The Electric Reliability Council of Texas, or Ercot, is facing two major upheavals in the coming years. First, renewable capacity in the region is forecasted to rise 120% by the end of the decade. And second, peak system demand could be as high as 152 gigawatts in 2030 by Ercot estimates, nearly double the current grid’s proven maximum. Incumbent utilities are ramping up spending to meet these challenges, but the resultant grid buildout still falls short of what is needed to hit net zero.

- Ercot is facing rising load growth and congestion, meaning that grid buildout and resilience retrofitting are crucial. The commission has forecast an additional 67 gigawatts (GW) of demand could connect by 2030, a 78% increase from 2023 levels.

- Load growth is concentrated in the oil- and wind-rich west and in the south, resulting in congestion charges and curtailment when exporting power to the rest of Texas.

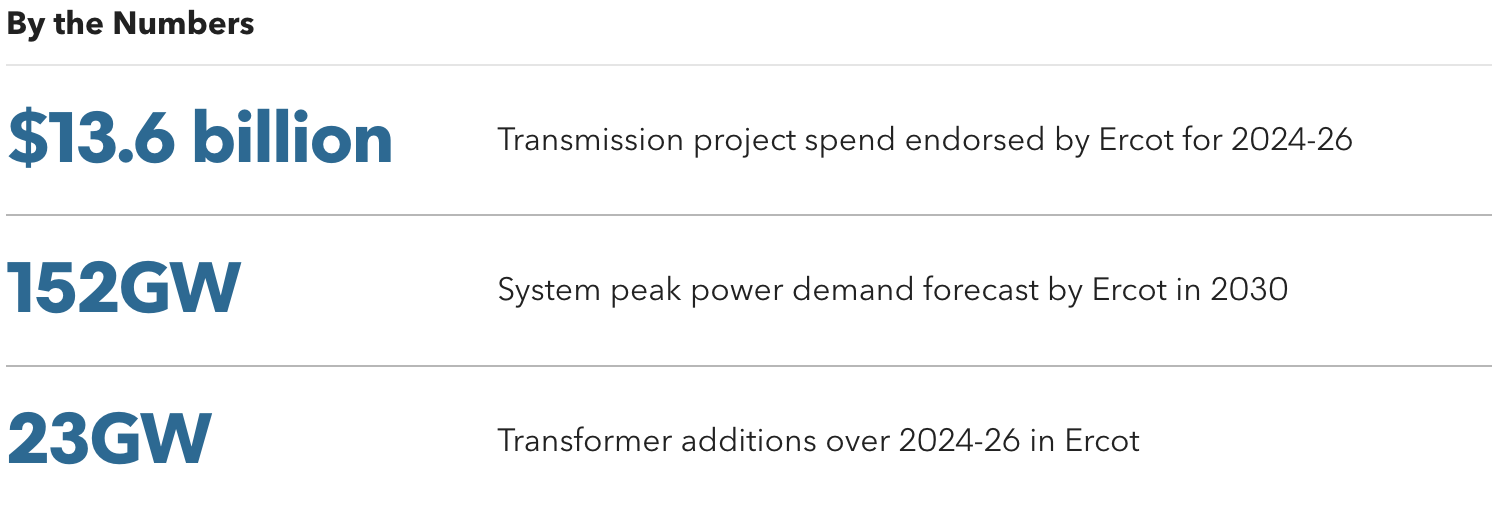

- Multiple Texan utilities are ramping up activities. Oncor Electric, ETT Texas, CenterPoint Energy and AEP Texas spent over $8.8 billion annually in capital expenditure on average over 2022-23. Oncor announced a $24.2 billion five-year capex plan and leads on planned transformer installations. AEP Texas is upgrading 16% of current transmission circuit miles.

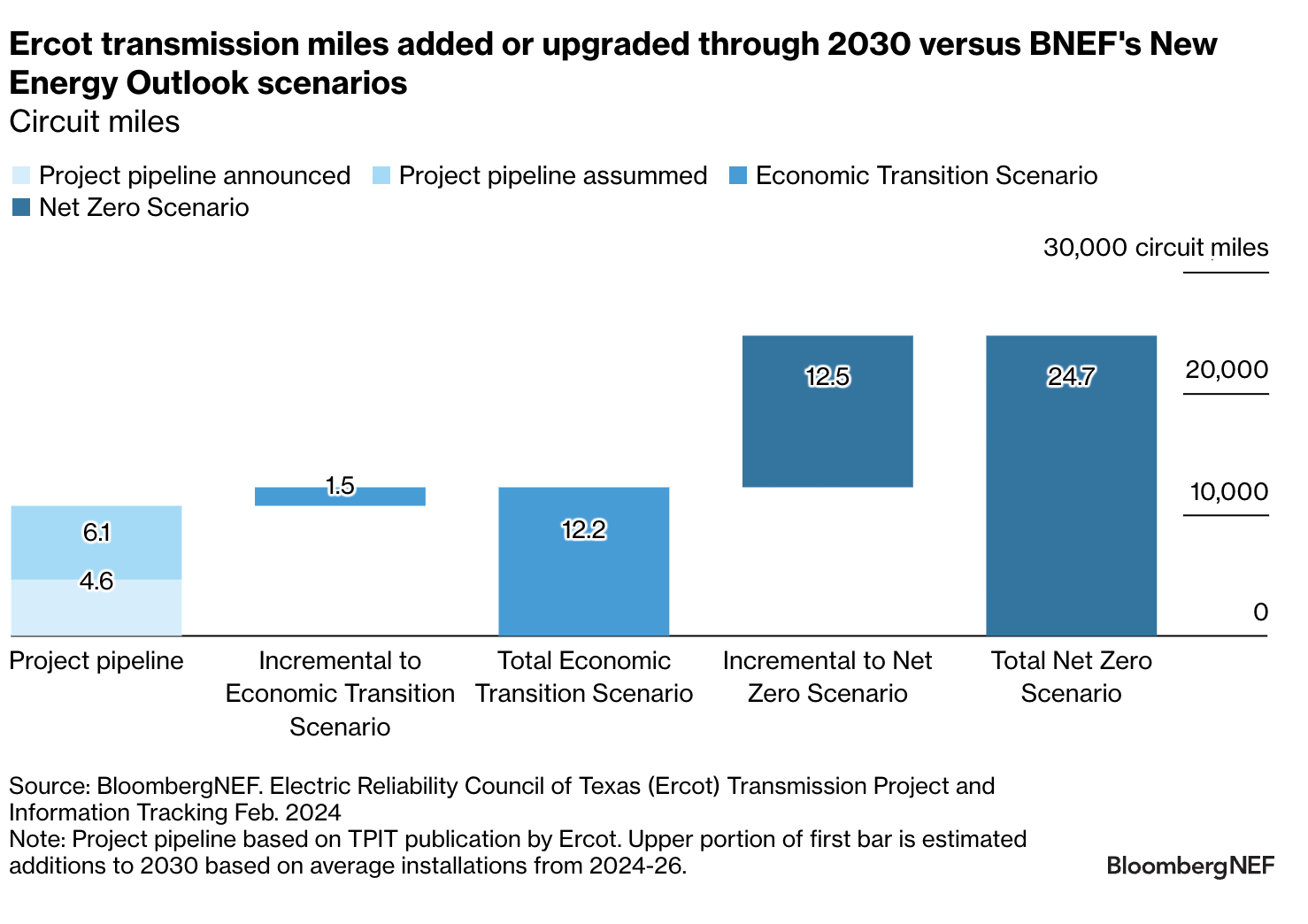

- Utilities plan to spend $13.6 billion on transmission development over 2024-26, which will support 4,600 circuit miles of power line upgrades and additions, and the deployment of transformers and new reactive power equipment. By 2030, planned transmission line upgrades and additions still fall 12% short of what’s needed in BNEF’s Economic Transition Scenario which could risk the grid’s ability to accommodate new generation and demand growth. It also falls far short of a net-zero transition path.

BNEF clients can access the full report here.