By Colin McKerracher, Head of Advanced Transport, BloombergNEF

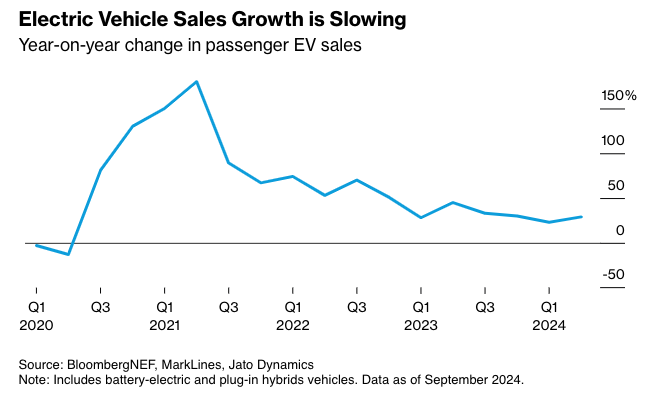

Around this time a year ago, the first headlines started to emerge about a drop-off in demand for electric vehicles. Automakers including General Motors and Ford began to scale back production plans and delay model launches, and others followed suit.

At the BloombergNEF Summit last week in London, my colleague Aleksandra O’Donovan gave a presentation taking stock of whether there really is an EV slowdown, and what it means for the global auto market.

The verdict: growth rates are slowing, but EV sales are heading for another record year. The full video of the talk can be found here.

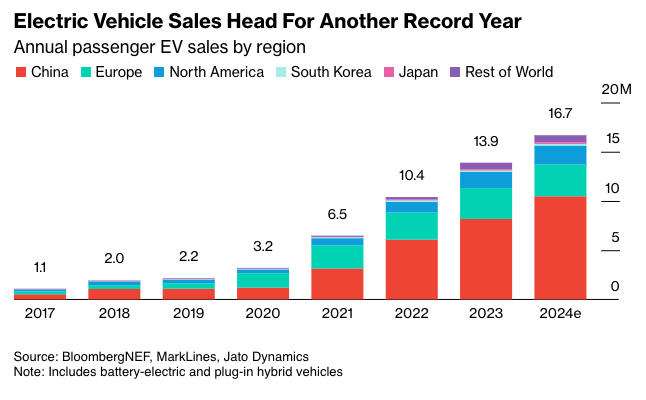

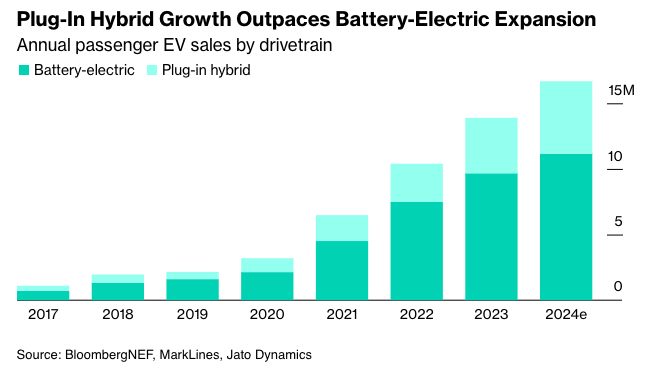

BNEF estimates that sales of EVs — including both battery-electric and plug-in hybrid vehicles — are headed to 16.7 million units this year, up from 13.9 million in 2023 and in line with our forecast at the start of the year.

In the first half of this year, global EV sales rose 26%, and preliminary data suggests sales increased around 30% in September. That’s very solid growth, though it is down from an increase of 33% last year and 60% the year before.

Countries like Japan and Germany — home to some of the largest automotive incumbents — have seen not just a slowdown in the growth rate, but an outright decline in EV sales. The drop in Germany was particularly sharp in August, when sales plunged 61%. While that’s alarming on the surface, not everything is as it seems. In August 2023, we saw a significant pull-forward in sales ahead of a subsidy cut, distorting the year-over-year comparison.

Gauging EV demand in Europe is complicated right now because many automakers are holding off launching more affordable EV models until 2025, when vehicle CO2 targets across the bloc toughen again. Automakers are by and large already compliant with the targets this year and have little incentive to sell additional EVs.

Something similar happened in 2019 ahead of the 2020 tightening of emissions standards — we saw an EV sales slowdown in the former year, followed by a big increase in the latter. We’re likely to see history repeat in Europe, with automakers prepping more affordable models like the new Renault 5, Hyundai Inster, Fiat Grande Panda, Skoda Epiq and VW ID2.all.

Pricing is still an issue in Europe, with some automakers trying to recoup the full development costs of their EV platforms across relatively low sales volumes. The Fiat 500e for example, is priced at an almost €12,000 ($13,000) premium to the standard Fiat 500, despite only having around €3,000 worth of batteries in it, based on BNEF analysis. The internal combustion version of the Fiat 500 costs less than €19,000. Asking mass market consumers to pay over 60% more than that to go electric was never going to be a winning strategy.

Looking east, China is still the biggest driving force behind the global EV market. It accounts for six out of every 10 plug-in vehicles sold globally so far this year, and the EV share of domestic sales is now over 50%. Sales jumped almost 50% in September, and the market shows no sign of slowing down. International automakers are as a result quickly being squeezed out of the China market.

Still, there’s an important asterisk beside the China numbers — much of the growth has been driven by plug-in hybrids and range-extended EVs, rather than battery-electric vehicles that powered past growth waves. Retail BEV sales in China are up 18% so far this year, while total plug-in sales are up 37%.

This is perhaps the most substantive part of the EV slowdown narrative. Global BEV sales will still be up this year, but are growing slower than plug-in hybrids due to sales in China.

EV sales in the US are further behind Europe and China, but still hit a record in the third quarter, with preliminary data showing around 390,000 vehicles sold.

Tesla’s sales have slowed this year and dipped below 50% of all EVs sold in the US, but the slack has been more than taken up by increasing numbers from groups like GM and Hyundai. Honda’s new EV, the Prologue, is also selling well. BNEF is expecting a strong finish to the year, with EVs crossing 10% of sales this year.

When things are changing quickly, it’s important to read more than just the headlines and dig into the numbers. EV sales growth is slowing, but volumes are still going up and will make up 20% of global vehicle sales this year.