By Dr. Kwasi Ampofo, Head of Metals and Mining, BloombergNEF

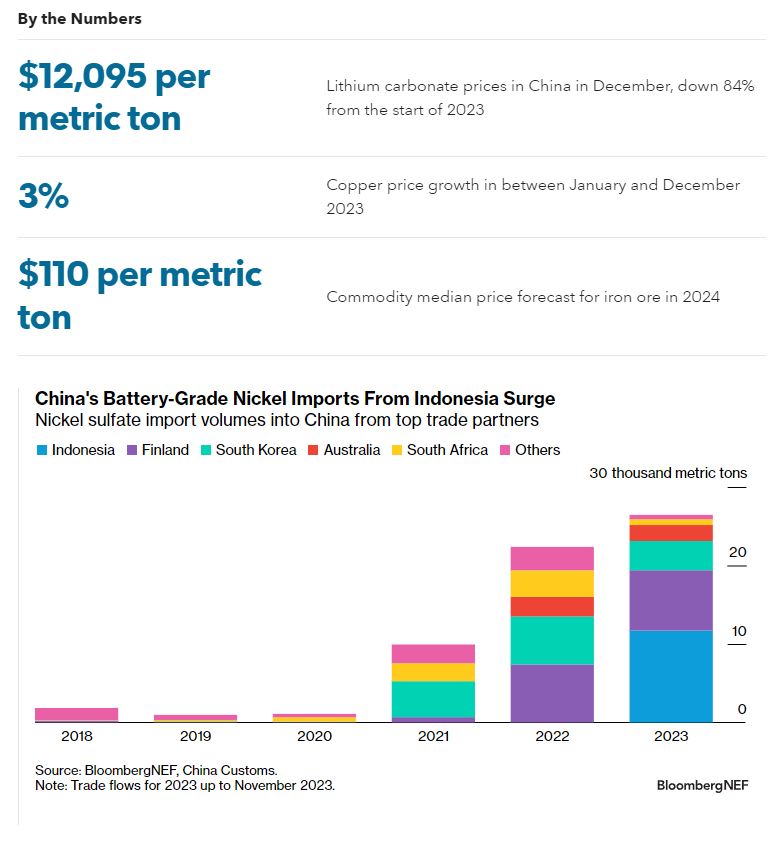

The prices of industrial metals such as copper and aluminum ended last year with a rally and have room to keeping grow this year as supply disruptions and steady demand maintain upward pressure. By contrast, the prices of battery metals such as lithium and cobalt declined across 2023 and are likely to remain subdued amid an anticipated slowdown in the growth of electric vehicle sales. Having surveyed the outlook across the two landscapes, these are the 10 key trends BloombergNEF has identified to watch in the metals and mining space in 2024:

- Global steel production is set to rise and lift the iron ore market.

- Easing inflationary pressure will not be enough to relieve production costs for metals.

- Copper supply growth to outpace the rise in energy transition-related demand.

- Increase in China’s aluminum supply will offset the delays from the restart of European projects.

- Copper and aluminum prices have room to grow, whiles iron ore enters backwardation.

- Lepidolite producers in China to face challenges from low prices.

- Battery metals demand growth to decelerate in 2024 from EV sales slowdown.

- Battery metals refining capacity outside China will be boosted by critical minerals policies.

- Nickel and cobalt sulfate exports from Indonesia to surge this year.

- Low-price environment for battery metals to persist in 2024.

BNEF clients can access the full report here.