Firm third quarter suggests global clean energy investment for the whole of 2017 may slightly exceed 2016’s total of $287.5 billion

London and New York, 5 October 2017 – Seven giant wind projects, each costing between $600 million and $4.5 billion, and spread between the U.S., Mexico, the U.K., Germany, China and Australia, helped global clean energy investment to jump 40% year-on-year in the third quarter of 2017.

The latest authoritative figures from the Bloomberg New Energy Finance database of deals and projects show that the world invested $66.9 billion in clean energy[1] in 3Q 2017, up from $64.9 billion in the second quarter of this year and $47.8 billion in the third quarter of 2016.

The numbers for the July-to-September quarter mean that investment in 2017 so far is running 2% above that in the same period of last year, suggesting that the annual total is likely to finish up close to, or a little ahead of, 2016’s figure of $287.5 billion. This year looks highly unlikely, however, to beat the record of $348.5 billion reached in 2015.

The stand-out move of the third quarter of 2017 was American Electric Power investing $4.5 billion in Invenergy’s 2GW Wind Catcher project in the Oklahoma Panhandle. Due to be completed by 2020, the project will have 800 turbines, connected to population centers via a 350-mile high-voltage power line. AEP still needs to secure some regulatory approvals, but construction has started and BNEF is treating the project as financed.

Amy Grace, head of North America research for BNEF, said: “Wind Catcher is an example of a regulated utility in a wind-rich area of the U.S. taking advantage of federal tax credits to build a project that will produce electricity at below the cost of its existing coal and gas generating plants.”

The other top asset finance transactions of the quarter were Dong Energy’s decision to proceed with the 1.4GW Hornsea 2 offshore wind farm in the U.K. North Sea, at an estimated $3.7 billion by the time it is completed in 2022-2023, and Northland Power’s financing of the 252MW Deutsche Bucht array in German waters, at $1.6 billion.

After those came two Chinese offshore wind farms (Guohua Dongtai and Zhoushan Putuo) totaling 552MW and an estimated $2.1 billion, the Zuma Reynosa III onshore wind farm in Mexico, at 424MW and an estimated $657 million, and the 450MW Coopers Gap onshore wind project in Queensland, Australia at $631 million. The biggest solar project financing was an estimated $460 million for First Solar’s 381MW California Flats PV park in the U.S.

Breaking the 3Q 2017 figures down by type of investment, asset finance of utility-scale renewable energy projects, such as those above, jumped 72% globally compared to the same quarter of last year, reaching $54.3 billion. Small-scale project investment (solar systems of less than 1MW) came to $10.8 billion in the latest quarter, up 9%.

The two other areas of investment that BNEF tracks quarterly are venture capital and private equity investment in specialist clean energy companies, and equity-raising on public markets by quoted companies in the sector. Both these areas had subdued activity in the third quarter.

VC/PE funding was only $662 million in 3Q, down 79% from a very strong equivalent period a year earlier. July to September 2017 was the weakest quarter for this type of investment since 2005. The only deal to break three-figure millions was a $109 million private equity expansion capital round for Indian solar project developer Clean Max Enviro Energy Solutions.

Public markets investment was also subdued, down 63% year-on-year at $1.4 billion, its lowest quarter since 1Q 2016. The biggest equity raisings were by Chinese company Beijing Shouhang Resources Saving, to fund activity in solar thermal generation (a $675 million private placement), and a $314 million initial public offering by Greencoat Renewables, a Dublin-based investment company targeting operating-stage wind projects in Ireland and the rest of the euro area.

Abraham Louw, associate, clean energy economics at BNEF, commented: “The weak third quarter figure for public markets investment came ironically despite a strong performance from clean energy stocks, with the NEX index for instance rising 7.5% between the end of June and the end of September, and now standing 22% up since the start of 2017.”

Taking all the categories of investment (asset finance, small-scale projects, VC/PE, public markets, and an adjustment for re-invested equity) together, country-level results for the third quarter included:

- China $23.8 billion, up 35% compared to 2Q 2016, down 8% from 2Q 2017.

- The U.S. $14.8 billion, up 45% year-on-year, up 8% quarter-on-quarter.

- Europe $11.6 billion, up 43% year-on-year, up 45% quarter-on-quarter.

- Germany $2.4 billion, down 5% year-on-year, down 26% quarter-on-quarter.

- Japan $2.2 billion, down 32% year-on-year, down 17% quarter-on-quarter.

- India $1.1 billion, down 49% year-on-year, down 60% quarter-on-quarter.

- Brazil $1.7 billion, up 32% year-on-year, down 4% quarter-on-quarter.

- Mexico $2.8 billion, up from almost nothing a year earlier, up 84% quarter-on-quarter.

- Australia $1.8 billion, up 388% year-on-year, down 10% quarter-on-quarter.

- Turkey $796 million, up from almost nothing a year earlier, and up 312% on 2Q 2017.

- France $631 million, up 109% year-on-year, down 21% quarter-on-quarter.

- South Korea $593 million, up 143% year-on-year and up 85% on 2Q 2017.

- Argentina $1.2 billion, up from almost nothing in 3Q 2016 and up 151% from 2Q 2017.

- The U.K. $4.6 billion, up 57% year-on-year, up tenfold quarter-on-quarter.

- Chile $1 billion, up 134% year-on-year, up 306% quarter-on-quarter.

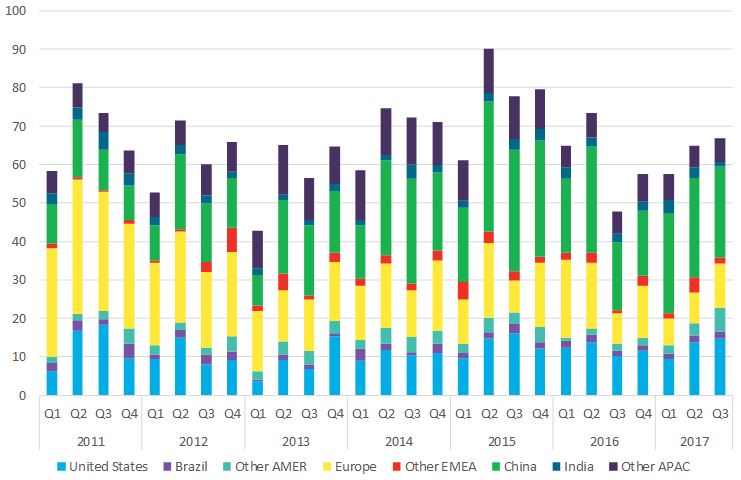

The following chart shows the quarterly trend in clean energy investment by region.

Global new investment in clean energy by region, by quarter, $billion

Source: Bloomberg New Energy Finance. Note: In this chart, asset finance is adjusted for re-invested equity. Clean energy covers renewable energy excluding large hydro, plus energy smart technologies such as energy efficiency, demand response, energy storage and electric vehicles.

BNEF’s annual figures, published every January, include certain categories of investment that are not in the quarterly data – namely corporate and government R&D in clean energy and asset finance of smart meters and energy storage projects.

[1] Clean energy is renewable energy excluding large hydro-electric projects of more than 50MW; plus energy smart technologies such as smart grid, battery storage and electric vehicles.

The report can be downloaded here.

CONTACTS

Veronika Henze

Bloomberg New Energy Finance

+1-646-324-1596

Catrin Thomas

Bloomberg New Energy Finance

+44-20-3525-0673

ABOUT BLOOMBERG NEW ENERGY FINANCE

Bloomberg New Energy Finance (BNEF) is an industry research firm focused on helping energy professionals generate opportunities. With a team of 200 experts spread across six continents, BNEF provides independent analysis and insight, enabling decision-makers to navigate change in an evolving energy economy.

Leveraging the most sophisticated new energy data sets in the world, BNEF synthesizes proprietary data into astute narratives that frame the financial, economic and policy implications of emerging energy technologies.

Bloomberg New Energy Finance is powered by Bloomberg’s global network of 19,000 employees in 192 locations, reporting 5,000 news stories a day. Visit https://about.bnef.com/ or request more information.

ABOUT BLOOMBERG

Bloomberg, the global business and financial information and news leader, gives influential decision makers a critical edge by connecting them to a dynamic network of information, people and ideas. The company’s strength – delivering data, news and analytics through innovative technology, quickly and accurately – is at the core of the Bloomberg Terminal. Bloomberg’s enterprise solutions build on the company’s core strength: leveraging technology to allow customers to access, integrate, distribute and manage data and information across organizations more efficiently and effectively. For more information, visit www.bloomberg.com or request a demo.