Emerging markets and developing economies (EM&DEs) account for nearly half of the total global greenhouse gas (GHG) emissions and over a third of energy-related emissions. However, the volume of capital currently being deployed to transition these countries to lower-carbon sources of energy is insufficient given the size of the climate challenge.

The BNEF report ‘Mobilizing Capital Into Emerging Markets and Developing Economies’, commissioned by GFANZ, offers a snapshot of current conditions for energy transition investment in EM&DEs. It analyses the slowing capital flows from wealthy to less developed nations post Covid-19. It notes that the “pipeline” of new clean energy projects under development has shrunk, that development finance institutions have deployed fewer dollars, that individual nations have implemented fewer critical policies and that the private sector scaled back investments in 2020-2021. Each major stakeholder group must raise its effort to help EM&DEs transition to lower-carbon energy.

Download the complete report here.

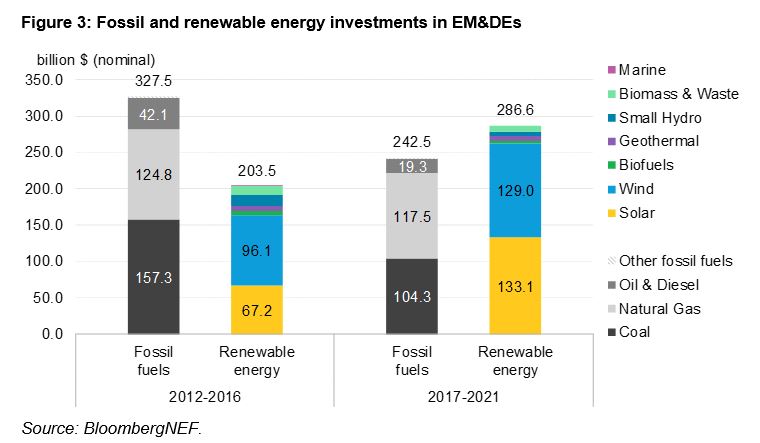

The news is far from all bad. Investment into renewable energy capacity jumped 40% in the five years ending in 2021, compared to 2012-2016. The past five years also saw a 25% drop in fossil-fuel fired capacity investment in these markets with renewables attracting 15% more capital than their fossil-fueled rivals. Despite supply-chain bottlenecks and higher commodity prices, clean energy is today more cost competitive in more nations than ever. However, overall energy transition investment, including funds flowing from wealthy to EM&DEs, has stalled at the very moment when it must accelerate.

Getting on track will require unprecedented collaboration between stakeholders – including policy makers, development financiers and private investors – to build durable enabling frameworks within nations. Extraordinary declines in zero-carbon technology costs and key successes in certain EM&DE’s highlight how quickly successes can come under the right circumstances. When the right players work together in the right ways, change can come very quickly.

The report’s key points:

- Climate investment into EM&DEs remains insufficient to meet the goals of the Paris agreement. Volumes currently being deployed into clean energy are far less than the $1 trillion/year the International Energy Agency (IEA) estimates will be needed by the end of the 2020s to reach net-zero global emissions by 2050.

- Decarbonizing energy, with a special focus on power generation, is the most immediate and efficient pathway to keeping EM&DEs on track in the race to zero. Looking to 2030, more than three quarters of potential global CO2 reductions will come from the power sector.

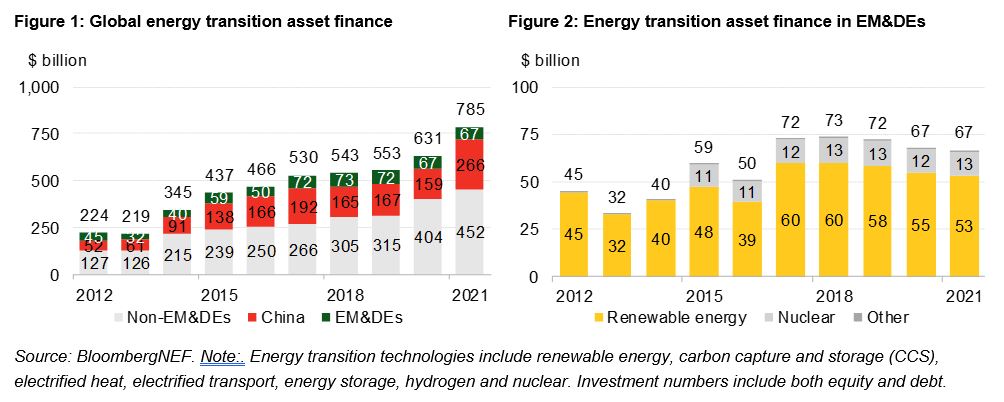

- The investment gap between developed and developing economies has widened. Global investment in low-carbon energy technologies hit a high of $785 billion in 2021, spiking 24% from the previous year, but the growth came nearly entirely in richer nations (Figure 1). In EM&DEs, energy transition asset finance stayed essentially flat in 2021 at under $67 billion (Figure 2). The 2021 share of global energy transition asset finance flowing into EM&DEs hit its lowest level in 10 years, at just 8%, far below the 20% peak reached in 2012.

- Foreign direct investment (FDI) for renewables in EM&DEs sank to a four-year low in 2021. Private FDI (including both equity and debt) hit its lowest level since 2016 while public flows plummeted to their lowest in 10 years, at a mere $2 billion. Public foreign funds accounted for just 13% of the total while private investment represented 87%.

- The macroeconomic picture has been challenging. A once-in-a-century pandemic, supply chain constraints, surging inflation, and economic contraction have created unique and challenging circumstances. As result, overall foreign direct investment into EM&DEs slipped in 2019-2020. The Bloomberg Global Emerging Markets Sovereign Index, which tracks the performance of major sovereign bonds in EM&DEs, is off 18.7% since 2019. Today’s challenge: rising interest rates.

- The project pipeline has shrunk. State- or utility-organized reverse auctions for clean power delivery contracts have historically proven most effective for scaling renewables in EM&DEs. But Covid-19 slowed economic growth, calling into question the need for additional capacity. Due to this uncertainty, only 13 EM&DEs contracted capacity through auctions in 2020, compared to a peak of 22 in 2019. Capacity awarded plummeted 56%, from 35.1GW in 2019 to 15.6GW in 2020, with 94% of activity in India.

- Nonetheless, investment into renewable energy capacity in EM&DEs saw a 41% spike in the five years ending in 2021, compared to 2012-2016. Solar led the growth with a doubling of investment, followed by wind with a 34% increase (Figure 3).

- Fossil investment has dropped since 2019, but volumes remain significant. EM&DEs attracted an estimated $243 billion for new fossil fuel-fired capacity 2017-2021, 25% below the investment recorded in 2012-2016. This trend should continue if investors follow through on public commitments (Figure 3).

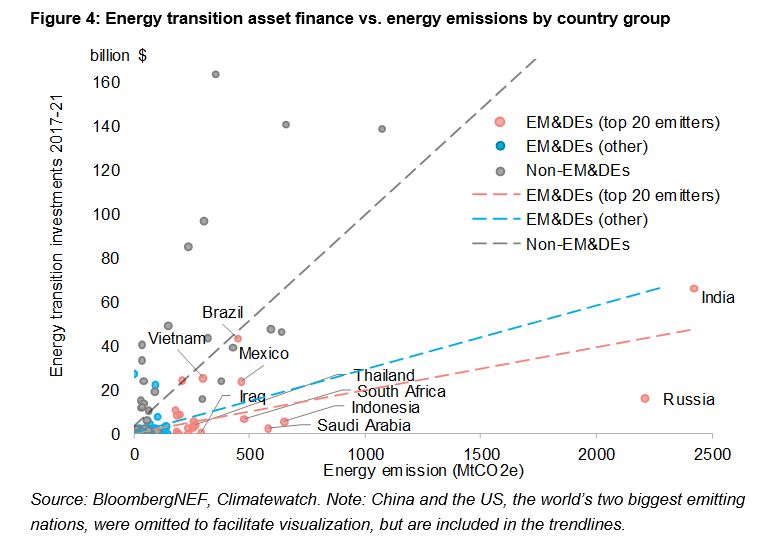

- The current allocation of energy transition funding is not aligned with the world’s long-term need to decarbonize. While developed nations attracted, on average, $121 million of energy transition investment over 2017-2021 for each MtCO2e energy emissions, the top 20 emitters among EM&DEs attracted just a fifth of that (Figure 4).

- Covid-19 and the war in Ukraine hurt many emerging markets, but some are showing resilience. While emerging markets inevitably have been subject to serious economic and policy disruptions since early 2020, the impacts have varied. Commodity exporting nations tended to benefit from the general uptick in prices while importers have suffered most.

- Despite renewables being cheaper than fossil fuels in most places, barriers limit emerging markets deployment. Renewables are the cheapest power source in countries where two-thirds of the world lives, including in many EM&DEs, and the economics have only improved as fossil fuel prices have surged. But financial, regulatory and policy-related obstacles can artificially inflate clean technologies costs or make them difficult to deploy.

- Appropriate policies are fundamental to attract climate finance, but only a limited number of EM&DEs have the necessary supportive policies in place. A growing number of emerging markets have made ambitious pledges to cut their CO2 emissions, but there is little evidence that these have triggered mass implementation of more concrete policies. Over 80% of emerging markets have clean energy targets in force, but more specific and effective mechanisms are lacking, such as auctions and feed-in tariffs. For other clean energy sectors, such as transport and clean buildings, the policy environment is even less developed.

- Coordinated public-private engagement is key to unlocking energy transition investment for EM&DEs. Once appropriate policies and regulations are in force, engagement between public and private stakeholders through catalytic investment is fundamental to help EM&DEs open doors to larger pools of private capital. More – much more – such engagement is now needed to accelerate the transition.