This article first appeared on the BNEF mobile app and the Bloomberg Terminal.

- Solar equity IRR around 10% in southern U.S. states

- Project yields and NPV dramatically improved

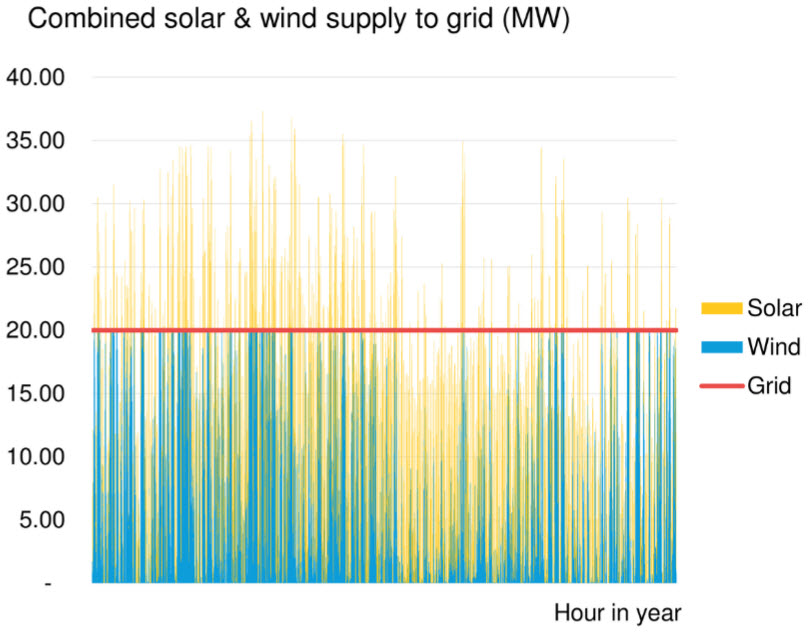

Solar fills the supply gaps when the wind is not blowing

Source: Bloomberg New Energy Finance

Renewable energy project developers and owners are increasingly looking to co-locating wind and solar at the same point on the grid to maximize returns. According to BNEF’s new co-location model, equity IRRs for a new solar project in southern U.S. states reach an impressive 10 percent, before tax credits, when it is dropped on top of an existing wind farm and takes advantage of the sunk costs of land lease and grid connection. The model calculates the optimal solar capacity to fill the supply gaps when the wind is not blowing, and sheds light on new opportunities for solar in the U.S. and beyond.

Clients can access the full report here.

BNEF Shorts are research excerpts available only on the BNEF mobile app and the Bloomberg Terminal, highlighting key findings from our reports. If you would like to learn more about our services, please contact us.