By Nelson Nsitem, Senior Energy Storage Associate, Yayoi Sekine, Head of Energy Storage, and Andy Leach, Energy Storage Associate, BloombergNEF

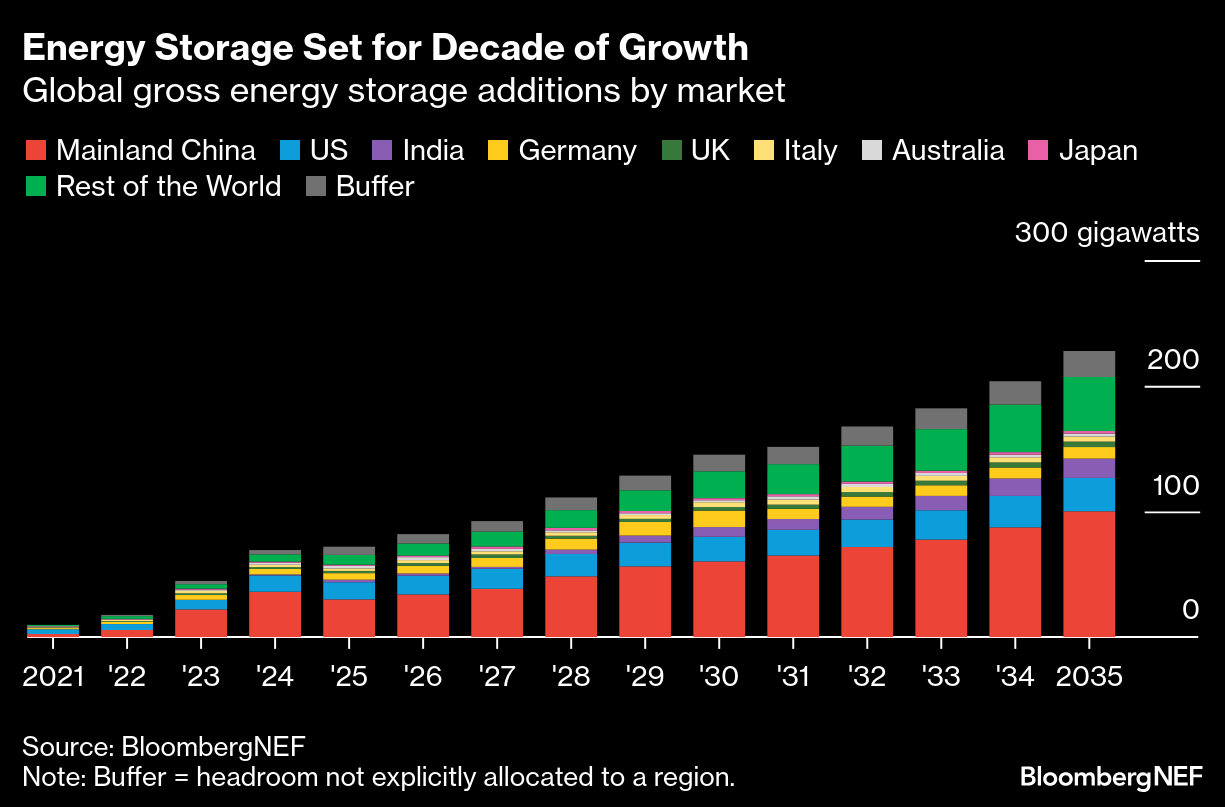

It will be another record year for energy storage installations globally, but the two largest markets – China and US – may face challenges next year due to targets already being met in one and uncertainties stemming from the new Trump administration in the other. Overall deployment will still rise every year in the next decade, as other markets rapidly scale up. BloombergNEF expects the energy storage market in 2035 to be 10 times larger than it is today, at 228 gigawatt (965 gigawatt-hours) cumulatively, in its latest outlook.

This year will see a massive 76% jump in global storage installations to 69 gigawatts/169 gigawatt-hours. China leads, while the US stays second. Other main markets are India, Germany, Italy, UK, Italy, Australia and Japan.

China’s momentum currently is around its provincial co-location mandates, which require batteries to be added to new solar or wind sites. Next year, however, the annual build in the Chinese market may drop by 17% in gigawatt terms, to 30GW/79GWh, as some provincial targets are met. New additions beyond those targets can be limited because of the lack of alternative business models.

The new administration will shape up a new phase of energy development in the US. With the continuing support of the Inflation Reduction Act and state-level policies, however, the market could grow massively to 2035.

In addition to the US and China, growth in the rest of the world picks up, thanks to auctions and tenders across Europe, Africa and Latin America. Countries to watch include Spain, Poland, Greece, South Africa, Chile and Brazil.

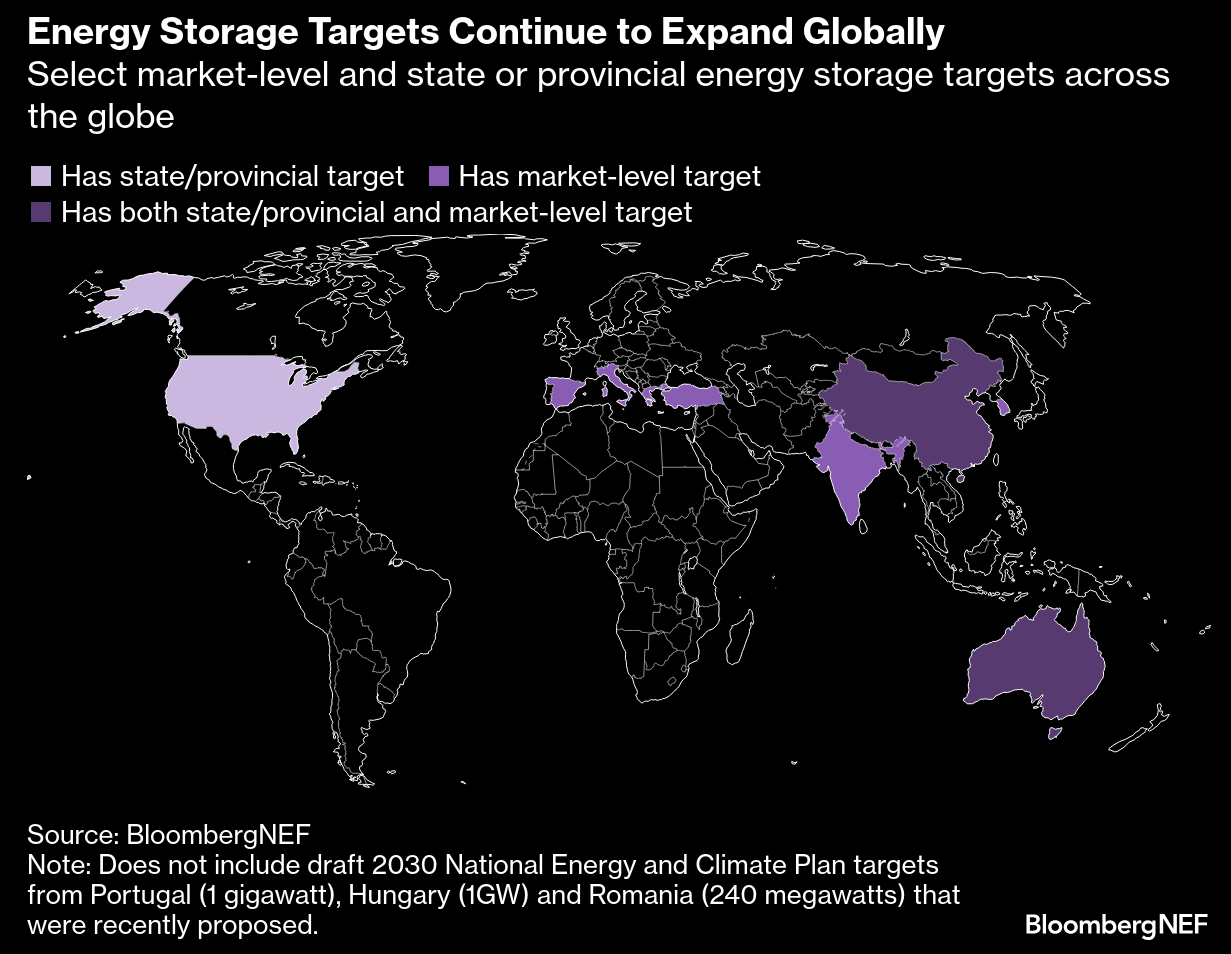

Nearly all top markets in the world have energy storage targets, some of which are expanding as 2030 looms closer. As of October 2024, BloombergNEF tracked energy storage targets in 26 regions across China, 13 US states and seven countries: Australia, South Korea, India, Greece, Italy, Spain and Turkey.

In view of these targets, governments have approved billions of dollars for support schemes that are helping to attract investment in energy storage capacity. This growth is increasingly necessary to keep up the expansion of solar and wind capacity.

The extent of support required is ratcheting down, thanks to a combination of falling battery prices and rising power price volatility in markets with higher levels of renewable penetration.

The design of energy storage support schemes popping up across the globe is also changing. We see from examples in Europe and Australia that governments are moving on from simply providing direct grant or capex support to offering mechanisms like two-way contracts for differences. This allows governments and power market operators to ensure that they only help developers manage their downside risk and prevent funding from going toward projects that would be otherwise profitable.

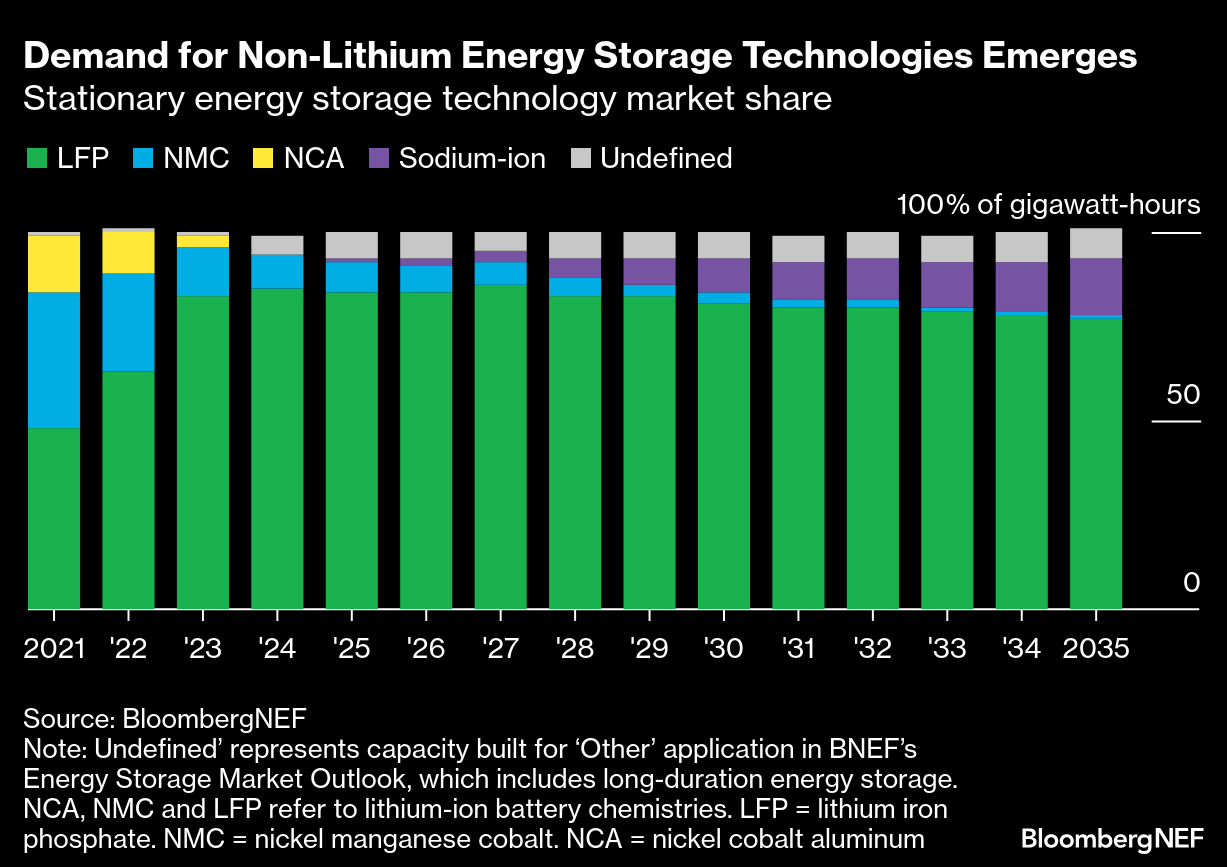

Technology-wise, BloombergNEF expects lithium iron phosphate (LFP) to remain the dominant chemistry for energy storage through 2035, largely due to its lower cost and higher cycle life compared to nickel-based lithium-ion battery chemistries. LFP’s lower energy density is less of a concern for the energy storage sector: weight and space are not as important for stationary systems, though bigger cell sizes have led to pack and system-level energy density improvements.

The growth in LFP’s market share is made possible by the aggressive scale-up in manufacturing capacity by Chinese battery makers. Some battery makers outside China, many of which historically specialized in nickel-based lithium-ion batteries, are also scaling up manufacturing of energy storage products using LFP. Major examples include South Korea-based LG Energy Solution and Samsung SDI, Japan’s Panasonic and Norway-based Freyr.

BNEF separated capacity as ‘undefined’ in the technology mix outlook for the first time to address capacity being built under ‘other’ applications, which includes long-duration energy storage (LDES). Within LDES, energy storage technologies other than lithium-ion and sodium-ion batteries will play a role, including non-battery technologies like thermal, mechanical and chemical storage solutions.

BNEF clients can access the full report here.

(Global additions in 2035 corrected to 228 gigawatts (965 gigawatt-hours) in text and chart on December 2, 2024.)