By

Tai Liu, Specialist, Oil, BloombergNEF

Crude oil prices slipped amid rising geopolitical tensions in the Middle East last week, which seems counterintuitive as conflict in the region can lead to major supply risks. It seems traders have already priced-in the possibility of supply disruptions since the attack on Iran’s diplomatic compound in Syria on April 1, which was widely attributed to Israel. BloombergNEF estimates a war premium of $25 per barrel was already embedded in oil prices even before Iran’s retaliatory attack against Israel on April 13. Supply fears were also reflected in the options market in the form of an elevated call skew for crude options.

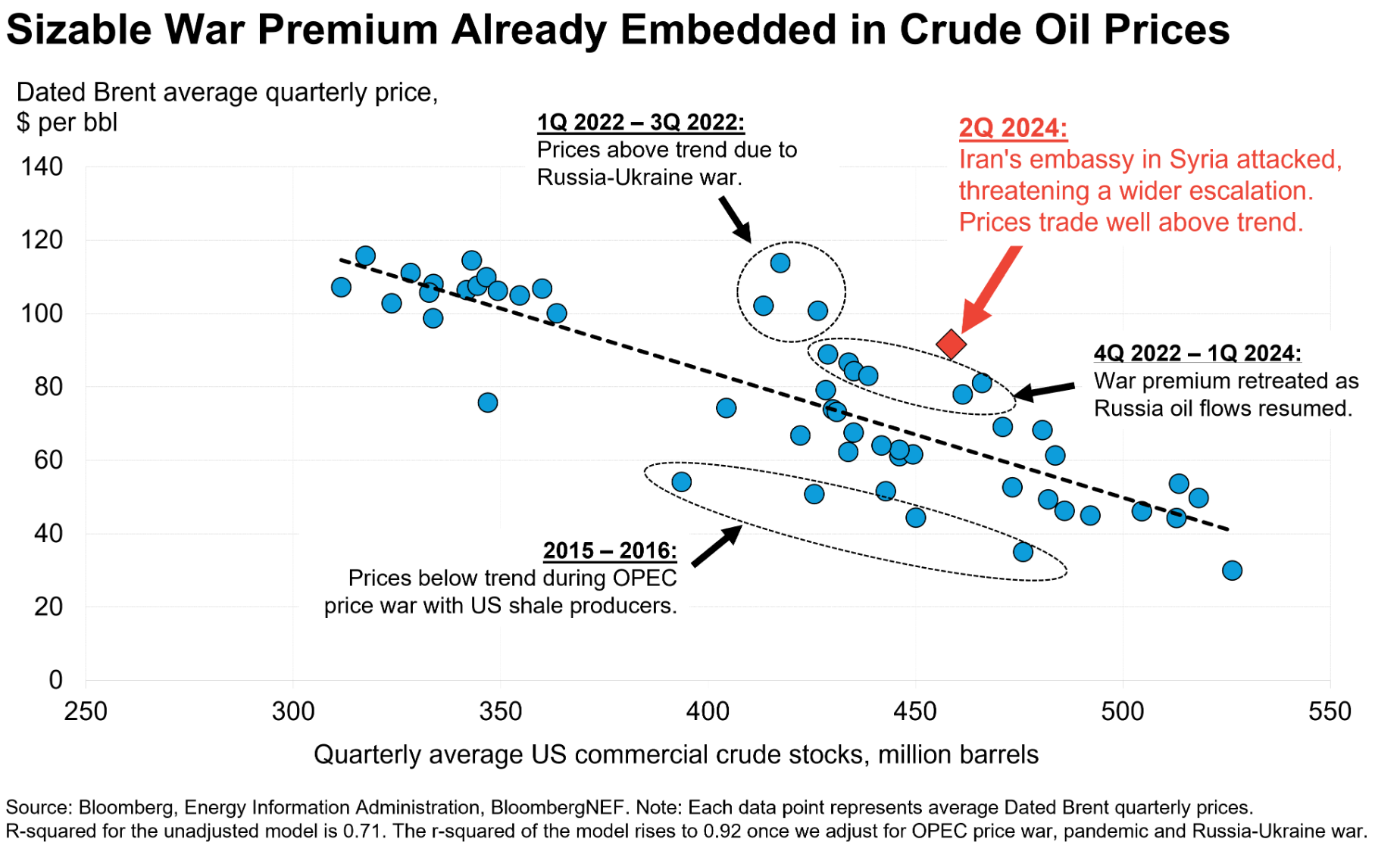

Short-term commodity prices usually have a reasonably strong inverse relationship with inventory levels – the higher the inventory level, the lower the prices because there are more supplies available in the market, and vice versa. Since the April 1 event, crude oil prices have been trading at a much higher level than what inventory level alone can explain. Dated Brent, the global crude oil price benchmark, was trading at $87 per barrel right before the April 1 attack. BNEF estimates Dated Brent prices should be closer to $66 per barrel if there were no heightened geopolitical risks in the Middle East as well as the ongoing Russia-Ukraine war.

Looking forward, a widening conflict in the Middle East can send oil prices higher. On the upside, BNEF observed a $30-$35 war premium in oil prices immediately after Russia invaded Ukraine, implying crude oil’s war premium can run another $5-$10 if tensions flare.

On the downside, the $25 war premium can quickly fizzle out if Iran and Israel de-escalate confrontation. Israel launched strike against Iran’s air base on April 18 as an answer to Iran’s attack over the weekend. Brent crude oil prices immediately traded as high as $90.70 in the overnight market as traders feared the worst. However, prices quickly slid as Iran downplayed the attack in the media, indicating a willingness to reduce tensions.

BNEF estimates the war premium was $11 per barrel in 1Q 2024 – before the attack on Iran’s embassy in Syria, but with the Russia-Ukraine war ongoing. Brent crude oil prices can retreat $10-$15 if the war premium returns to 1Q 2024 levels. Moreover, US crude oil inventories have been building in the past four weeks, which historically is a bearish sign for prices.

The calculations assume r-squared – which measures how much of the variances of the dependent variable (price) can be explained by the independent variable (inventory levels) – for the unadjusted model is 0.71. The model is based on quarterly average oil price.