Climate transition plans are entering the mainstream, as policy makers and financial institutions search for credible proofs that carbon-emitting industries and companies are moving toward net zero.

These plans set out an entity’s climate objectives, together with the strategies, engagement, governance and metrics for it to achieve them. The “gold standard” blueprint is laid out by the UK’s Transition Plan Taskforce, or TPT, which released a set of cross-sector disclosure recommendations on October 9.

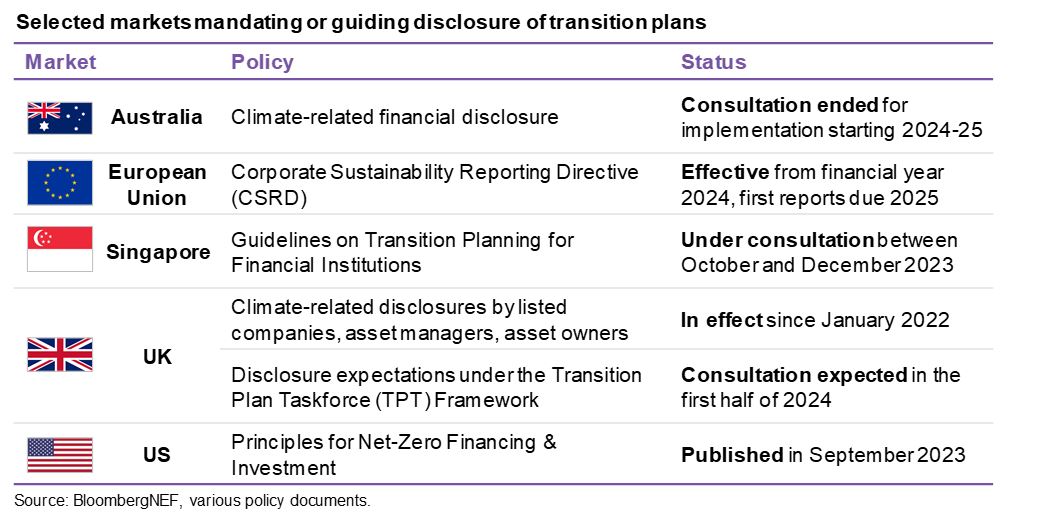

An increasing number of regulators are pushing for the disclosure of transition plans. The UK’s Financial Conduct Authority will adopt the TPT framework for disclosure by listed entities, with the first reports due in 2026. Regulators in the European Union, US, Singapore and Australia have also made or are in the process of developing policies encouraging, if not mandating, entities to disclose transition plans.

Financial institutions are also incorporating these plans into their decision-making. The German unit of ING Groep NV rejected loan applications based on borrowers’ responses to the bank’s inquiries about their carbon footprint, according to Bloomberg News. NatWest Group Plc and Mizuho Financial Group Inc. have signaled similar intentions.

Difference from climate reporting

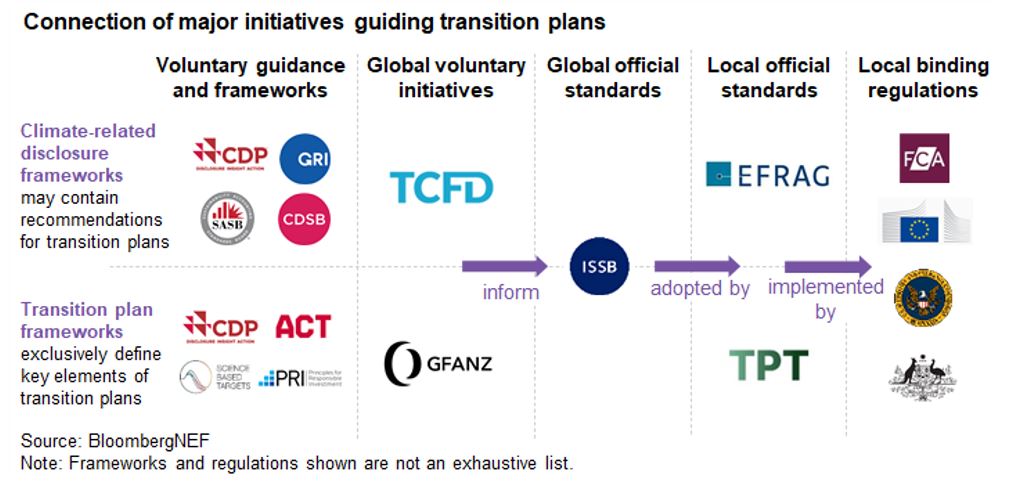

Several initiatives have in the past provided guidance on transition plans, including the Task Force on Climate-Related Financial Disclosures (TCFD) and the Glasgow Financial Alliance for Net Zero (GFANZ). In a growing sea of frameworks and standards, the TPT is set to build consensus while providing further depth and detailed guidance on what to disclose.

A major difference between transition plans and other sustainability or climate reporting is the objective they serve. While sustainability disclosures require entities to identify the climate-related risks and opportunities they face, transition plans focus on the strategy to respond to such risks and achieve an organization’s climate objectives. The GFANZ framework points out the significant overlap between climate-risk management and transition planning – both activities use a common set of data and metrics, as well as practices such as engagement.

Publication of the final frameworks of the International Sustainability Standards Board, or ISSB, in June 2023 marked an important milestone in the quest for global consistency across corporate sustainability disclosures. They are now considered equal in importance to financial reporting. However, though the ISSB’s standards on climate reporting prescribe entities to disclose information about “any climate-related transition plan the entity has, including information about key assumptions used in developing its transition plan, and dependencies on which the entity’s transition plan relies”, they do not provide the full, detailed picture of what constitutes a transition plan.

Connections to transition finance

Transition plans relate to, but are not the sole purpose for, transition finance. Companies looking to raise funds under the transition finance label are expected to have credible transition strategies in place. But labeled finance may not be the only use case. Some financial institutions may use transition plans to inform both labeled and unlabeled investments and lending, so they fit these institutions’ own decarbonization trajectory.

As climate regulations become stricter, financial institutions and companies they engage will have to hone their transition planning and disclosure practices. While the TPT serves as the official standard in the UK, regulators elsewhere should strive for consistency to reduce the burden of disclosure and allow for comparisons.