The Texas legislature refuses to proceed with a bill that would reprice billions of dollars in energy and ancillary services charges incurred during last month’s power crisis. On March 20, 2021, the prices the bill seeks to resettle were made final. Resettling prices is unlikely, but if it does happen it would have meant undermining the integrity of investing in Texas, with adverse impacts rippling far outside of the state’s power market. This report details both sides of the debate.

-

The Texas House of Representatives Committee on State Affairs faced a historic decision regarding energy market prices for more than 30 hours from February 17 to February 19, 2021. The decision would have affected billions in power costs and upend the future of the market. On Thursday, March 18, the committee met without advancing the bill to the House floor.

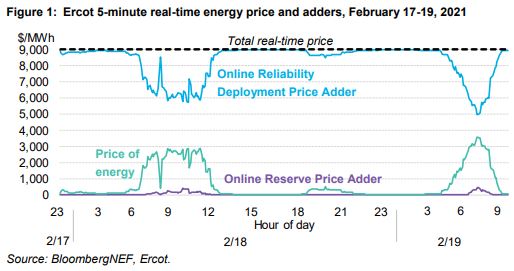

- On February 15, Ercot received out-of-market instruction from the Public Utility Commission of Texas (PUCT) to lock prices at $9,000/MWh during the grid’s emergency operation. After February 17, there was no load shed but Ercot remained in emergency operations and prices remained at $9,000/MWh because of the order.

- The PUCT’s actions are at the crux of the quarrel over energy pricing. Ercot’s scarcity pricesare usually set by reserve levels via an administratively-set demand curve for reserves. But thanks in part to a software error discovered on February 15, the PUCT intervened to tie scarcity prices to Ercot’s emergency operation status instead of reserve levels.

- The region’s independent market monitor Potomac Economics estimates that the order artificially raised prices by $4.2 billion. At this point we don’t know where energy prices would have landed without the order. NRG has filed statements opposing repricing, while other generators and electric cooperatives like Exelon, RWE and Brazos have come out in favor.

-

A resettling of prices could have completely undermined faith in the market. Any party investing in Texas now or in the future would need to price in the risk that the legislature would again order retroactive action on already-cleared power prices.

This note is part of a series on the Texas power crisis, available to BNEF clients on web or via the Bloomberg Terminal.