By Maia Godemer, Senior Associate, Green and Sustainable Finance

Sustainability-linked bonds are currently a very small corner of the sustainable debt market, representing just 4% of the $6.4 trillion of issuance to date. Tying the interest rate of a bond to a company’s achievement of a sustainability goal, SLBs have had a rocky existence, with issuance dropping 21% last year. They are riddled with exit clauses, toothless terms and conditions, vague timelines and opaque targets – all designed to protect issuers, some of whom have hundreds of millions of dollars of interest rate penalties on the line. But correcting course could unlock trillions of dollars of investment, shepherding decarbonization in ways no other financial instrument can.

- SLBs are popular with a diverse set of sectors, with issuance led by utilities (23%), consumer non-cyclical companies (22%) and industrials (16%). Most of these bonds have a bi-annual or annual coupon payment, or an interest rate paid on the bond that is fixed instead of tied to a reference rate like the Euribor. Some 70% of these bonds are callable, meaning they can be paid off before interest rates are increased – a major criticism of this sustainable debt instrument.

- Around 69%, or $164.8 billion, of SLBs issued are tied to greenhouse gas emission reduction targets, followed by increases in renewable energy capacity and use ($26.7 billion). Among the largest SLBs covering 50% of the market, the average interest rate step-up is only 25 basis points (bps) if the company misses its target. Just 21 of the largest SLBs have a step-up of 40bps or more, indicating that, in isolation, the impact on these bonds is negatable. One might expect SLBs with lower penalties to have more frequent coupon payments to compensate, but there is no correlation. Additionally, some of the largest SLBs have coupon payment dates that are years after sustainability target observation dates and others have capped their interest rate penalties.

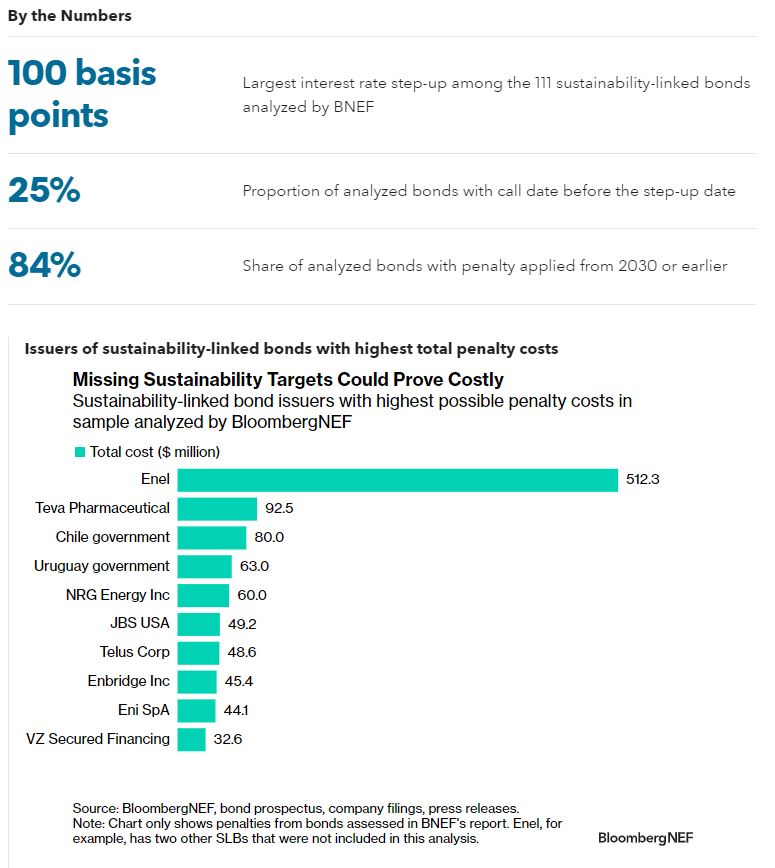

- Across the sample analyzed by BloombergNEF, the 10 SLB issuers with the highest total penalty costs collectively face over $1 billion in interest rate penalties if they miss their sustainability goals. Transparent, third party-validated targets underpinning SLBs will boost the confidence of investors like BlackRock and Allianz, who hold more than $7 billion of SLBs combined.