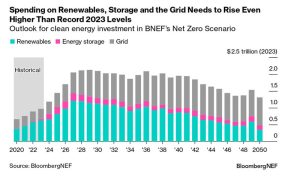

● Following a record $623 billion being invested in renewables in 2023, BNEF estimates this must climb to an average of $1 trillion per year (in 2023 dollars) between 2024 and 2030.

● An average of $193 billion per year is also required for battery storage over this period and $607 billion for electricity grids.

● New report from BNEF, supported by Bloomberg Philanthropies, reveals the first update since the tripling target was set at COP28, details what progress has been made and which regions and sectors need to invest most.

New York, September 24, 2024 – Countries are not on track to meet the target of tripling renewable energy capacity by 2030, but the goal is still within reach. That is according to a new report Unlocking Investment to Triple Renewables, released at the Global Renewables Summit in New York City from BloombergNEF (BNEF) with support from Bloomberg Philanthropies. Strategic investment in battery storage and electricity grids and more support for emerging markets and developing economies are key to getting on track.

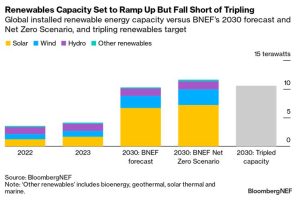

At the COP28 climate conference, held in Dubai last year, nearly 200 Parties agreed to take action to triple global renewables capacity from 2022 levels by the end of the decade. This aligns with BNEF’s own Net Zero Scenario, which models a realistic pathway to reach net-zero emissions by 2050 while limiting global temperature rise to well below 2 degrees Celsius.

In the 10 months since that agreement was made, the energy transition has proceeded at a considerable pace thanks to rapidly falling costs for solar and batteries, and the continued affordability of wind. BNEF now expects around 10.3 terawatts of renewable power capacity to be in operation by 2030, up from 4.1 terawatts at the end of 2023. Nonetheless, this is still 13% short of what is needed for a net-zero pathway.

“Since COP28, we’ve seen real progress in renewable energy investment, but it’s not happening fast enough,” said Michael R. Bloomberg, UN Secretary-General’s Special Envoy on Climate Ambition and Solutions, founder of Bloomberg L.P. and Bloomberg Philanthropies. “The more the public, private, civil society, and nonprofit sectors come together to develop and implement concrete plans for eliminating barriers to investment, the better chance we have of reaching our net-zero goals, growing the global economy, and saving more lives.”

“The target of tripling renewable energy capacity to be on a net-zero pathway to 2050 is still achievable” said Meredith Annex, co-lead author of the report. “However, governments need to remove barriers to renewable energy expansion and support the financing of clean energy projects, especially in developing countries. Building out power grids is particularly vital.”

Tripling renewable energy capacity and meeting climate targets hinges on investment increasing even further from the record levels seen in 2023. BNEF estimates an average of $1 trillion per year (in 2023 dollars) must go toward renewables between now and the end of the decade, plus $193 billion per year for storage and $607 billion for grids.

This is feasible, especially as the cost of renewable energy has fallen over the past decade. The early indicators are positive. In the first half of 2024 alone, BNEF estimates $312 billion was invested in renewables. Of this, $221 billion went to both large and small solar projects, and $91 billion to wind.

Solar has become so cheap that it is growing rapidly with very little government support and is now expected to make up the majority of progress to the tripling renewables target. Solar has a lower capacity factor and in seasonal climates can leave a large deficit in power supply during the winter. For a smoother transition to net zero, policy should support sectors where investment is lagging, such as wind, storage and grids.

China was yet again the largest market for renewable energy investment in the first half of this year, with a total of $130 billion. In this market and in Brazil, the policies, project pipeline and investment environment are broadly on track to meet their contribution to the global tripling goal. While Europe, the US and India have strong policy support for the energy transition, they need to accelerate their efforts.

Japan, Indonesia, the Middle East, North Africa and Turkey region and sub-Saharan Africa are well behind the required volumes of renewables deployment and investment. Nearly one year out since the COP28 target was set, there is a need to address the different challenges holding back the development of renewable energy industries in these markets.

For the full report, please visit this link.

Contacts

BloombergNEF

Oktavia Catsaros

ocatsaros@bloomberg.net

Bloomberg Philanthropies

Marshall Cohen

mcohen@bloomberg.org

About Bloomberg Philanthropies

Bloomberg Philanthropies invests in 700 cities and 150 countries around the world to ensure better, longer lives for the greatest number of people. The organization focuses on creating lasting change in five key areas: the Arts, Education, Environment, Government Innovation, and Public Health. Bloomberg Philanthropies encompasses all of Michael R. Bloomberg’s giving, including his foundation, corporate, and personal philanthropy as well as Bloomberg Associates, a philanthropic consultancy that advises cities around the world. In 2023, Bloomberg Philanthropies distributed $3 billion. For more information, please visit bloomberg.org, sign up for our newsletter, or follow us on Instagram, LinkedIn, YouTube, Threads, Facebook, and X.