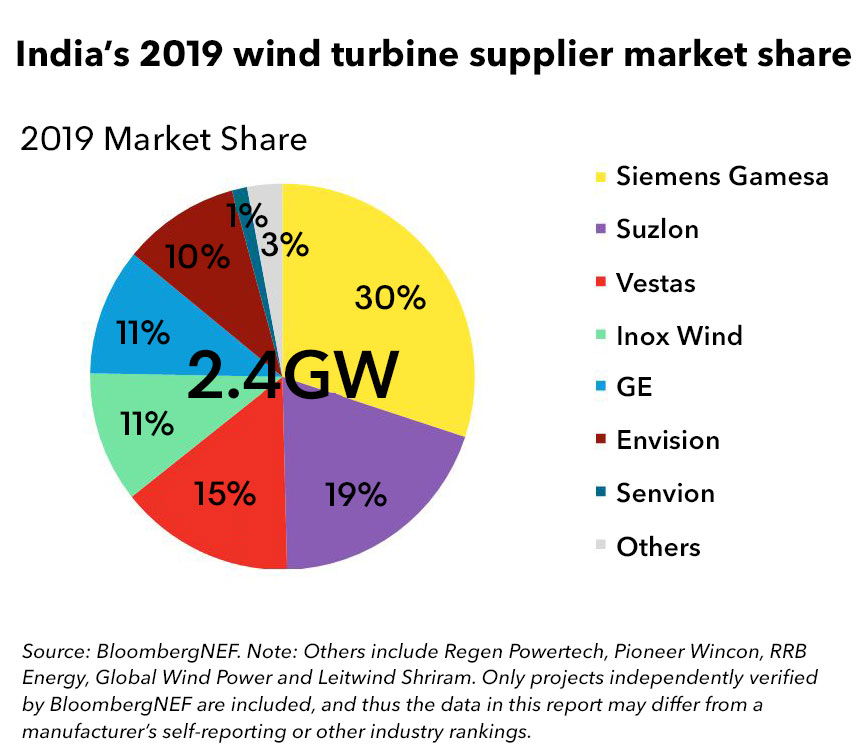

India added 2.4GW of new wind capacity in 2019 – marginally above its 2018 installations of 2.3GW. The top two turbine makers grabbed 49% of the Indian market in 2019. Siemens Gamesa emerged as the top turbine supplier in 2019, pushing the last year’s number one, Suzlon, into second place. Vestas, Inox Wind, GE Renewable Energy and Envision Energy together grabbed 47% market share. The remaining 4% was supplied by five other manufacturers.

A hangover from last year’s problems over land acquisition and transmission connectivity will trouble wind project developers and manufacturers in 2020. Expect 2.6GW of new wind capacity additions in 2020, roughly 8% higher than the 2019 total, according to Atin Jain, India associate at BloombergNEF.

If Suzlon’s project execution challenges continue, it could provide an opening in 2020 for Siemens Gamesa to strengthen its market leadership in India. Other international manufacturers like GE, Acciona Nordex, Vestas and Envision could also try to eat into the former industry leader’s market share, says Shantanu Jaiswal, head of India research at BNEF.

- Siemens Gamesa seized the top spot in the manufacturers’ rankings in 2019, toppling the domestic supplier Suzlon. Operational issues at other manufacturers, and the competitive nature of Siemens Gamesa, helped it reach the top position. The company was able to seize 453MW of new turbine orders from Alfanar Company that were originally supposed to be supplied by Senvion.

- Suzlon’s market share in total installations dropped to 19% in 2019, from 41% in 2018 as the company faced financial and operational challenges. Suzlon installed 0.46GW of projects in 2019, 50% lower than its installations in 2018.

Clients can find the full report and rankings on The Terminal or on web. The Global Wind Turbine Markets Share report for 2019 is also available on The Terminal and on the web.

All the data used in this report are based on BloombergNEF’s project database of installed wind farms in India. The data is cross-checked project-by-project against data submissions made to BNEF by each wind turbine manufacturer. Only projects independently verified by BloombergNEF are included, and thus the data in this report may differ from a manufacturer’s self-reporting or other industry rankings. Turbines delivered within one year would not necessarily be installed or commissioned within the same year given the normal lead times in developing wind projects. On the other hand, projects with turbines delivered in the previous year may be commissioned within the current year and be credited.