This article first appeared on the BNEF mobile app and the Bloomberg Terminal.

- VC portfolios increasingly balance hardware and software

- Brinc helps hardware startups start manufacturing in China

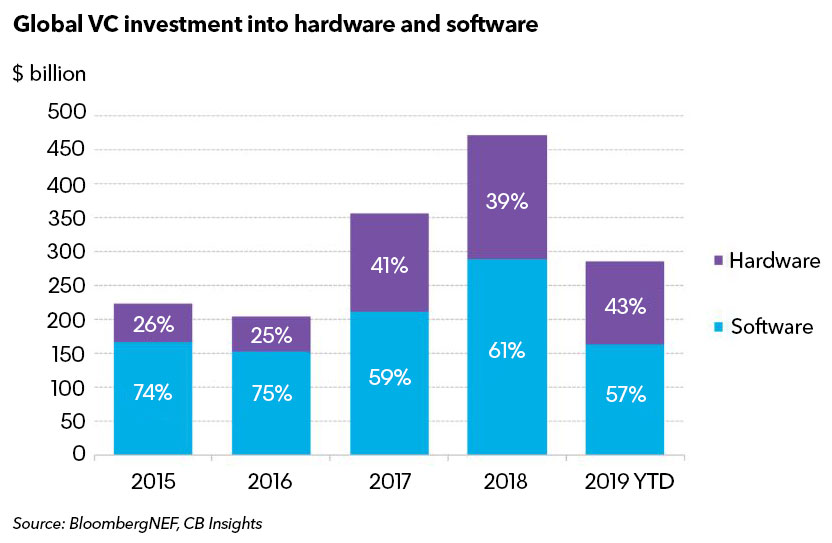

After record year for venture capital last year, 2019 could be the best yet for hardware startups. Forty-three percent of VC money invested this year has gone to hardware — covering industrial, energy, consumer products, automotive and electronics.

VC is keen on software startups, which often have quicker returns and less development risk. Early movers such as Hong Kong-based accelerator Brinc are looking at hardware. Brinc helps startups manufacture in China by solving technical and mechanical issues.

Hardware, notably for the internet-of-things, has been getting more attention recently. From 26% of investment in 2014, it has gained 17 percentage points.

Large VCs NEA, Y Combinator and Andreeseen Horrowitz still spend less than 10% on hardware. It requires a more patient VC attitude. Brinc has made no exits from its 78 investments.

Clients can find the report ‘BloombergNEF Technology Radar: The Industrial Sensors Edition’ on The Terminal or on web.

BNEF Shorts are research excerpts available only on the BNEF mobile app and the Bloomberg Terminal, highlighting key findings from our reports. If you would like to learn more about our services, please contact us.