1. China dominates clean energy manufacturing

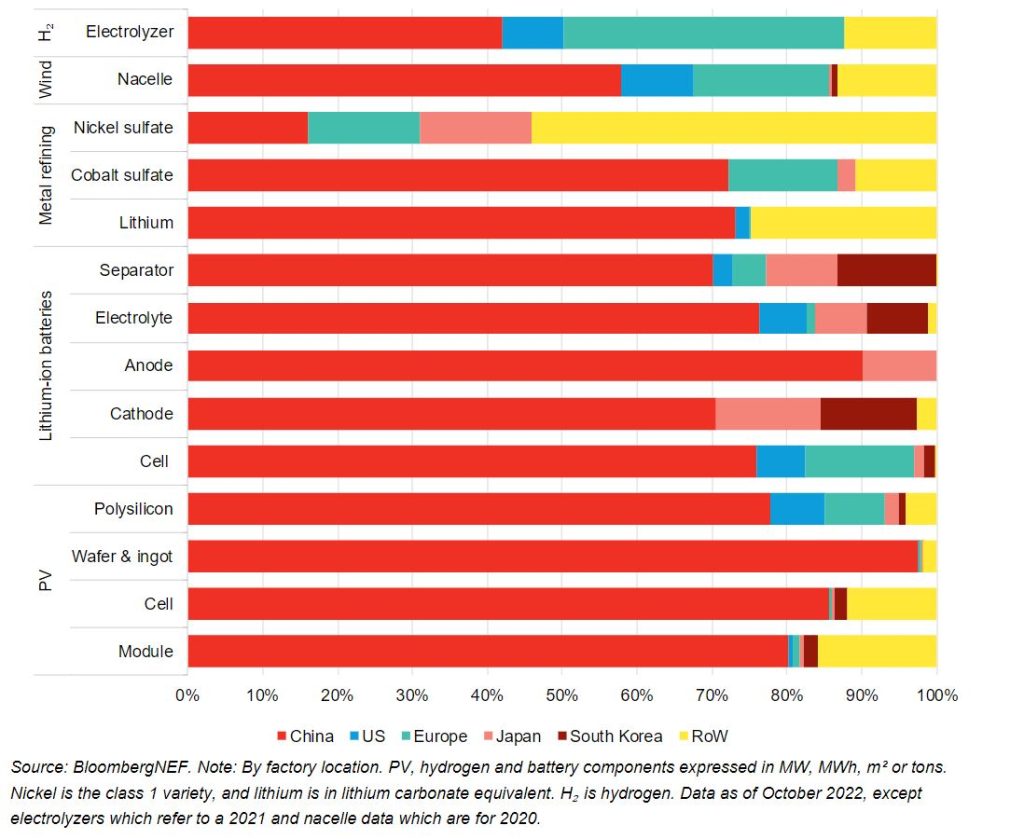

Clean technology factories are shockingly concentrated. Over the past two decades, China has emerged as the world’s battery and solar equipment hegemon. As the world’s top oil producer, Saudi Aramco pumped some 11% of the world’s crude in 2021. That pales before the 70% of production capacity in 11 clean energy segments nestled within China’s borders.

Download the complete report here.

Top-down incentives, low costs, surging demand, rules that favor local companies, fierce domestic competition – all played a role in engineering China’s efficient, integrated production hubs that dominate clean energy manufacturing. No other country has done as much to harness economies of scale and drive down the cost of solar and batteries, burnishing the energy transition’s economics in the process.

Clean energy manufacturing capacity by location

Yet the political winds are changing. Increasingly, policymakers are recognizing that same efficiency-enhancing concentration as a gaping vulnerability.

2. Localizing clean energy factories is a political priority

A war in Europe and growing tensions over the Taiwan Strait have made a strong case for diversifying supply. And today’s clean energy supply chains have shown their vulnerability to a host of risks beyond geopolitics.

A series of unfortunate events rippled through Chinese provinces over 2022. Consider polysilicon, a critical solar input mostly produced in China. Lockdowns in Shanghai, a factory fire in Xinjiang, a drought-induced power crisis in Sichuan; all interrupted exports of the PV material. In the midst of August’s drought, polysilicon spot prices spiked to levels not seen for over a decade.

Jobs are another concern. As the energy transition picks up, governments are eager to accrue what economic value can be gained from onshoring manufacturing.

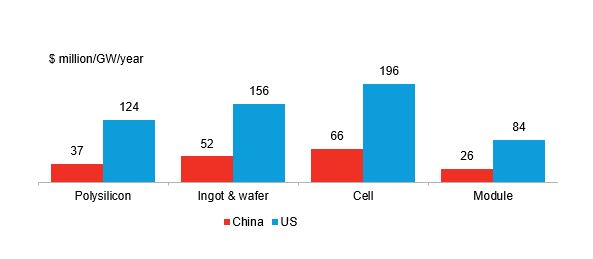

The US, EU and India are particularly keen to localize the production of clean energy technologies. Western policymakers will have to loosen their wallets, for constructing factories at home is far more costly than in China.

PV factory capex

Source: BloombergNEF. Note: Assumes integrated ingot and wafer factories.

3. Onshoring manufacturing will come at a cost

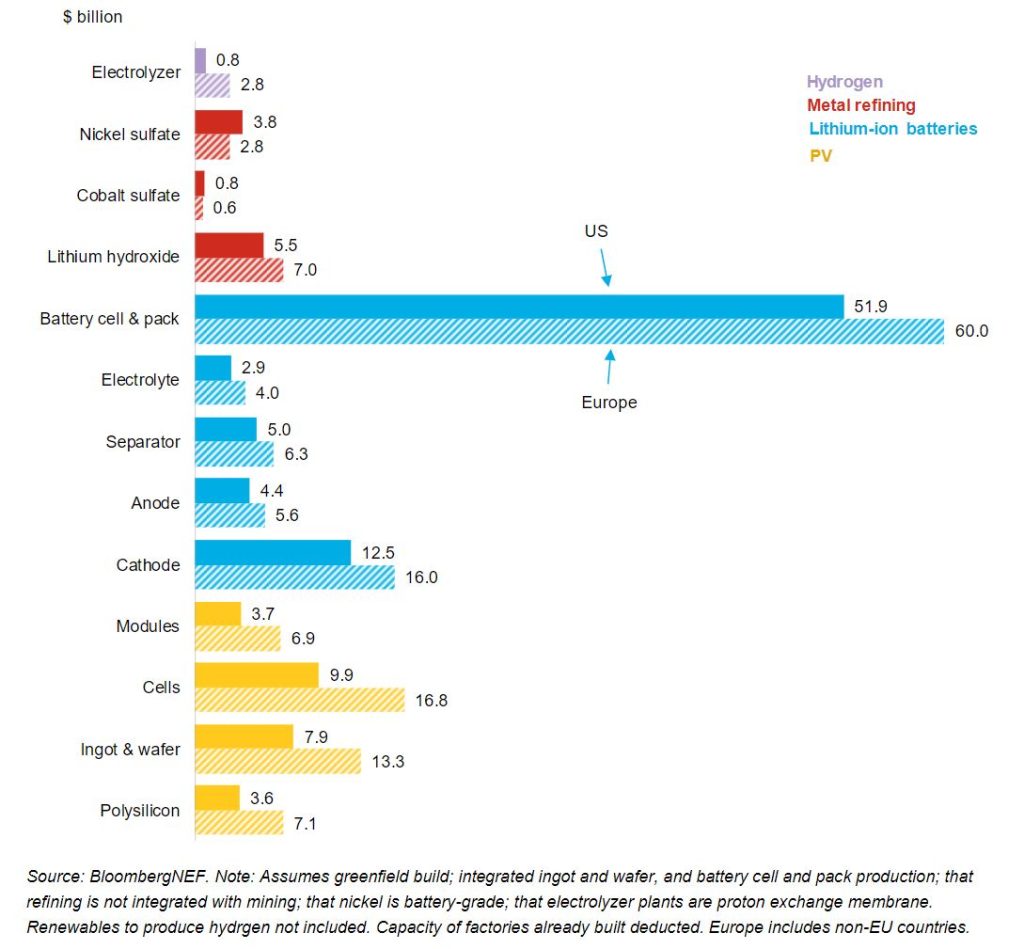

Building the factories needed to meet local demand for battery components, battery metals, solar, lithium-ion batteries and electrolyzers by, say, 2030 would cost billions. To be precise, about $149 billion in Europe and $113 in the US. The bulk of that – 62% in Europe – is devoted to the battery supply chain. Battery cell factories would cost more than all other battery segments combined, including metal refineries.

In general, the cost of deploying clean technologies is a good deal higher than building the associated factories. In Europe, where low-carbon hydrogen production is set to skyrocket, the electrolyzer factories needed to meet the region’s demand would cost just $2.8 billion. That’s about a tenth of the $27 billion required to deploy low-carbon electrolyzers, not including the associated renewables capacity. If clean tech were built in the West, these deployment costs would increase further.

Upfront capital for new factories required to meet domestic 2030 clean-energy demand, Europe and US

Upfront investment typically represents a small share of a factory’s lifetime costs, though these are bulkier for segments like polysilicon and battery cells. On the whole, operating costs – energy, labor and materials – are generally more important. European companies can build all the electrolyzer factories they like, but may find themselves competing with Chinese electrolyzers produced at a fifth of the cost.

4. The Inflation Reduction Act is a game-changer

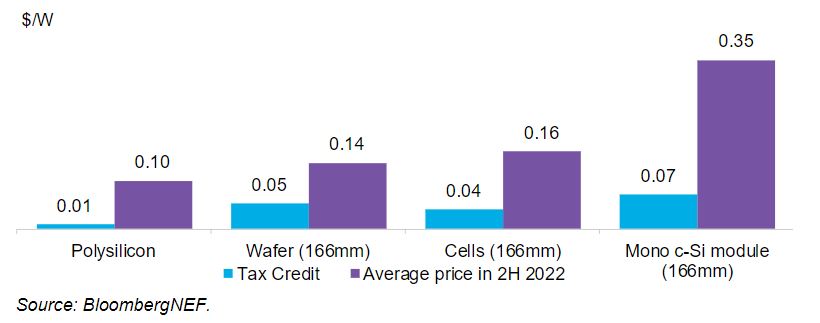

To many, challenging China’s supremacy in the solar and battery arena has long seemed like a pipe dream. August 12 may go down as the day when all that changed. The passage of the Inflation Reduction Act was Joe Biden’s tour de force, and finally endowed the US with a federal climate policy worthy of that name. Its provisions unlock a subsidy buffet, notably in the form of tax credits, which can be claimed for deploying clean technology but – crucially – for the output of manufacturing facilities.

Those tax credits are a game-changer. Output-based subsidies are available for American factories across the wind, solar and battery value chains. They cover a big enough chunk of production costs to matter and run through 2032. Subsidy carrots are backed by sticks: trade barriers (many of which carried over from under Donald Trump) and, for the battery value chain, local content provisions for the components and refined metals contained by subsidized electric vehicles.

Proposed US IRA solar manufacturing tax credits and average prices in 2021

Most surprisingly, the subsidies’ budget is infinite for as long as they are in force. The Biden administration estimates the IRA will allocate $370 billion to clean energy, but depending on take-up, the actual tab could leave that figure in the dust.

Europe is not sleeping, either. Various grant programs are backing new factories for electrolyzers and batteries. But against the IRA’s concerted approach, the EU’s support looks piecemeal and is dependent on member states chipping in to be truly leveraged.

As the world’s biggest free-trade bloc, the EU has an instinctive aversion to local content rules, though that may yet change: on October 26 the French president called for a “Buy European Act” to match Washington’s approach to supporting green technology. The EU plans to bring in mandatory carbon footprint thresholds for batteries sold in the bloc – a policy that will come into force in 2027.

5. Nurturing ecosystems will not be easy

China has efficiencies of scale, and vertically integrated ecosystems that drive down costs. For instance, Chinese-battery makers like CATL make cathodes and invest in separator plants while taking stakes in anode producers. Today, integration is a far greater boon to the country’s competitiveness than government largesse, low-cost power or cheap labor.

Creating similar ecosystems is a big hurdle. For PV in the US, for instance, that will mean breathing life into a network of material suppliers, whether for glass, backsheets or ethylene vinyl acetate. Much of the equipment used in battery factories would have to be imported from China. And across various sectors, manufacturers in the West expect to run their factories at much lower utilization rates, given the lack of immediate service and support for equipment.

That the US and Europe will succeed in their ambitions to localize is not a foregone conclusion. Countries typically build up their production capabilities by hosting foreign manufacturers. Investments by Japanese and South Korean battery-makers are planned across the US. Yet, to various degrees, the bleeding-edge knowledge concerning PV, battery and electrolyzer manufacturing resides in China. And Chinese manufacturers are finding it harder to site facilities in the US and, to a lesser extent, Europe. That may slow the transfer of knowledge and, in some areas, complicate the emergence of manufacturing.

If Western policymakers succeed, another question presents itself: what will be the impact on learning rates? The vertiginous drop in the cost of PV and batteries were largely enabled by China. These cost declines have stalled as pandemic and conflict battered global trade flows but, even as supply chains unsnarl, localized manufacturing could act as another dampener on clean energy’s competitiveness. Localizing the production of clean energy equipment would make supply chains more resilient and create jobs. It also means a pricier energy transition just as investment needs to get scaling, fast.

Watch the webinar: The Cost of Localizing Clean Energy Supply Chains