By Mariko O’Neil, Power & Carbon, BloombergNEF

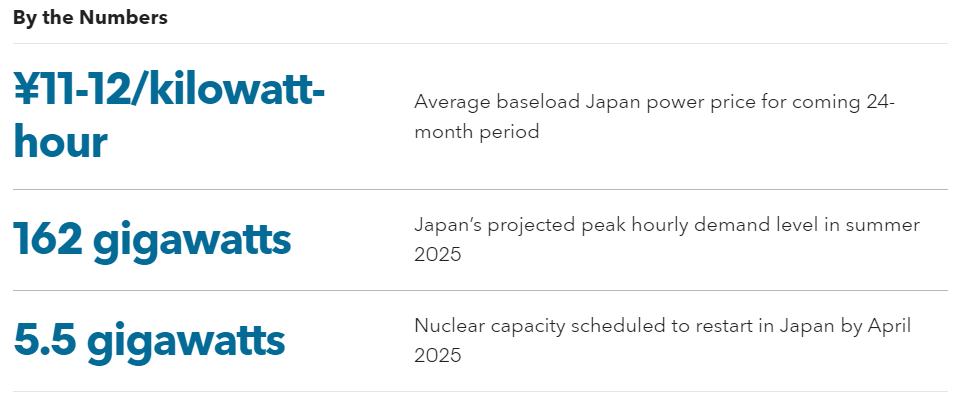

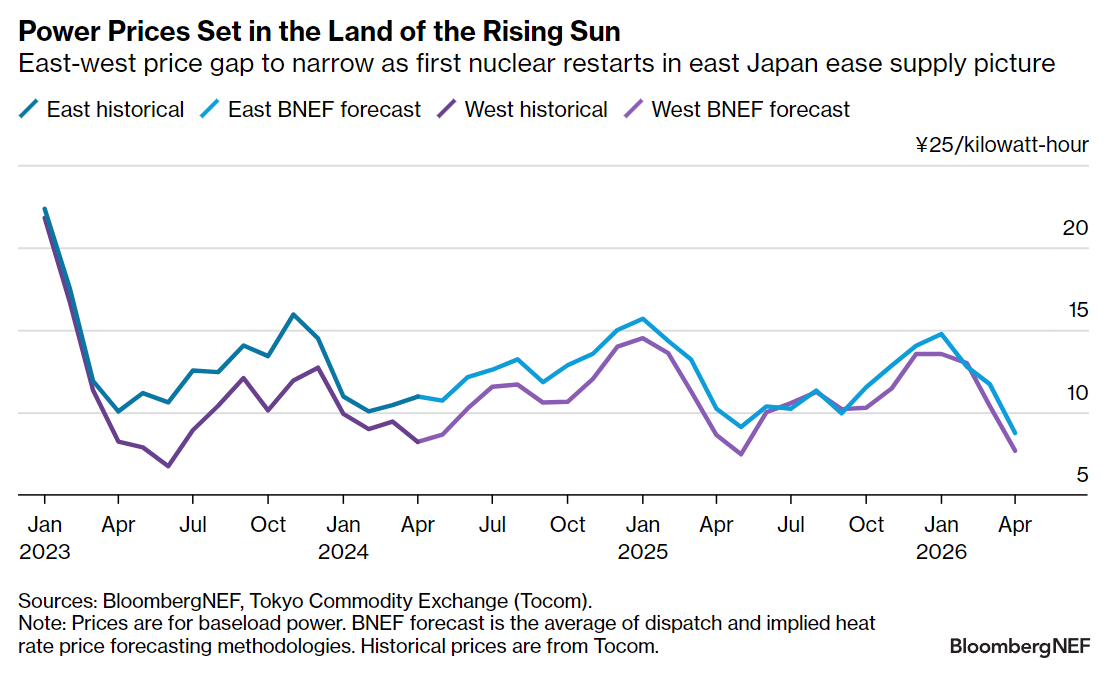

Prices in the world’s third-largest liberalized power market have calmed since skyrocketing gas prices and a supply crunch sent them soaring in 2022. BloombergNEF expects Japan’s power prices to continue to ease, averaging ¥11-12 per kilowatt-hour ($71-77/megawatt-hour) in the coming two years – underpinned by nuclear and renewable capacity additions amid sluggish demand. However, a combination of rising solar penetration and variable weather-driven demand spells deepening duck curves and intraday volatility.

- BNEF expects monthly average Japanese power prices to peak at around ¥15 per kilowatt-hour (kWh) in January 2025. An 11% year-on-year drop in 2024 is expected to be followed by a 2% rise in 2025. Japan’s import dependence makes its power prices highly sensitive to global commodity markets, particularly for liquefied natural gas (LNG) as gas remains the marginal generation technology setting power prices during most hours.

- Supply is gradually outstripping demand. BNEF anticipates 16GW of capacity additions in the coming 24 months, representing a 7% increase in available capacity (accounting for outages and intermittency). Meanwhile, a drop in baseload power demand due to a shrinking population is somewhat buffered by an uptick in temperature-related variable demand. BNEF expects an average total power demand of 847 terawatt-hours in 2025, or for demand in the next two years to be around 0.3% lower than 2023 – during which new sources of electricity demand spurred by the energy transition will have little impact.

- BNEF’s forecasts are on average more bearish than the current forward curve, which is pricing baseload power at a ¥2/kWh premium to BNEF’s modeled forecasts in east Japan, and ¥0.2/kWh in west Japan. This gap could point to a risk premium for delays in east Japan’s long-awaited nuclear restarts, which remain a major unknown. A scenario in which restarts of the upcoming five reactors are delayed by a few months raises average system prices by 1% in the year to July 2025 and implies some 20 cargoes of additional LNG demand for the country’s power sector over that period.

- Continued nuclear restarts and renewable buildout bring low marginal cost capacity to Japan’s power system. This in turn increases the hours in which gas is pushed out of the mix – though it is a delicate balance: a continued drop in gas prices amid stubborn coal prices could prompt fuel switching to gas.

BNEF clients can access the full report here.

Learn more about key takeaways from the report in our associated webinar.