This article first appeared on Bloomberg View and the Bloomberg Terminal.

Two large insurers recently announced restrictions on underwriting or investing in coal assets and companies. The announcements are significant, but it’s the details of each company’s policy that really matter. Zurich Insurance Group AG’s policy might turn out to be more than it looks like at first glance; Chubb Ltd.’s policy might turn out to be less.

Zurich’s policy states that the insurer generally will no longer underwrite or invest in companies that:

- Generate more than 30% of their revenue from mining thermal coal, or produce more than 20 million tons of thermal coal per year;

- Generate more than 30% of their electricity from coal;

- Are in the process of developing any new coal mining or coal power infrastructure;

- Generate at least 30% of their revenue directly from the extraction of oil from oil sands;

- Are purpose-built (or “dedicated”) transportation infrastructure operators for oil sands products, including pipelines and railway transportation;

- Generate more than 30% of their revenue from mining oil shale, or

- Generate more than 30% of their electricity from oil shale.

I asked Zurich if the company has already determined which companies its policies will exclude and whether the policy will apply to all underwriting and investment, or just to new underwriting and investment. A spokesperson told me the policy applies to existing and potential future customers, as well as investments, and that the process is “ongoing.”

So while Zurich has not yet identified the companies that meet the recently announced guidelines, publicly available data offer some guidance on which companies this policy could affect.

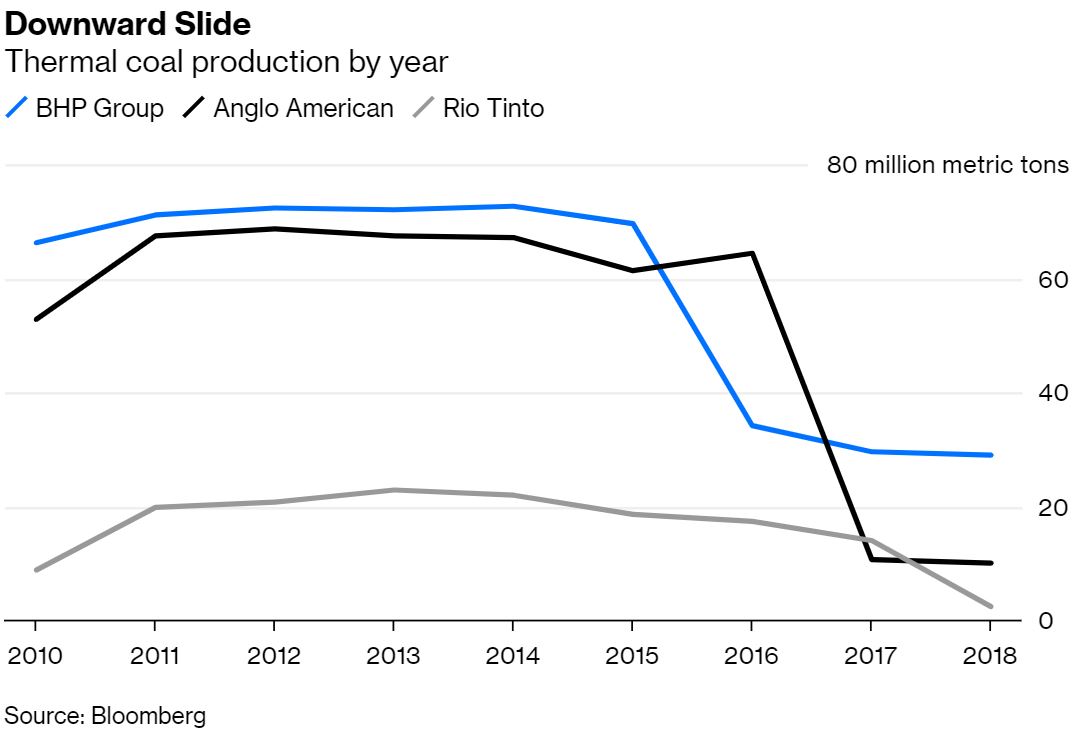

First, and perhaps obviously, both revenue and volume thresholds exclude any companies that primarily mine thermal coal. It also would exclude at least one major diversified miner: BHP Group Ltd. BHP booked $43 billion in revenue in 2018 and has a current market cap of $137 billion; it produced more than 29 million metric tons of coal last year. Fellow diversified miners Anglo American Plc and Rio Tinto Plc produced less than 10 million tons each.

I don’t know if BHP is a customer of Zurich. I do know that BHP Chief Executive Officer Andrew Mackenzie, speaking during the company’s second-quarter 2019 earnings call in February, said BHP’s thermal coal strategy isn’t a growth strategy:

The message from met coal is quite different than it is for energy coal. We are comfortable with our position in energy coal at the moment, but this is not something that we will seek to grow going forward. And we will continue to examine whether or not this is something to be competitive to remain in the portfolio.

And as the Financial Times recently reported, “BHP Group is exploring options for its thermal coal business including a disposal amid a growing investor focus on environmental, social, and governance issues.” This exploration — or examination, as Mackenzie calls it — is in the very early stages, according to the Financial Times. It is beginning, though, at the same time that Zurich plans to start talks with clients and the companies it invests in regarding their exposure to thermal coal, oil sands and oil shales and their transition plans away from that exposure.

Zurich’s oil sands policy could affect a number of Canadian oil companies. In 2018, Suncor Energy Inc. received 36.3% of its $29.7 billion in revenue from oil sands production, while Cenovus Energy Inc. received 41.5% of its $16.1 billion in revenue from oil sands production.

As for Zurich’s restriction on companies that generate more than 30% of their electricity from coal? That’s more companies than I can easily count. Last year, only 27% of U.S. power generation came from coal, but there are many utilities here that are still more than 30% coal-fired, and many more in other countries that are more than 30% coal-fired.

Though Chubb’s new policy does not include oil sands, its coal-related insurance policy is similar to Zurich’s:

- New Coal Plant Construction & Operation. Chubb will not underwrite risks related to the construction and operation of new coal-fired plants. Exceptions to this policy will be considered until 2022 (i) in regions that do not have practical near-term alternative energy sources, and (ii) taking into account the insured’s commitments to reduce coal dependence.

- Coal Mining. Chubb will not underwrite new risks for companies that generate more than 30% of revenues from thermal coal mining. Chubb will phase out coverage of existing risks that exceed this threshold by 2022.

- Utilities. Chubb will not underwrite new risks for companies that generate more than 30% of their energy production from coal. Chubb will phase out coverage of existing risks that exceed this threshold beginning in 2022, taking into account the viability of alternative energy sources in the impacted region.

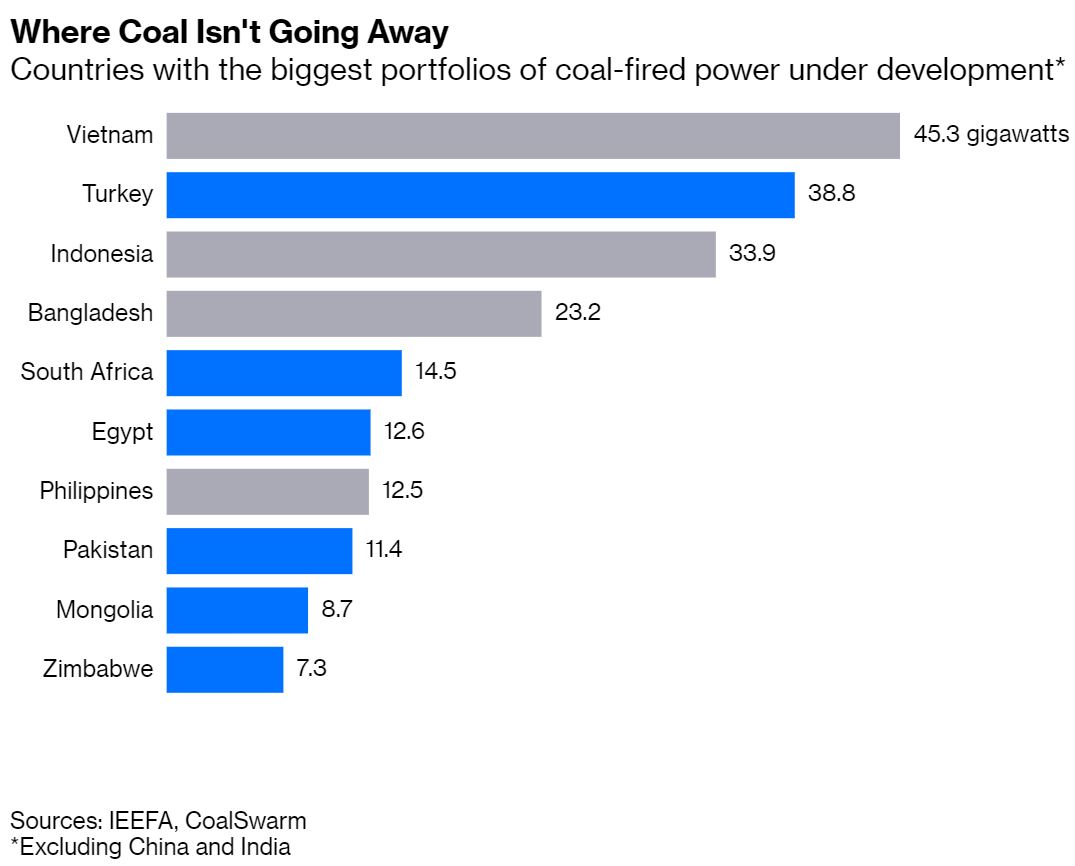

There’s something worth noting here: Chubb will consider exceptions to this policy until 2022 “in regions that do not have practical near-term alternative energy sources” to coal. That’s not a long window of time, but it is a very wide range of assets and companies. It’s Southeast Asia-sized, in fact, where there are more than 100 gigawatts of coal-fired capacity under development:

That doesn’t include China (which has more than 200 gigawatts under development) and India (more than 100 gigawatts under development). Chubb declined to comment when asked if it had identified regions it says have no practical near-term alternative-energy sources.