By Adithya Bhashyam, Associate, Hydrogen, BloombergNEF

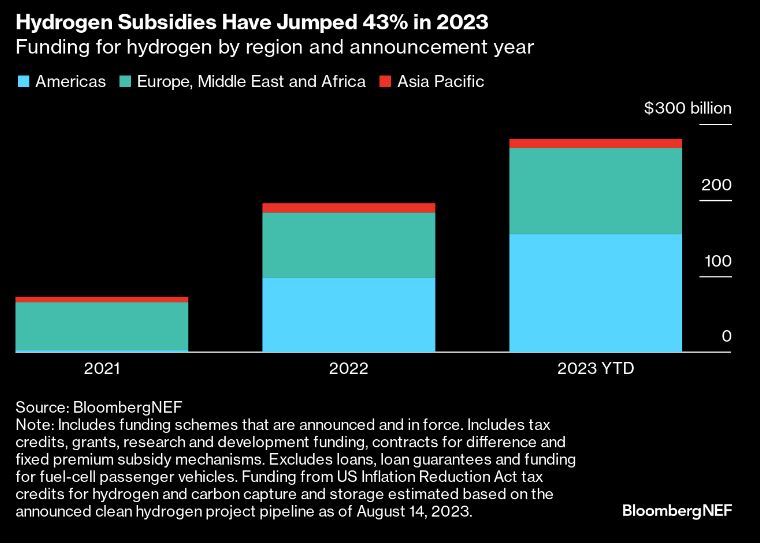

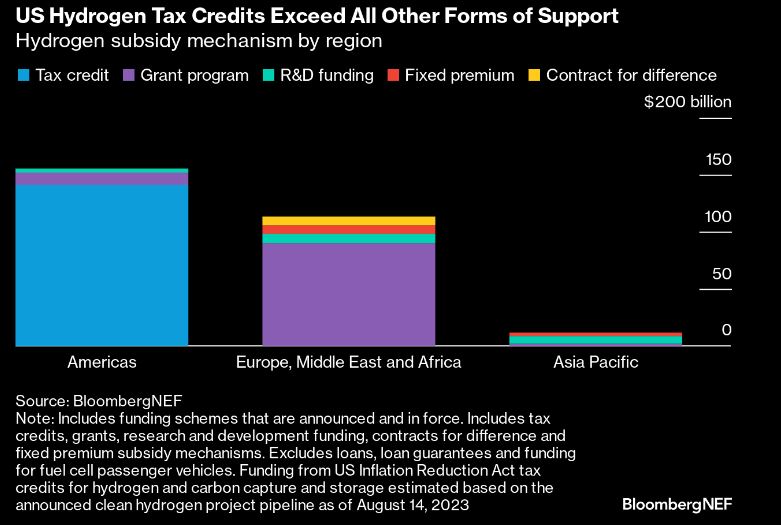

Subsidies announced for low-carbon hydrogen – a critical input for a decarbonizing world – have quadrupled over the last two years to cross $280 billion, according to the latest update from BloombergNEF. The US stands far ahead of every other country, with the $137 billion expected to flow to eligible projects over the next 10 years making clean hydrogen cheaper for the whole world.

The US edge comes from the compelling offer of $3 per kilogram of low-carbon hydrogen produced – promised under the US Inflation Reduction Act. BNEF currently estimates the cost of clean hydrogen production at $2.3 to $4.8 per kilogram. The US support makes low-carbon hydrogen competitive with hydrogen from natural gas, enables economies of scale and drives the technology down the cost curve, changing the hydrogen landscape for everyone.

Other markets are responding to the US Inflation Reduction Act, but are not able to match its financial might. European subsidies are around 27% lower and spread across numerous national grant programs, making them less accessible than in the US.

The US subsidies through the IRA are mainly in the form of tax credits. Newer funding mechanisms like contracts for difference and fixed premium subsidies – which provide revenue support to hydrogen projects during operation – are starting to emerge in Europe, but they still lack the heft required to make a significant difference.

Subsidies in Asia Pacific are significantly smaller than elsewhere, accounting for just 4% of the global total and focusing largely on research and development.

Technologies to produce and use hydrogen will likely become cheaper globally driven by US demand. Countries reliant on hydrogen imports could also take advantage of cheaper US hydrogen exports. Some countries like Germany are therefore strategizing to establish leadership as technology providers to the hydrogen sector rather than large-scale producers.

Meanwhile, the number of countries with a hydrogen strategy now stands at 44, while as many as 35 are working on one, according to BNEF’s latest Hydrogen Strategy Tracker.

As more countries release a vision for developing their domestic hydrogen sector, many may now start to rethink their role in a global hydrogen market in the face of cheaper US production.