By Dr. Kwasi Ampofo, Head of Metals and Mining, BloombergNEF

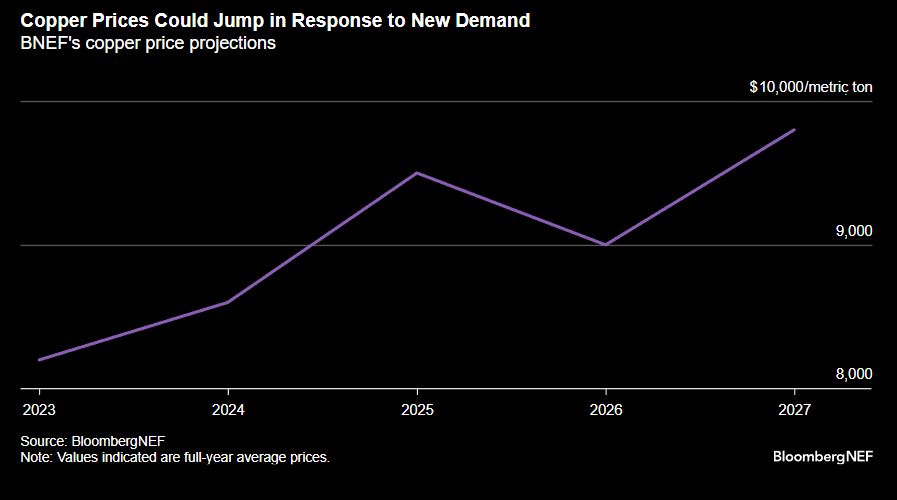

Demand for copper is set to continue rising and is anticipated to exceed primary supply within the next four years. The mismatch in supply and demand is likely to result in copper prices surging 20% by 2027, according to BloombergNEF analysis.

The primary supply of copper is set to fall short of demand between 2023 and 2027, with secondary production increasingly supporting supply with as much as 5.4 million metric tons by 2027. In 2024, the primary supply deficit is projected to be 3.6 million tons, which is less than the past 10-year average of 3.9 million tons. Based on these factors, copper prices are more likely respond to economic sentiment than the long-term supply and demand balance.

After 2025, the supply deficit is forecast to peak at 4.5 million tons, and pricing should then begin to reflect the tighter market compared with previous years. This will incentivize production from recycling sources to meet growing demand. In addition, the global economy will likely overcome recession concerns, which will lead to a stabilization of interest rates. The deficit level in 2025 will be similar to the 4.6 million tons seen in 2021, when the average copper price was $9,700 per ton.

Uncertainty has surrounded copper demand this year and has had a significant impact on prices. Copper has experienced price volatility in 2023, driven by China’s slow economic recovery and the dim economic outlook in the US. The average year-to-date London Metal Exchange copper price is $8,659 per ton, with a high of $9,356 in January and hitting lows of $7,902 in late May. Further, economic indicators in South Korea and Japan have echoed the same weakness observed in China and purchasing managers’ index readings across major Asian manufacturing hubs have seen continued monthly declines.

China is responsible for over 50% of the world’s copper demand, according to BNEF. An economic slowdown in the country could put significant downward pressure on prices. On the other hand, while the lower US inflation rate of 3.2% in July 2023 compared with the peak of 8.5% a year earlier could be a sign of softening prices, it could also increase expectations that the interest-rate tightening cycle will ease, which could in turn boost copper prices over the next two years.