Vestas leads a group of three major manufacturers, but a “big four” will emerge this year

London and New York, 22 February 2017 – With a clear lead, Vestas reclaimed the top spot in the annual ranking of wind turbine manufacturers, according to figures compiled by Bloomberg New Energy Finance.

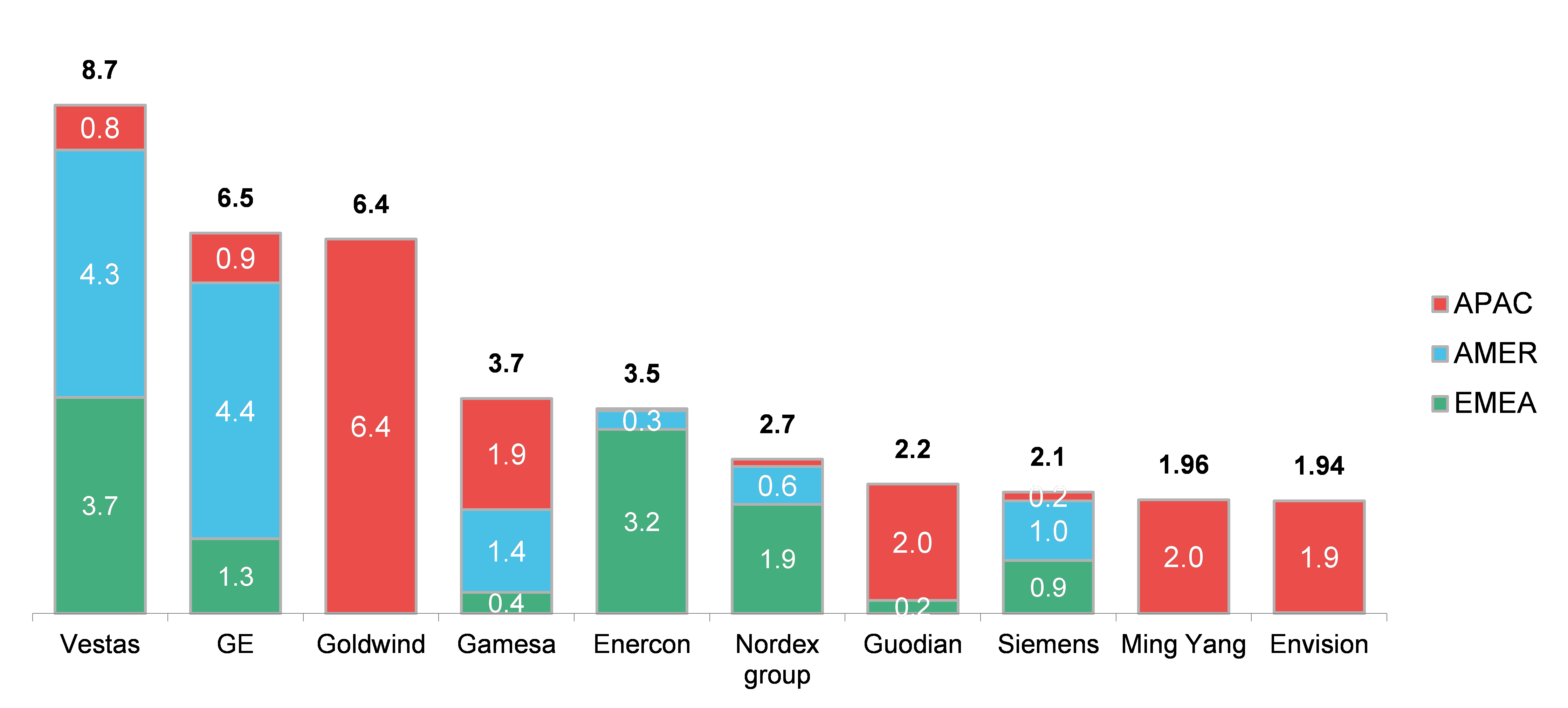

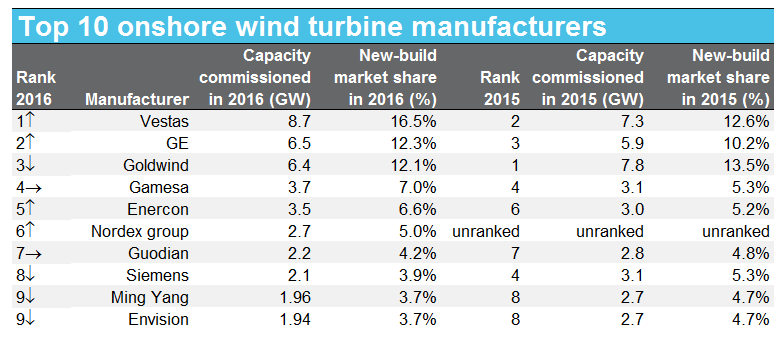

Some 8.7GW of Vestas turbines were installed in 2016, good for 16% of all onshore wind installations last year. Vestas returns to the top spot thanks to a strong push in the US. The Danish turbine manufacturer continues to pursue a global strategy with projects commissioned in 35 countries, more than any other turbine maker.

General Electric placed second with 6.5GW, some 0.6GW more than in 2015. While GE narrowly lost its traditional lead in the US market for newly commissioned turbines to Vestas, it managed to increase its global presence to 21 countries in 2016, from 14 in 2015.

Xinjiang Goldwind Science & Technology fell from first to third place with 6.4GW in 2016. Virtually all of the Chinese manufacturer’s capacity was built in its home market, where Goldwind further extended its market share. China’s contracting wind market had a clear impact on Goldwind, as overall installations there were 22.8GW, down 21% from the record 29GW in 2015.

“This years’ ranking shows why 2016 was all about mergers in the turbine-maker sector,” said David Hostert, head of wind research for BNEF. “There is now a strong breakaway group of three companies at the front, with a fairly tight field following. The upcoming merger of Siemens Wind and Gamesa will allow the joined company to catch up and create a ‘big four’ group of dominant manufacturers. Staying at the front of this pack will require both significant size and a balanced presence in the right markets.”

Spain’s Gamesa came in fourth place for onshore turbine installations, narrowly ahead of Germany’s Enercon. Both companies managed to significantly increase their overall installations compared to 2015. While one out of every two Enercon turbines was installed in Germany, almost one in three Gamesa turbines was installed in India.

Nordex group returned to the top 10 in sixth place, after its merger with Acciona Windpower last year. China’s Guodian United Power remained in seventh place, ahead of Siemens. The latter fell four places in the onshore ranking compared to 2015. Chinese firms Ming Yang and Envision tied for ninth place, with the difference between the two manufacturers too close to call.

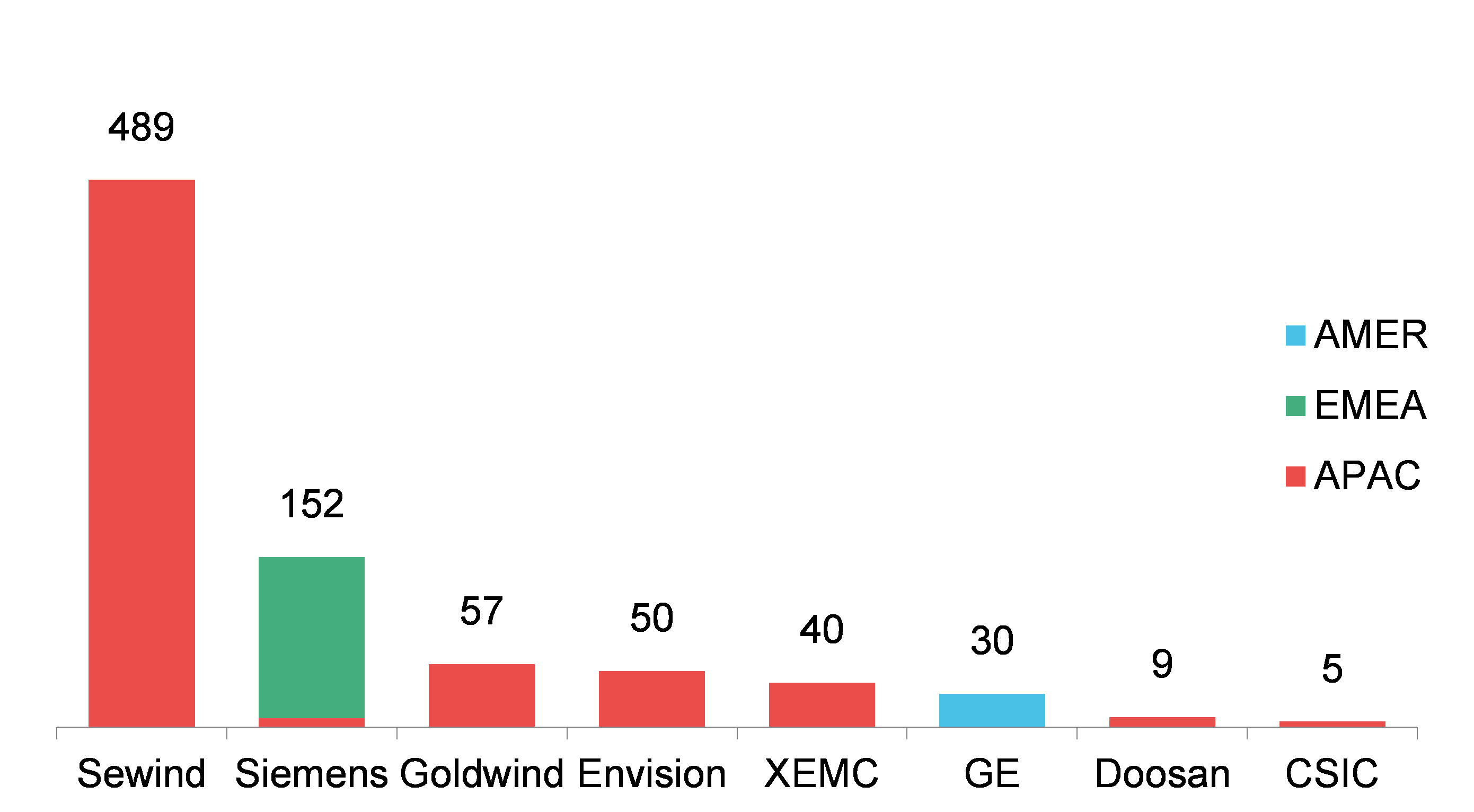

Only 832MW of new offshore wind capacity was commissioned in 2016 in a year that was dominated by installations in Asia. While 2016 was a record for new offshore wind financings for projects to be built over the next few years in Europe, the actual amount being commissioned globally last year was far below 2015’s 4.2GW. China’s Sewind, which produces Siemens offshore turbines under license in China, placed first with 489MW. Of these, some 388MW were Siemens turbines and 101MW were machines of its own design. Under our methodology, Siemens placed second with two projects, in the Netherlands and Taiwan.

Bloomberg New Energy Finance compiles its annual onshore and offshore turbine manufacturer ranking based on its unique bottom-up project database and selected market sources to provide a global, harmonized methodology. These figures may, therefore, vary from manufacturer self-reporting. Gamesa and Siemens are shown as separate companies as the merger between Siemens Wind and Gamesa is not yet finalized.

Top 10 onshore turbine manufacturers, 2016 (GW)

Source: Bloomberg New Energy Finance. Note: Includes onshore turbines only. Ranking based on BNEF project data base and selected market sources.

Top 10 offshore turbine manufacturers, 2016 (MW)

Source: Bloomberg New Energy Finance. Note: Includes offshore turbines only. Total installations were 832MW in 2016. Siemens turbines built under license in China by Sewind are credited to Sewind. In 2016, Sewind commissioned 388MW of Siemens wind turbines and 100.8MW of its own-brand turbines. Neither MHI Vestas (a 50:50 JV between Mitsubishi Heavy Industries and Vestas) nor Adwen (a 50:50 JV between Gamesa and Areva) commissioned turbines in 2016. Offshore projects in AMER and EMEA are counted when fully operational, this does not include partially commissioned projects. Offshore projects in AMER are counted when installed.

Source: Bloomberg New Energy Finance.

CONTACT:

Veronika Henze

Bloomberg New Energy Finance

+1-646-324-1596

vhenze@bloomberg.net

Catrin Thomas

Bloomberg New Energy Finance

+44-20-3525-0673

cthomas106@bloomberg.net

ABOUT BLOOMBERG NEW ENERGY FINANCE

Bloomberg New Energy Finance (BNEF) is an industry research firm focused on helping energy professionals generate opportunities. With a team of experts spread across six continents, BNEF provides independent analysis and insight, enabling decision-makers to navigate change in an evolving energy economy.

Leveraging the most sophisticated new energy data sets in the world, BNEF synthesizes proprietary data into astute narratives that frame the financial, economic and policy implications of emerging energy technologies.

Bloomberg New Energy Finance is powered by Bloomberg’s global network of 19,000 employees in 192 locations, reporting 5,000 news stories a day. Visit https://about.bnef.com/ or request more information.

ABOUT BLOOMBERG

Bloomberg, the global business and financial information and news leader, gives influential decision makers a critical edge by connecting them to a dynamic network of information, people and ideas. The company’s strength – delivering data, news and analytics through innovative technology, quickly and accurately – is at the core of the Bloomberg Professional service. Bloomberg’s enterprise solutions build on the company’s core strength: leveraging technology to allow customers to access, integrate, distribute and manage data and information across organizations more efficiently and effectively. For more information, visit www.bloomberg.com or request a demo.