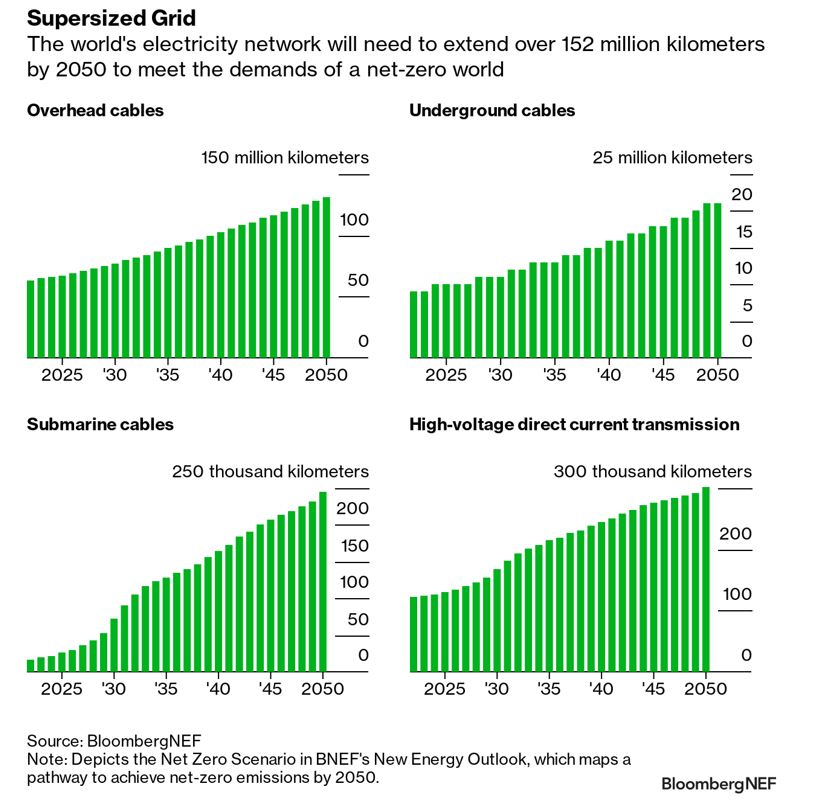

Imagine it’s 2050 and the world has managed to reach net-zero emissions. If you deconstruct the electricity grid and lay it out in a single line, those cables will stretch all the way to the Sun.

A 152-million-kilometer supersized grid is what’s needed to power a greener future and avert climate disaster, according to BloombergNEF. That’s more than double the length of the grid today.

While solar and wind will undoubtedly be the stars of the energy transition, new renewables capacity is useless without the infrastructure to transport that clean electricity from where it’s produced to the end user. Grids will also be at the heart of enabling the charging network to accelerate the electric vehicle revolution, scaling up energy storage to complement intermittent renewables, and powering the electrolyzers that split water to produce green hydrogen.

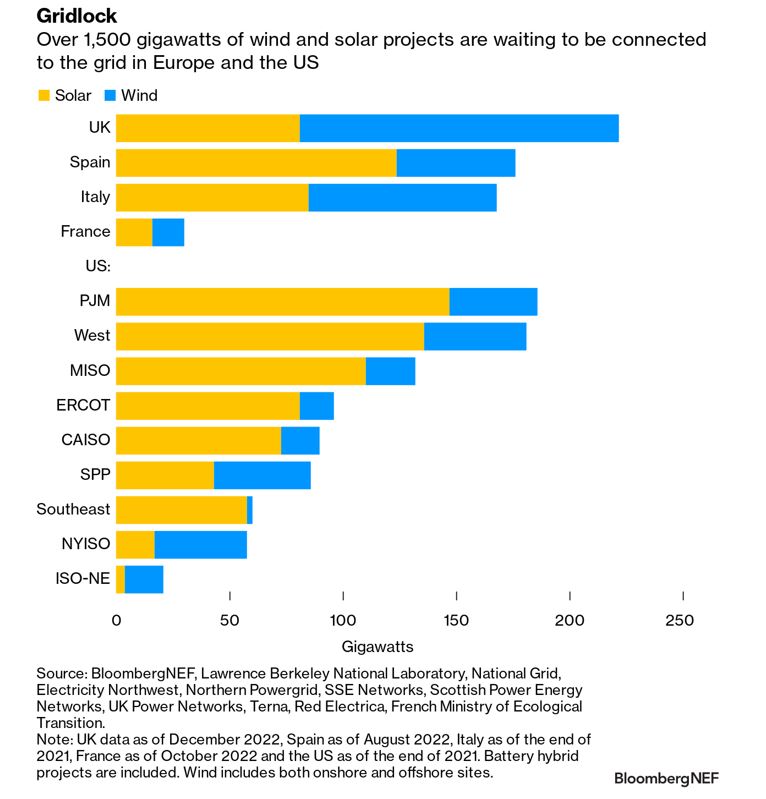

The pivotal role of the grid is evident in the bottlenecks getting new clean energy capacity connected. There’s almost 1,000 gigawatts of solar projects stuck in the interconnection queue across the US and Europe, close to four times the amount of new solar capacity installed around the world last year. Over 500 gigawatts of wind is also waiting to be plugged into the grid, five times as much as was built in 2022.

Put another way, if all the wind and solar farms in limbo were built and connected to the grid, they would add up to more than the present electricity generation capacity of the US.

Projects can end up being stuck in an interconnection queue for years. In an ideal world, developers would apply for permission, receive the green light, build their project and connect to the grid. But they get bogged down in assessments of how the new capacity will impact the wider network and what reinforcements to existing infrastructure will need to be made.

US held back by a fragmented and outdated grid

The problem is particularly acute in the US where the patchwork of now-antiquated grids was designed around a system reliant on fossil-fuel-powered electricity generation and planning for a renewables-led future doesn’t take a holistic view. Building long-distance transmission in the US is challenging in the absence of a federal authority empowered to approve such infrastructure. The Federal Energy Regulatory Commission has proposed two major reforms to streamline interconnection queues and encourage grid operators to do more long-term planning.

It’s not just about more cables and wires, they need to be located in the right place, and this is changing as solar and wind farms crop up in different areas of the country to traditional coal and gas plants. Rather than taking a proactive approach to preparing the grid, it is currently being fixed bit by bit as new projects come along.

The required upgrades mean the cost of getting a connection to the grid is rising. For renewables projects in PJM and the Midcontinent Independent System Operator – two regional power markets in the US – the average interconnection cost hit $120 per kilowatt between 2020 and 2022, some 65% higher than 2015 to 2019.

Spiraling costs and years-long delays are leading some developers to just give up and walk away. According to Lawrence Berkeley National Laboratory, less than a quarter of wind and solar projects that seek a grid connection in the US actually end up operating. Prolonged setbacks could see materials get more expensive, land options expire and customers to sell the power to lose interest.

Inflation Reduction Act provides some hope

As the aging US grid struggles to cope with increasingly frequent severe weather events, there are question marks over whether it can handle the demands of the energy transition. An estimated 70% of transmission lines in the US are more than 25 years old.

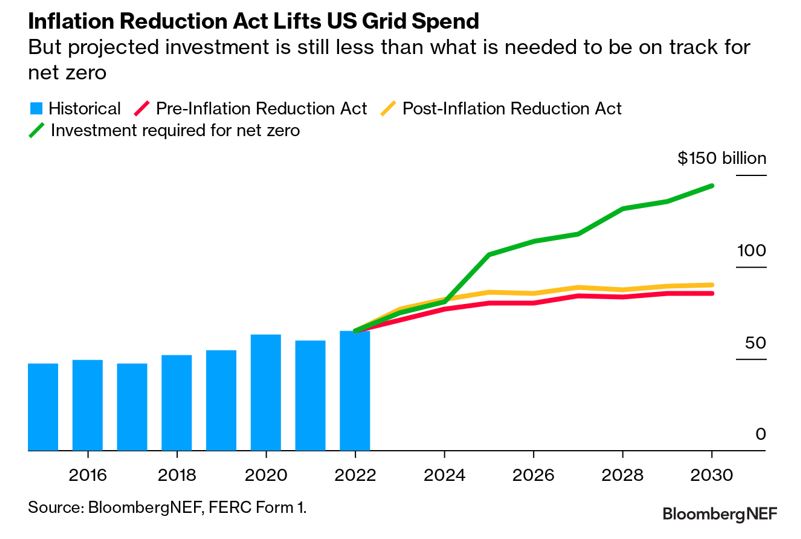

Legislation from the past couple of years should help, with the Infrastructure Investment and Jobs Act and Inflation Reduction Act allocating $29 billion of federal funding between them to initiatives related to the grid.

BNEF expects this to stimulate $83 billion of extra grid investment through to the end of the decade. This comprises $23 billion in direct federal funding for new power lines, asset upgrades and the deployment of novel technologies; $13 billion in finance attracted from the private sector; $39 billion to connect the 121 gigawatts of additional renewables advanced by the Inflation Reduction Act; and $8 billion in grid investment for electric vehicles.

Still, overall spending is set to fall short of a net-zero emissions trajectory.

A $21 trillion backbone of the energy transition

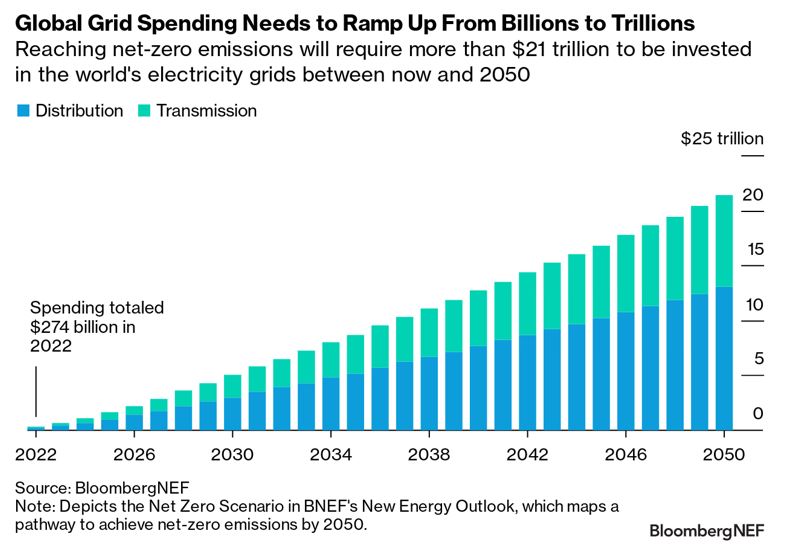

Scaling up the world’s grids won’t come cheap. Huge amounts of capital are needed to not only expand and upgrade networks to accommodate new generation assets and higher electricity demand, but also to replace aging assets. BNEF’s Net Zero Scenario envisages more than $21 trillion being spent by 2050, with the US and China alone accounting for over a third of this investment.

Staying on track for net zero will require annual expenditure on grids to jump more than threefold over the coming decades, from $274 billion in 2022 to almost $1 trillion by 2050. Incremental progress is expected this year, with BNEF anticipating global spending will top $300 billion.

But it’s not as simple as throwing money at a problem. Policymakers will need to step up to reform regulatory frameworks and permitting processes, and support supply chains to unlock this level of investment.

There’s also the ‘not in my backyard’ issue as people baulk at the idea of a view spoiled by pylons and crisscrossing wires. Underground cables can overcome this constraint and also provide protection from extreme weather events such as hurricanes and wildfires. BNEF’s Net Zero Scenario sees the underground power line network more than doubling by 2050 to 21 million kilometers.

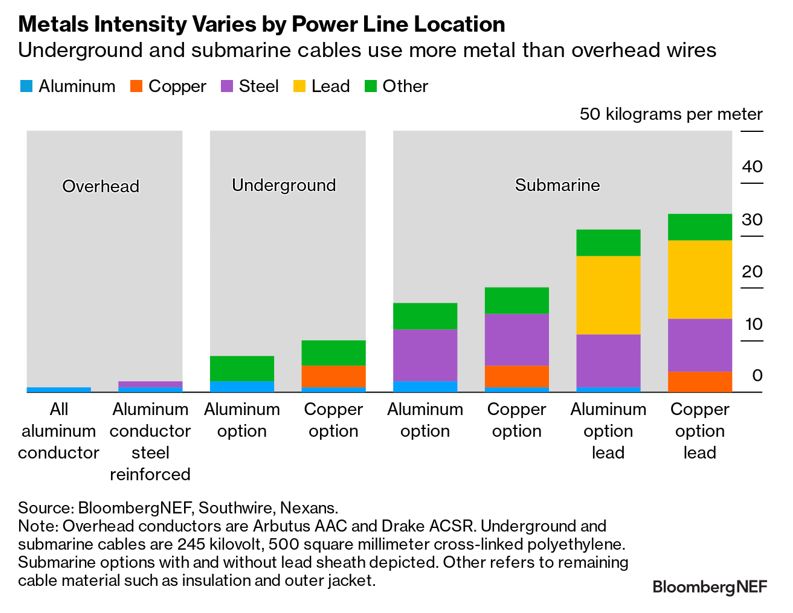

Underground cables are more metals intensive than overhead wires, however, and the submarine transmission lines needed for offshore wind are even more so. Undergrounding can also be more costly, take longer to build and make operation and maintenance challenging.

Overhead wires are primarily made of aluminum as copper is heavier to string between pylons and nearly twice as expensive after adjusting for conductivity. But copper is still preferred for underground and submarine cables due to its superior technical performance.

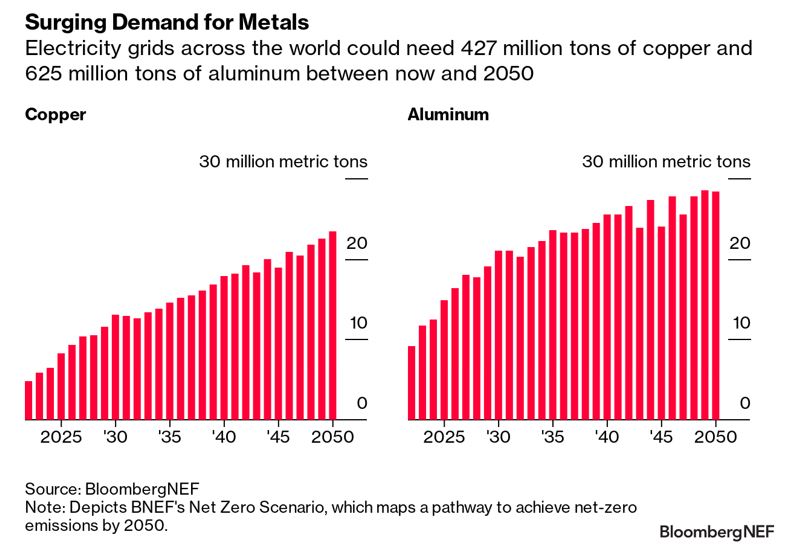

Building networks of transmission and distribution lines that can power a net-zero future will require an extraordinary amount of metals. BNEF expects the electricity grid to be the top consumer of copper among energy transition sectors in a net-zero world, needing around 427 million metric tons of the red metal between now and 2050. That’s almost eight times as much as wind turbines, solar panels and energy storage combined, and 1.5 times the amount of copper that will go into electric vehicles. By mid-century, the grid could account for more than a third of global copper demand.

There are ways to tame the grid’s hunger for metals. Advanced conductors, such as those that use aluminum wrapped around composite materials like carbon and ceramic fiber, can be deployed both above and below ground and improve the payback on expensive copper and aluminum by pushing more electricity through the same corridors. While more expensive upfront than conventional conductors, this could be offset by the efficiency gains on offer.

High-voltage direct current transmission lines also use roughly half the metal of alternating current lines thanks to fewer wires and thinner conductors. China in particular is leaning on high-voltage DC infrastructure to connect renewables generation in more remote areas to urban demand centers.