By Corey Cantor, Senior Associate, Electric Vehicles, BloombergNEF

It’s been a big year for electric vehicles. Sales are rising, battery prices are dropping, and BloombergNEF has pushed up its sales forecast thanks to huge sales in China, South Korea and North America. On the flip side, legacy automakers are backing away from their EV targets, and the US election is sending a president with a litany of complaints about clean cars back to the White House.

As the year draws to a close, here are 10 key trends that helped shape the EV world in 2024 – and could pave the industry’s way going forward.

Tesla shifts lanes

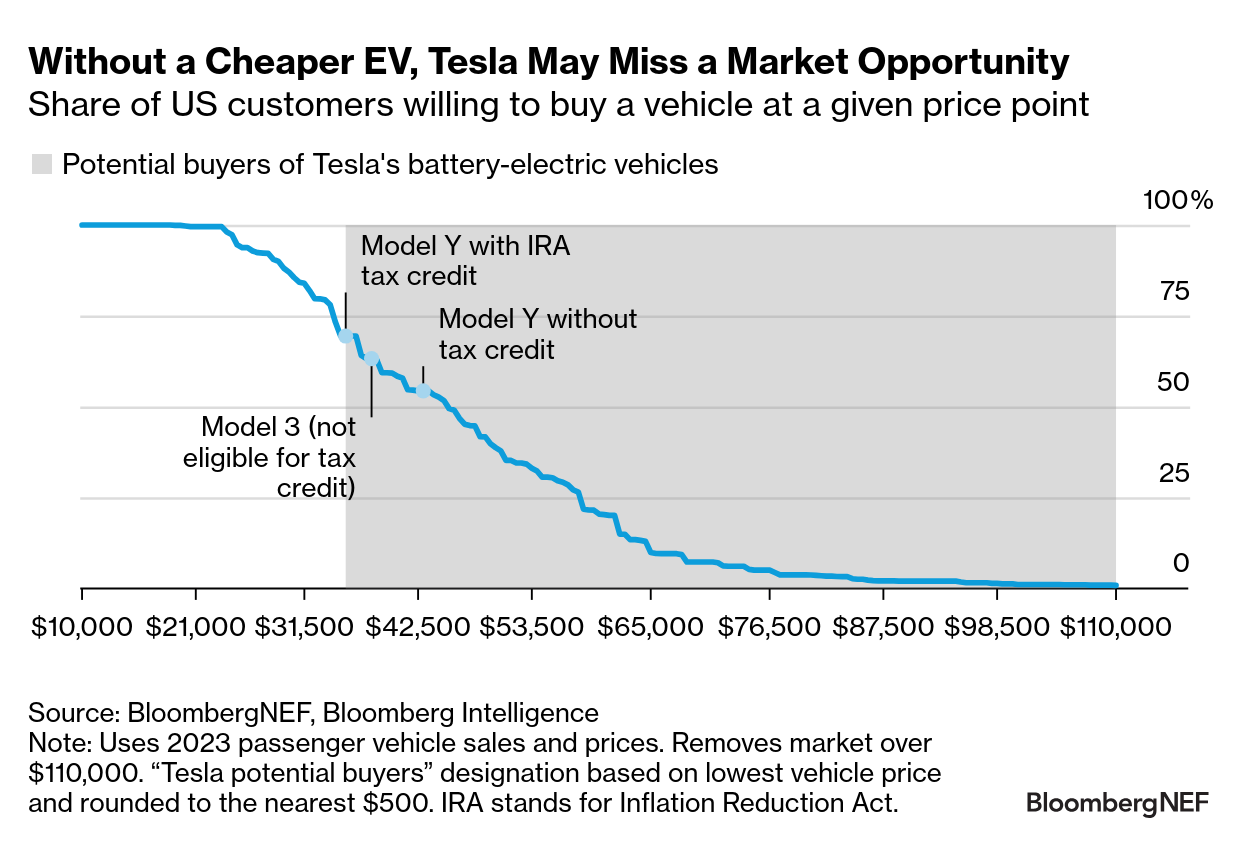

From the cancellation of a $25,000 car to the turn toward autonomous robotaxis and artificial intelligence, the world’s biggest manufacturer of battery-electric cars has been making waves with its abrupt shifts in direction.

Tesla’s actions often influence investors and outside stakeholders, so moving away from their goal of cheaper vehicles is a big deal, especially since most Teslas remain out of reach for many American consumers. The Cybertruck did better than naysayers expected, but does it have legs going into 2025? CEO Elon Musk mentioned in Tesla’s 3Q 2024 earnings call that cheaper Tesla vehicles may be delivered next year, but there are no details.

BYD ups its EV sales targets

The Chinese automaker BYD continues to take the world by storm. In a year when many automakers are stepping back from their EV targets, BYD upped its target to 4 million car sales this year — and is on track to meet that goal. BYD’s 2024 sales have been boosted by plug-in hybrids and extended-range EVs.

Legacy automakers struggle

The challenges faced by major legacy automakers like Nissan and Stellantis boiled up at the end of the year, with major restructuring and the departure of a long-standing CEO. Given that these automakers together sold nearly 10 million cars in 2023, their displacement could represent market opportunity for their competitors.

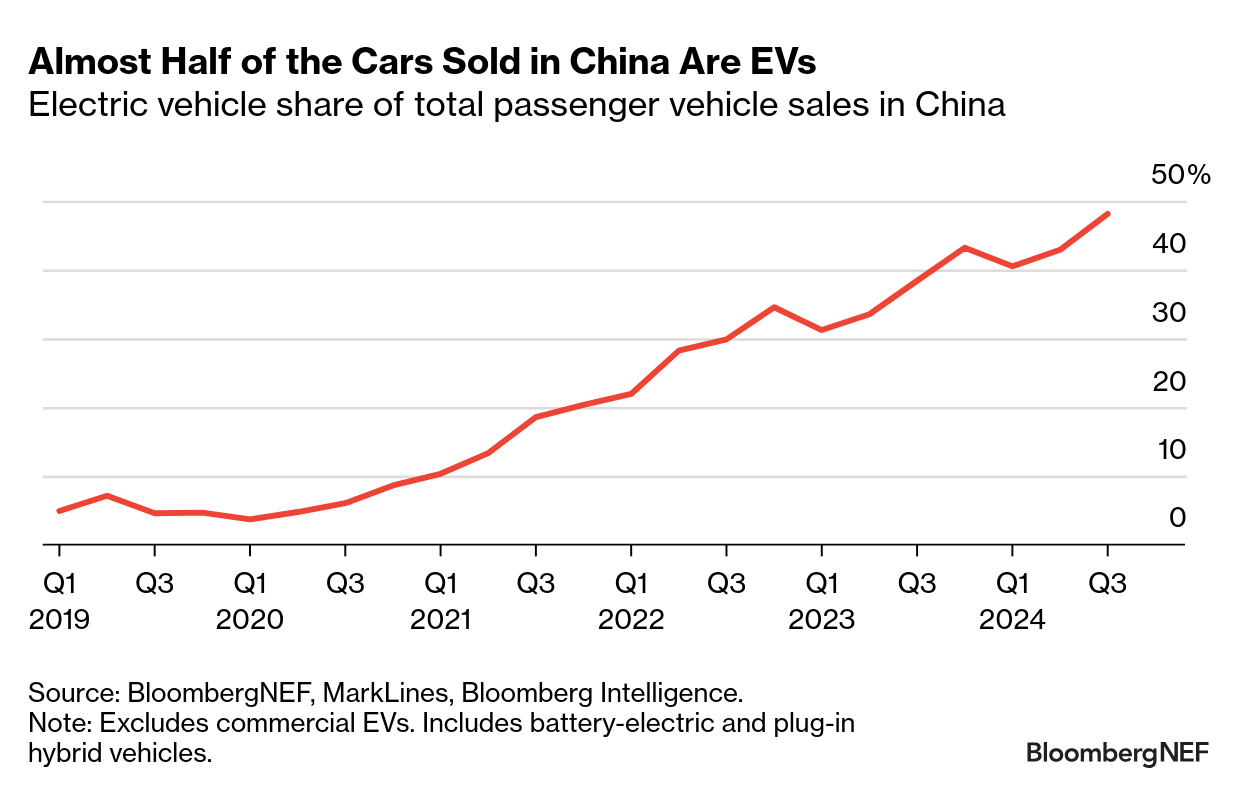

China approaches 50% EV share of sales and becomes a challenging market for non-domestic carmakers

While the full-year EV results are not yet in, China reached a significant threshold this year: a single month when more than half of all vehicles sold were battery-electric or plug-in hybrid. That’s up from less than 10% just five years ago.

Such a change is dramatic and important for global decarbonization. At the same time, non-Chinese automakers outside of Tesla have found it more and more difficult to compete in the world’s largest auto market, particularly given the domestic surge in EV manufacturing. GM’s $5 billion restructuring with its joint-venture partner SAIC is just the latest in a string of announcements about automakers changing their approach to selling in China.

Tariffs make a comeback

Whether it’s the European negotiations with China over EVs entering the European market, US President Joe Biden’s tariffs on Chinese EVs and battery materials, or President-elect Donald Trump’s proposed across-the-board tariffs, protectionism is back in style in 2024. While in the long term this could end up boosting domestic manufacturing for automakers in each of the major automotive regions (the US, Europe, etc.), it’s possible that a full-scale trade war could pose major risks for legacy automakers and EV upstarts alike.

Startup magic still exists

Xiaomi, a Chinese smartphone company, released an EV this year – the SU7 – that has proven to be quite the hit. The company started delivering cars in April, and by November, Xiaomi CEO Lei Jun was posting a celebratory statement on X about having passed the 100,000-unit milestone. While the future is unclear, especially in a competitive EV market, the company has upped its 2024 delivery goal to 130,000 from 120,000, and its impressive block start suggests it’s one to watch in the coming year.

Trump’s resurgence could short-circuit US investment efforts

During the 2024 US presidential race, Trump called out EV subsidies and vowed to take aim at what he called an “EV mandate”. Elon Musk’s newfound role as a close Trump advisor could result in gentler-than-expected approach to EV policy, but it’s more likely that federal EV support, from fuel economy standards to new loans and grants, is going to be pulled back in a major way in 2025.

That could have a major impact on future US EV adoption and manufacturing investments. The fate of the Inflation Reduction Act – and its EV- and battery-related tax credits – remains a more open question given the incredibly thin margins in the US House of Representatives.

GM and Honda hit their stride

The emergence of GM’s EVs on the Ultium platform was big story for clean vehicles in the US. For years, delay and automation issues hampered the scaleup of GM’s new generation of electric cars, most prominently the Blazer and Equinox models. But 2024 brought record EV sales for GM, particularly in the third quarter of the year. Perhaps even more surprising is the fact that Honda’s Prologue – a Blazer cousin – is on pace to be among America’s highest-selling EVs. Brand still matters.

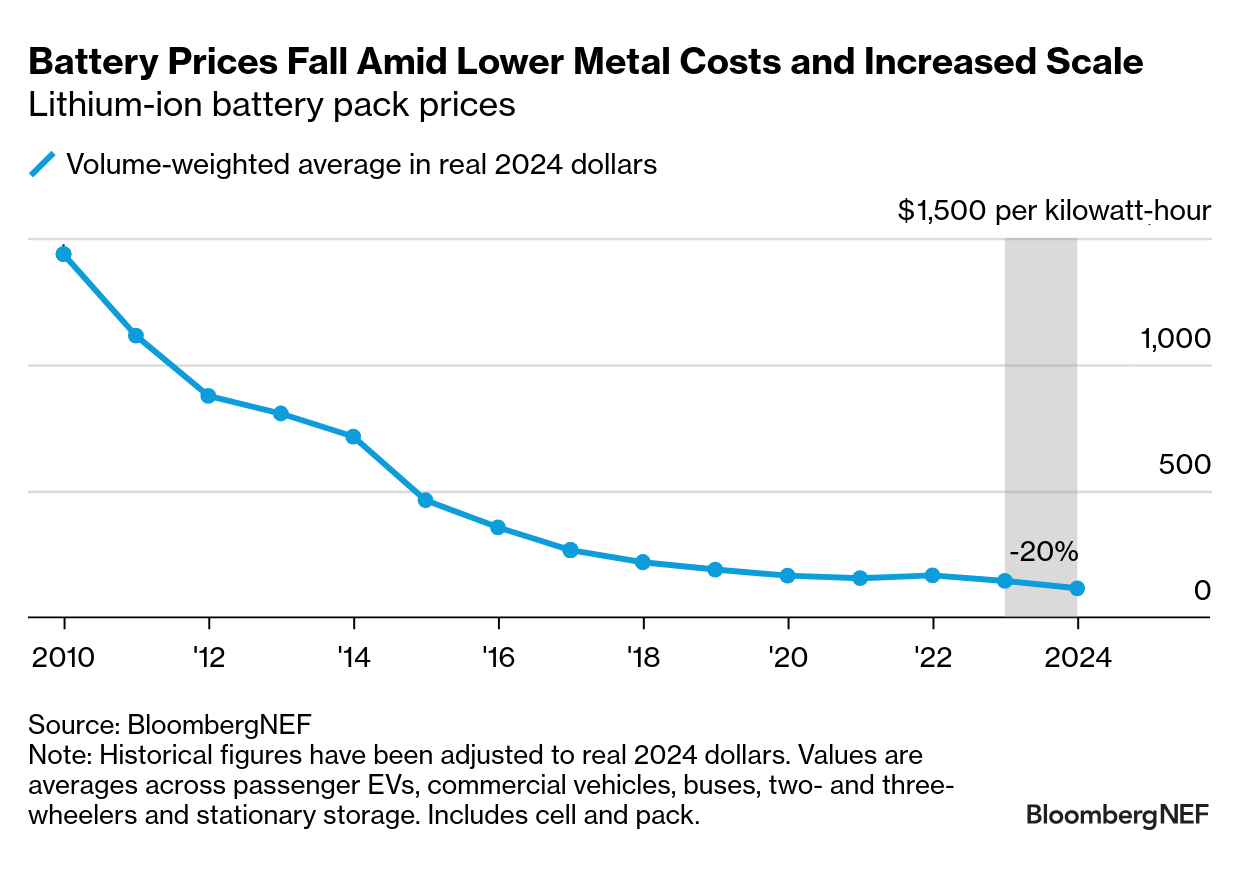

Battery prices continue to drop

Global lithium-ion battery prices fell to $115 per kilowatt-hour this year, down 20% from 2023 levels. There were numerous contributing factors, not all necessarily healthy for the industry. Nevertheless, assuming prices are ultimately passed along to consumers, EVs could be approaching a range of price parity with internal combustion engine cars. A long-promised moment appears to be at hand, but it won’t happen everywhere all at once.

Norway nears 100% electric vehicle share

It’s not surprising that Norway will be the first country to phase out internal combustion engine vehicle sales, but its approach and consistently high EV share of sales are almost underappreciated. Despite Norway being a relatively cold country (and cold weather is notoriously bad for EV batteries), EVs rule the roads and are closing in on 100% of all new car sales. It’s nice to end the year on a positive note, and this story helps focus us on the big picture: despite setbacks and headwinds, the electrification journey continues.

BNEF clients can access more EV coverage here.