By Colin McKerracher, Head of Advanced Transport, BloombergNEF

Battery manufacturers are having hard times this year. LG Energy Solutions and Samsung SDI recently posted falling quarterly revenues and profits, while Panasonic’s battery division missed its targets. Even the world’s largest battery maker, CATL, reported its first drop in quarterly profit earlier this year.

Most of this has been caused by a slowdown in the growth rate for electric-vehicle sales, leading to lower-than-expected battery volumes, intense competition and price cuts to defend market share.

EVs are the biggest source of demand for batteries, and the industry’s overcapacity issue isn’t going anywhere anytime soon. Nameplate battery manufacturing capacity just in China alone reached 2.2 terawatt-hours at the end of 2023, almost double the 1.2 TWh of global demand that BNEF is expecting for 2024.

Despite that, it’s worth keeping an eye on the stationary storage market, which has boomed the last two years. BloombergNEF team of analysts who follow the space are expecting this to continue, with energy storage installations rising 61% this year. Prices for turnkey energy storage systems are down 43% from a year ago, and that’s leading to a big increase in deployments.

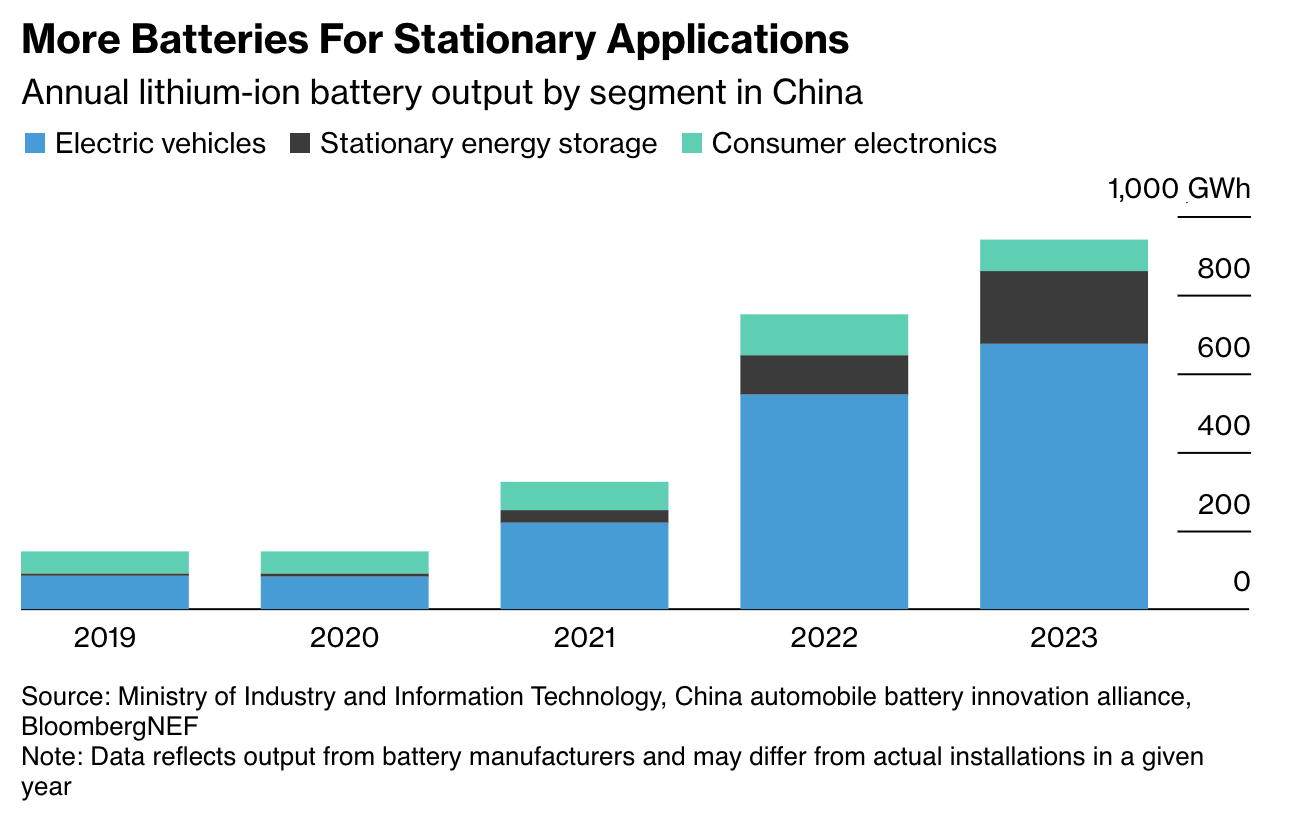

As with many of these topics, the most interesting data is coming out of China, where energy storage applications overtook consumer electronics as the second-largest application for battery production last year.

Global energy storage installations — including residential, commercial and utility scale — account for a growing share of total battery demand, rising from 6% in 2020 to an expected 13% this year. Put another way, the ratio of EV battery demand to stationary battery demand has fallen from 15-to-1 to 6-to-1 over the last four years.

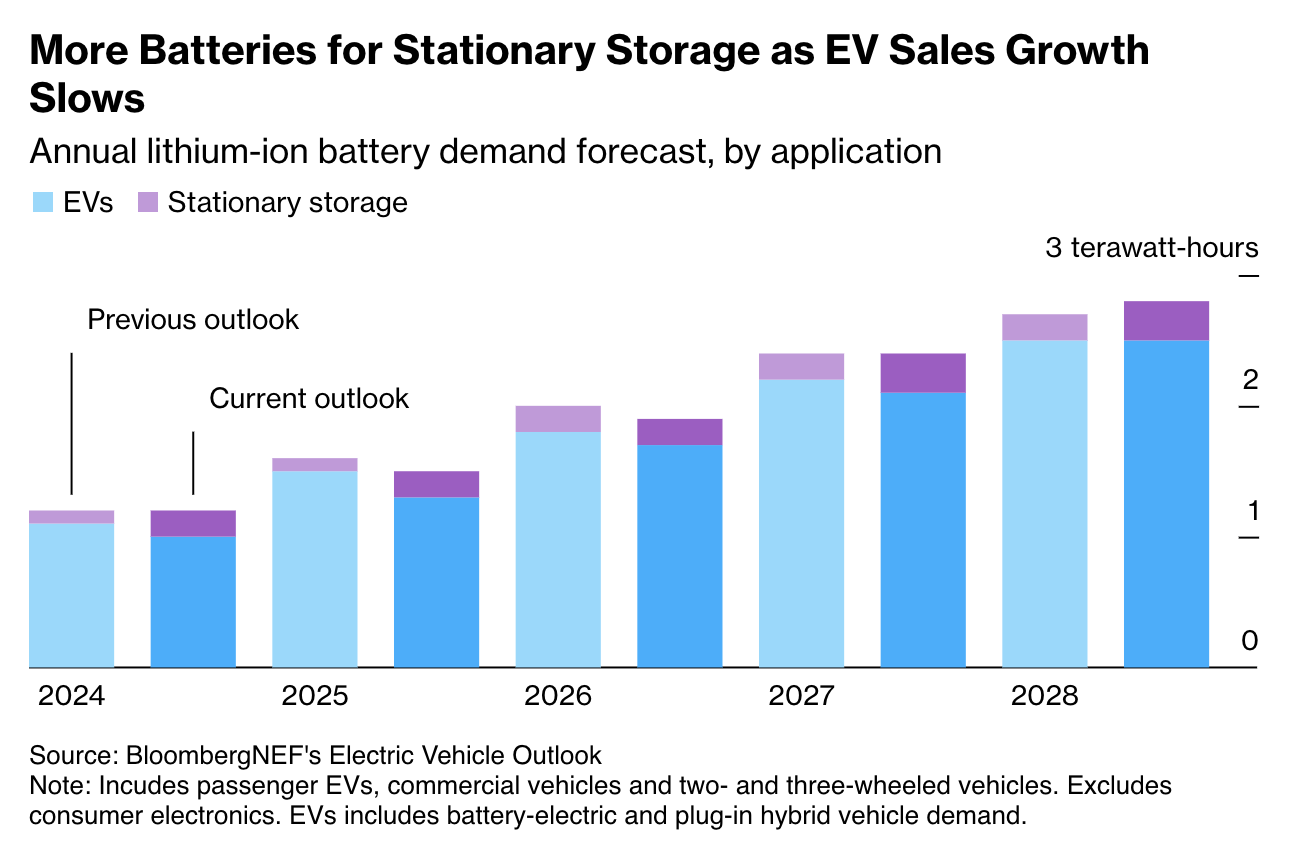

That means stationary storage is now a material part of global battery demand and is growing much faster than the EV segment. In BNEF’s most recent Electric Vehicle Outlook, expected EV battery demand over the next four years was downgraded due to lower outlooks in markets like Germany, Italy and the US compared to previous iterations of the report. The overall lithium-ion battery demand forecast remained almost constant due to increased expectations on the stationary side of the market.

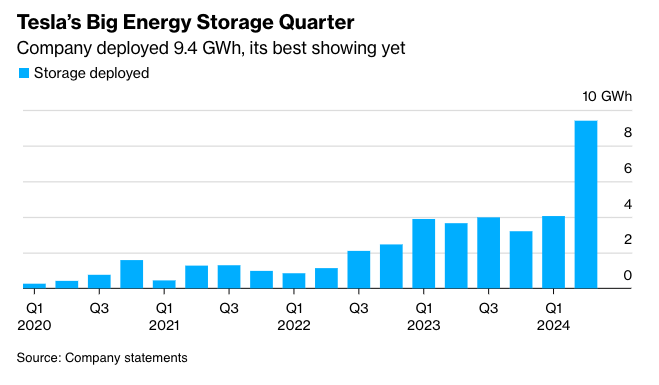

Tesla’s latest results also reflect this trend. The company’s EV sales were down in the second quarter, but the energy generation and storage division deployed 9.4 GWh, more than double the 4.1 GWh installed in the first quarter and on pace for a huge increase over the 14.7 GWh deployed in all of 2023.

Tesla’s latest results also reflect this trend. The company’s EV sales were down in the second quarter, but the energy generation and storage division deployed 9.4 GWh, more than double the 4.1 GWh installed in the first quarter and on pace for a huge increase over the 14.7 GWh deployed in all of 2023.

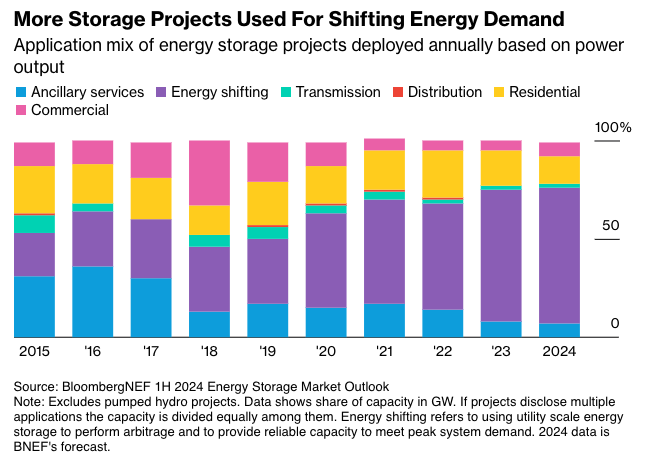

In the past, many energy storage projects were aimed at what are called ancillary services in the power markets. These are things like regulating frequency on the grid, and while they can be lucrative, they tend to be relatively small markets and have increasingly been tapped out.

This year, two-thirds of all storage installations are being used for energy-shifting applications, like price arbitrage and helping to integrate renewables. That’s a big jump from previous years and reflects a growing number of provincial mandates in China that require wind and solar projects to be paired with energy storage.

This year, two-thirds of all storage installations are being used for energy-shifting applications, like price arbitrage and helping to integrate renewables. That’s a big jump from previous years and reflects a growing number of provincial mandates in China that require wind and solar projects to be paired with energy storage.

As battery manufacturers hunt down new markets to help alleviate excess capacity, creative solutions may emerge. At a recent industry trade show, BNEF analysts noted a significant number of residential energy storage systems designed to sit on balconies and pair with a growing amount of solar PV systems in Europe targeting the same market. These are niche applications for now, but they highlight how industries get creative when the pressure is on.

The outlook for battery demand will continue to be closely tied to EVs, but the stationary storage market is worth watching. As one part of the energy transition temporarily slows, another is speeding up.