By Emma Champion, Head of Regional Energy Transitions, BloombergNEF

South Africa’s coal-heavy power system will transform rapidly even in an economics-led scenario, new BNEF modelling finds. The country needs an average of $5.9 billion of investment in power generation per year from 2021 to 2040, to deliver on the cheapest capacity mix to replace its retiring coal fleet.

Solar boom incoming, cutting coal output

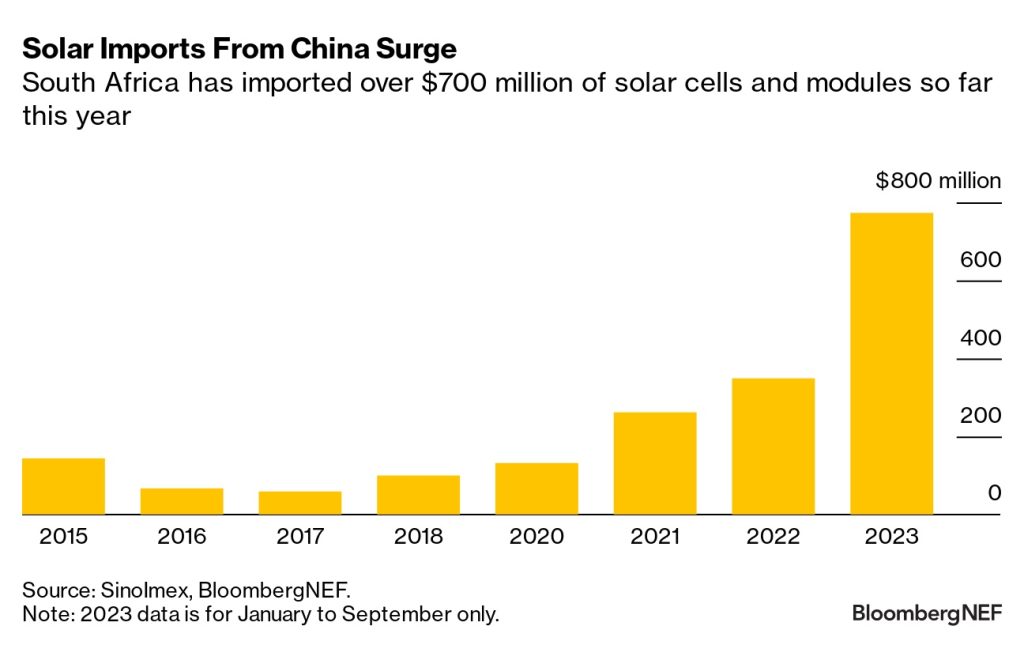

Small-scale solar installations are booming in South Africa amid rolling power cuts and regulatory changes. Export data for solar products from China surged in 2023, with $770 million directed to South Africa in the first half alone.

Despite a slowdown in exports since July, BNEF expects over 3.5 gigawatts of residential and commercial solar to be added annually from 2023 to at least 2025, or until the electricity supply crisis ends.

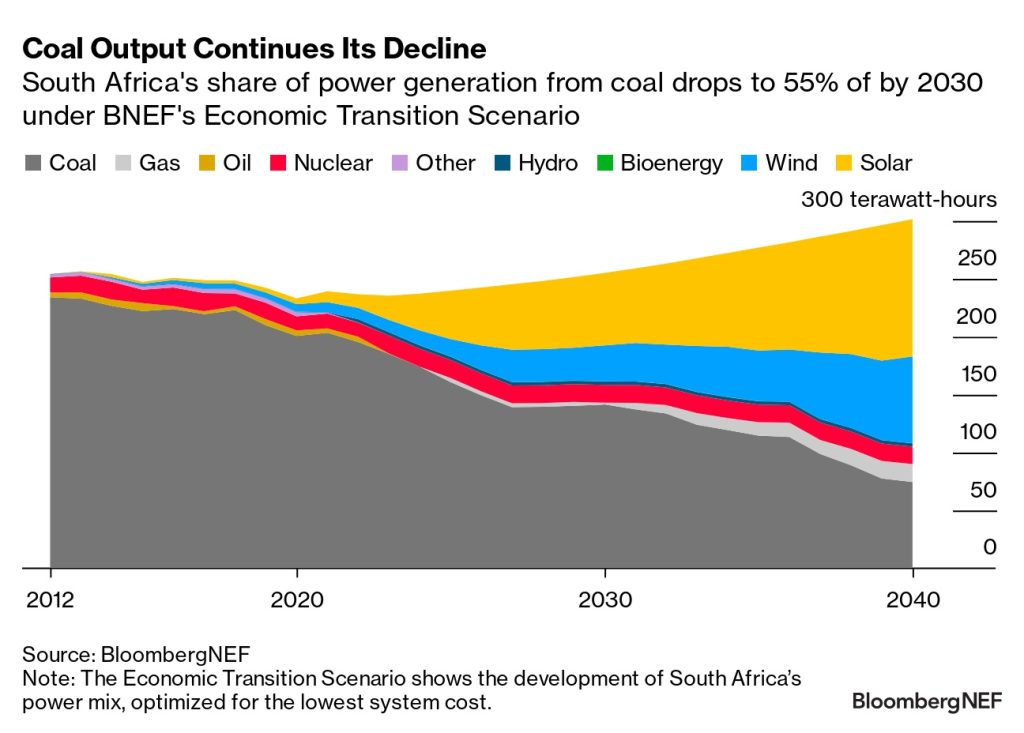

The deployment of 36 gigawatts of new wind and solar by 2030, under BloombergNEF’s economics-led scenario, means that renewables grow to supply over a third of South Africa’s power mix. This lowers demand for coal generation by 28% by 2030 from 2021 levels, and cuts emissions produced by the coal-heavy grid by almost a third.

During the 2030s, new-build solar becomes cheaper than running even the most efficient coal units, driving installations further. Renewables, primarily wind and solar, supply two thirds of South Africa’s electricity mix by 2040.

New generators can ease coal retirements

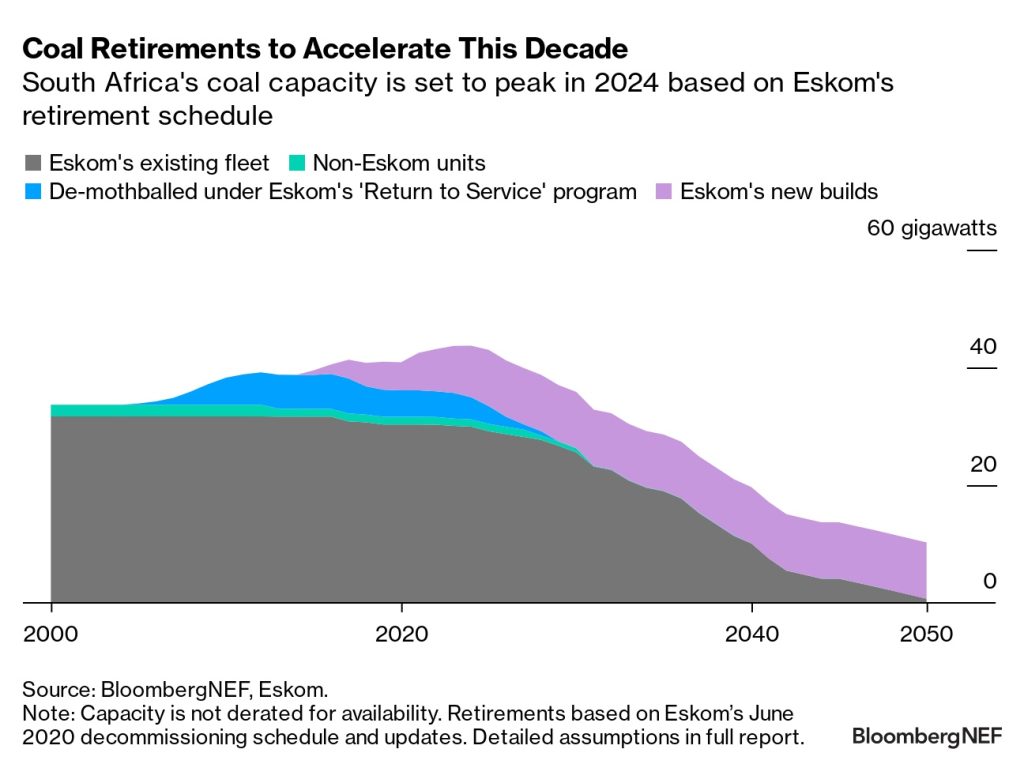

South Africa needs new bulk generation and backup capacity to replace retiring coal plants and ensure system adequacy. Coal capacity owned by national utility Eskom is due to peak in 2024, followed by a long-term decline as closures exceed new-build capacity additions.

As demand grows and coal retirements accelerate in the 2030s, BNEF’s Economic Transition Scenario sees 41 gigawatts of additional new solar and wind deployed in South Africa by 2040, effectively doubling the fleet of variable renewables from 2030.

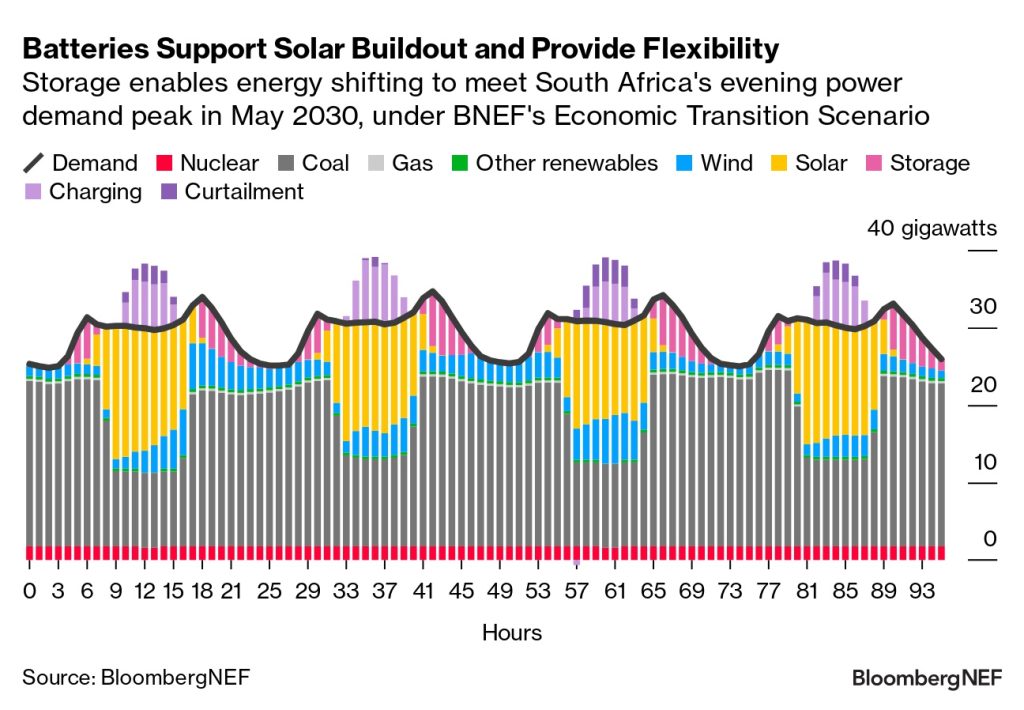

Battery storage and flexible gas plants are the most cost-efficient solution to complement growth in solar and wind generation and guarantee supply. The fleet of batteries and gas plants reach a cumulative 37 gigawatts by 2040, almost the size of today’s coal fleet.

Alongside remaining coal plants, gas plants support the system during times when output from renewable energy is low, while batteries shift solar generation to other parts of the day.

South Africa needs to triple historical clean energy investment

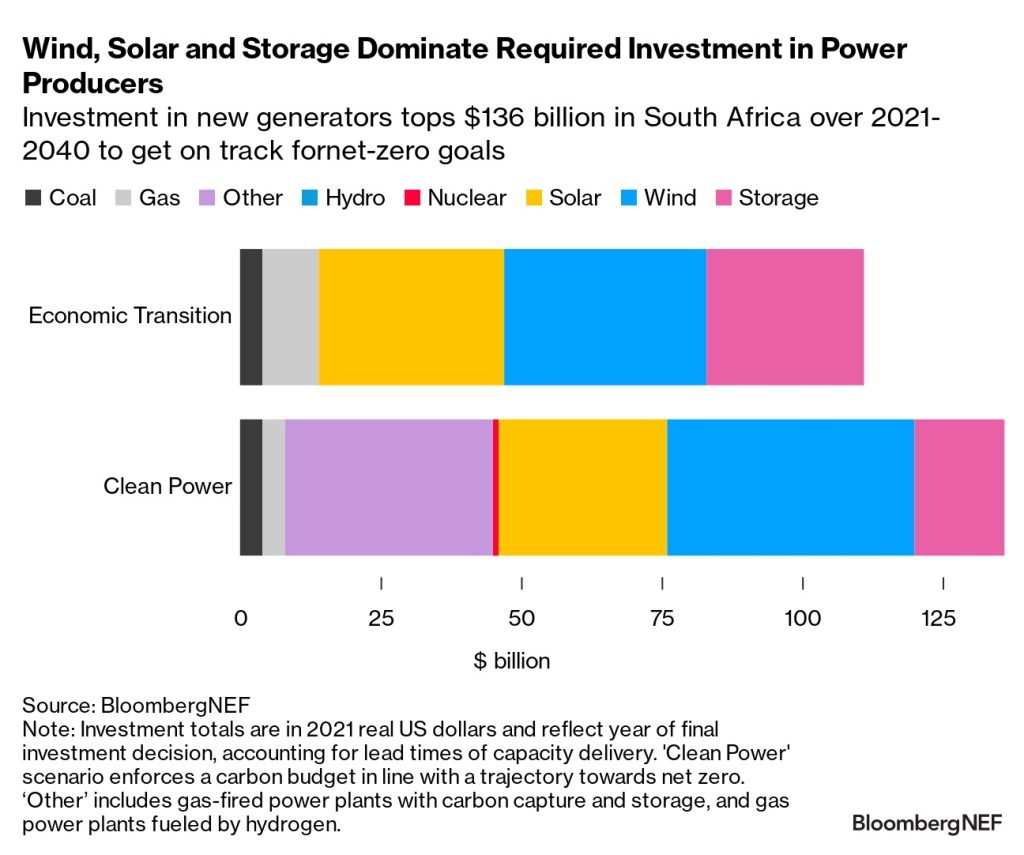

Over the next two decades, the power system transition requires $111 billion of investment in new generating capacity over 2021-2040, according to BNEF’s Economic Transition Scenario. Of this, 87% goes to zero-carbon plants, tripling the historical investment rate.

BNEF tracked $34 billion of investment into renewable energy projects, primarily solar and wind, in South Africa over 2004-2022.

A more ambitious scenario, that would align South Africa’s power sector to a net-zero trajectory, requires a cumulative $136 billion in investment in new generating capacity 2021-2040. This includes investment in zero-carbon backup capacity, such as hydrogen-ready gas plants.

Such a scenario would get South Africa 80% of the way to the lower bound of government climate targets, if appropriate policies are put in place.

Deep-dive on South Africa’s power transition

The South Africa Power Transition Outlook was produced by BloombergNEF in partnership with Bloomberg Philanthropies. Read the full report here.