There is an urgent need to scale new climate technology innovations that can deliver equitable, economic and timely decarbonization. BloombergNEF released three white papers that analyze technology innovations and the early-stage companies developing them. These technologies could play an important role in addressing climate challenges.

These publications are part of BNEF’s climate-tech and innovation coverage, tied to our annual Pioneers competition. The Pioneers program identifies a group of game-changing technologies or innovations with the potential to accelerate global decarbonization and address climate change. In 2021, the Pioneers competition focused on recognizing innovators across three key challenges (see this year’s winners here). The BNEF white papers cover these challenges:

- Managing and optimizing commercial freight

- Advancing sustainable materials

- Monitoring and understanding our changing planet

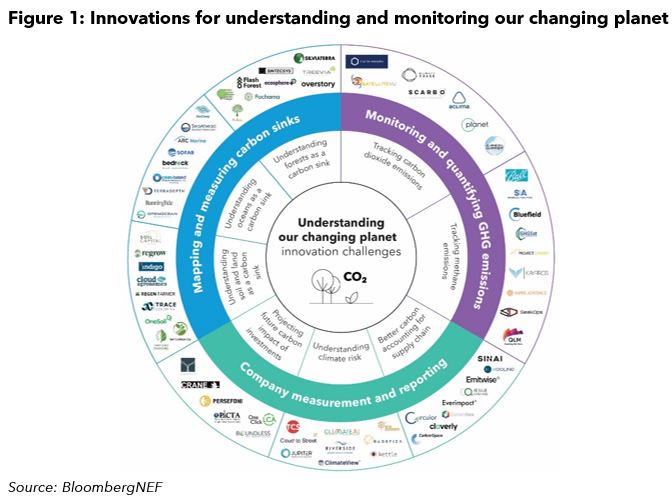

The third paper, profiled in this article, outlines the impact that rising levels of greenhouse gases are having on our planet, and what damage this brings. The paper reviews technology innovations that will help us understand the impact of climate change and better track the amount and location of carbon dioxide and methane emissions globally. It also presents technologies and tools that will help corporations and governments track their own carbon footprint, the physical risks associated with climate change, and begin to project future emissions of their operations.

Monitoring and understanding our changing planet

As climate change increasingly impacts the planet, there are some important and urgent challenges to better understand how the world is reacts to rising greenhouse gas levels, to monitor any changes, and to evaluate the role that natural carbon sinks can play in decarbonization. In this white paper, we analyze technology innovations, profile 62 early-stage companies and provide data on the $1.4 billion of early-stage venture money directed to these technologies since 2015.

Mapping and measuring carbon sinks: Ocean and land carbon sinks each year absorb more than 50% of anthropogenic carbon dioxide emissions. Yet, human activity and climate change is damaging the ability of the sea, soil and trees to continue to be significant carbon sinks. Globally, soils have lost between 50-70% of their original carbon stock and only one major rainforest (the Congo) remains a strong carbon sink. This paper reviews technologies that can measure the carbon absorption of nature, help increase this characteristic and monetize the protection of natural carbon sinks.

Monitoring and quantifying greenhouse gas emissions: We can calculate the amount of carbon dioxide and methane in the atmosphere, but it is still difficult to pinpoint the exact sources of emissions, and quantify their amount. This is particularly true for fugitive emissions arising in particular from the energy and agriculture sectors. This paper reviews technologies that can record and measure fugitive greenhouse gases so that governments and corporations can address the source of the leaks and meet climate goals.

Company-level measurement and reporting: Companies and financial institutions must better understand their impact on the planet, while also assessing the risk that climate change has to their business. Of the 150 companies with net-zero targets that BNEF tracks, only 66 address some, or all, of their Scope 3 emissions. And while 60% of S&P 500 companies own assets at a high risk of climate-change physical risk, very few corporates understand the extent of the risk. This paper reviews technologies that help report on Scope 3 emissions, those to understand the physical climate risk of assets, and ways to project the carbon emissions of future investments.