

Eleven of the 20 brand owners ranked have set targets to increase the share of recycled materials in their packaging by 2025 or 2030. L’Oréal and Danone have the highest share of packaging from bio-based or recycled sources, accounting for over 30% in 2023. Both companies also have some of the most ambitious 2025 targets. This will require them to rapidly increase their recycled or bio-based content by around 8-10 percentage points per year, much faster than what they have achieved in the past. L’Oréal also has an even more ambitious 2030 target – to make 100% of its packaging from sustainable sources by the end of the decade.

The undersupply of high-grade recycled plastic in many markets is stifling brand owners’ ability to achieve their targets, resulting in some delaying or revising their goals. For example, PepsiCo previously had a target to achieve 25% post-consumer recycled (PCR) content in its packaging by 2025, but this target is no longer mentioned on its website and the company is instead aiming for 50% PCR content by 2030. In 2023, Unilever revised its original goal to halve virgin plastic consumption by 2025, shifting the target to 30% by 2026 and 40% by 2028.

As a result, some brand owners are investing directly in recycling infrastructure to increase recycled plastic supply. For example, Nestlé agreed to provide Impact Recycling a £7 million ($9 million) loan to construct a new facility to mechanically recycle flexible plastics in the UK.

Some brands are focusing more on targets to cut their absolute virgin plastic packaging use altogether by light-weighting, re-designing and investing in reusable and refillable packaging. Reducing absolute packaging use can also contribute to the net-zero targets of companies.

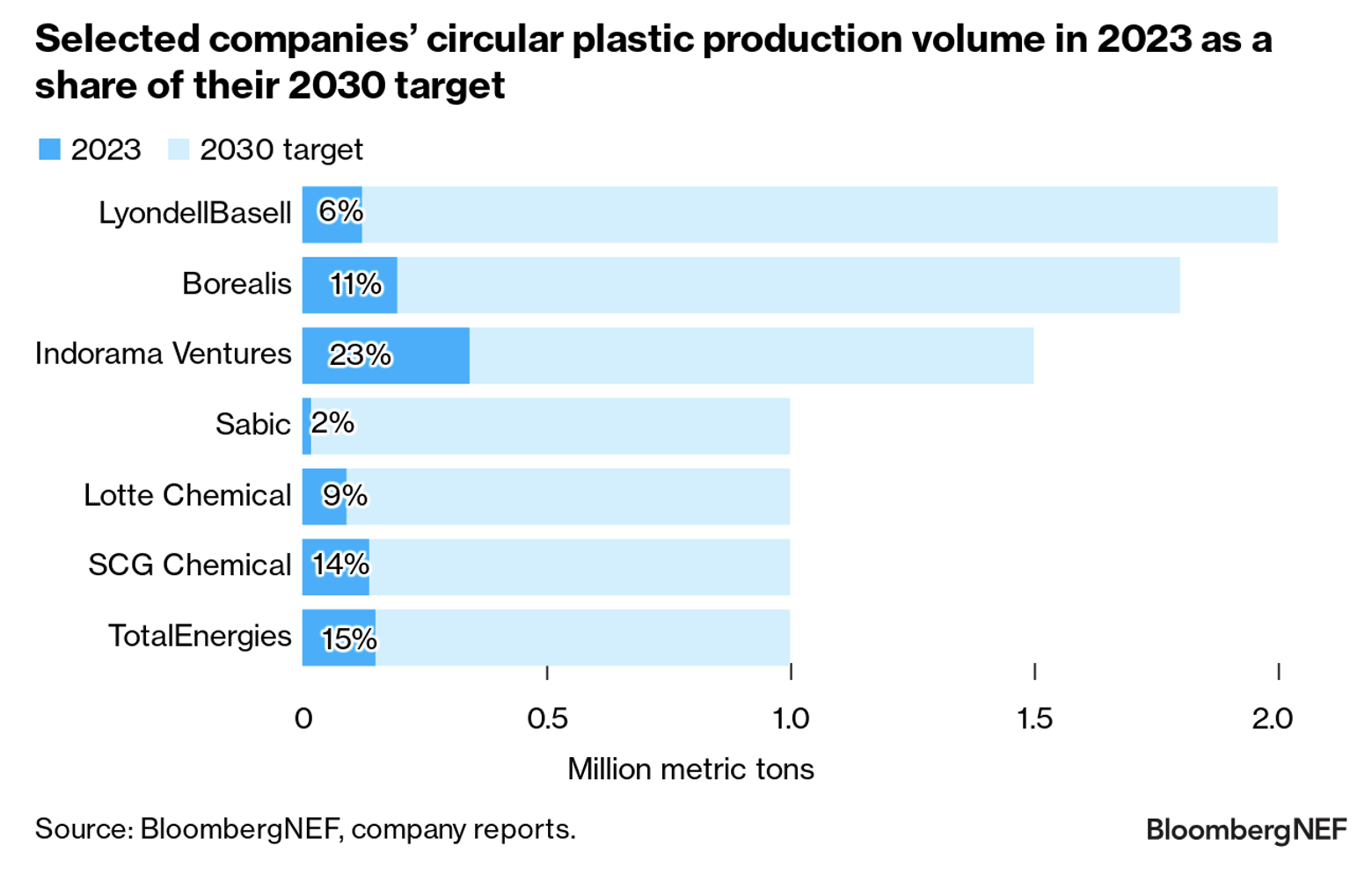

Most plastic producers are far from their 2030 circular production goals

On the supply side, over 80% of the producers in the ranking have set targets to produce millions of tons of sustainable (recycled or bio-based) materials by 2030 or earlier. Fourteen of these companies have set clear production targets by 2030, while two (Shell and Hanwha) have goals that do not specify the volume or the targeted date. If these 14 companies meet their targets, they alone would supply around 15.5 million tons of sustainable plastics per year by 2030. This equates to roughly the total polymer production capacity of PetroChina, the second-largest producers ranked.

Production targets hold the highest weight in BNEF’s ranking methodology, as this reflects the upper limit of how circular a producer’s polymers will be this decade. Only a few producers have disclosed their current progress, as many are still waiting for more recycling capacity to be commissioned. Companies also face challenges in sourcing scrap or sustainable feedstock to produce circular plastics. To add to the pressure, some producers reported weaker financial results in 2023 due to global overcapacity and flagging demand.

Nevertheless, most producers are counting on chemical recycling to achieve their production targets. All ranked producers (except PetroChina) have announced projects or partnerships involving chemical recycling technologies. Such processes use chemicals to convert plastic waste into virgin-grade feedstock materials such as recycled naphtha. Data tracked by BNEF shows chemical recycling capacity could reach around 5.3 million tons by 2030, if all the announced capacity comes online.