By James Ellis, Head of Latin America Research, BloombergNEF

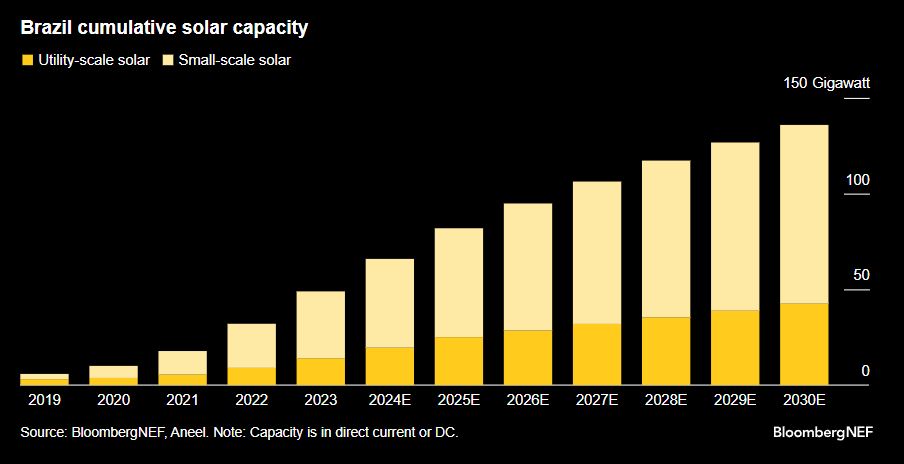

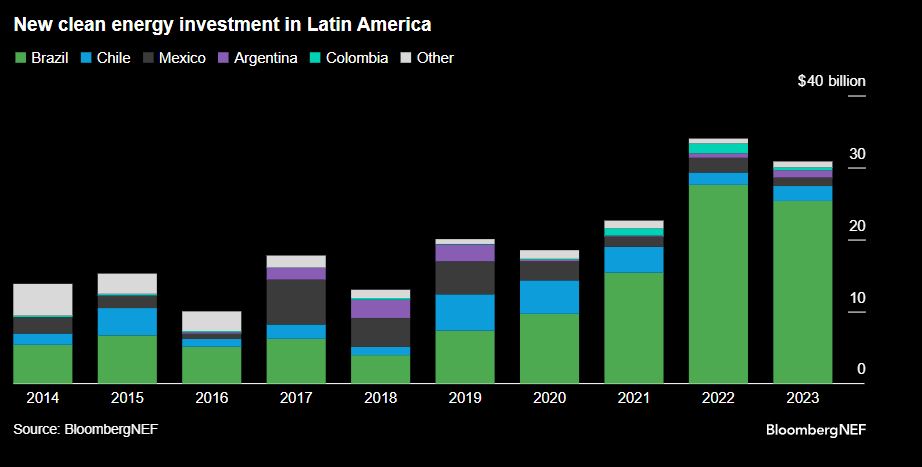

Solar installations are set to jump in Brazil – the Latin American giant accounting for over 80% of the total clean energy investment in the region last year. The boom is driven by small-scale plants of 5 megawatts or less. These catapulted Brazil to the world’s third largest solar market in 2023, after China and the US, and ahead of countries like Germany and India.

It is a good time for the country to showcase its green credentials. It will preside over UN’s COP30 climate conference in 2025, and is leading the G20 this year.

Brazil installed about 17 gigawatts of solar last year, roughly equal to its entire solar market in 2021. The booming sub-5 megawatt segment is eligible for net-metering, allowing generators – both households and commercial consumers – to claim credit for power generated.

Relatively high retail power prices make the net-metering incentives even more compelling, and enabled Brazil’s small-scale solar sector to take in investment of more than $17 billion in 2023. It propelled Brazil to the sixth largest destination for energy transition investments globally, and highest among emerging markets after China.

President Luiz Inacio Lula da Silva is keen to reposition Brazil as a climate leader in a bid to boost the economy and shore up his profile abroad and popularity at home. Even Petrobras, the region’s biggest oil company, is steering toward green energy.

Headwinds facing small-scale solar development include rising transmission tariffs introduced by the 2022 reform of the net-metering legislation, difficulties in getting permits from the energy distributor, competition with the wholesale market and import taxes on modules. In January, the Brazilian government ended its import tax exemption for modules and set relatively high exemption thresholds that will enable around 30 gigawatts of tariff-exempt imports through mid-2027.

Best wind

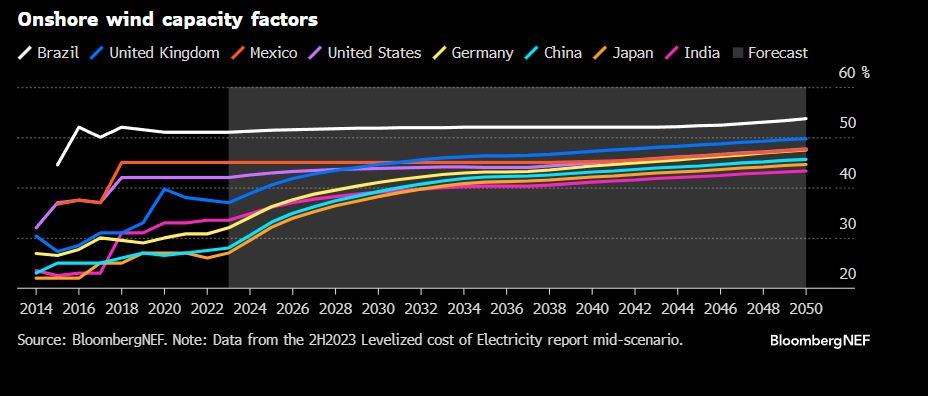

The country also has the best wind resources in the world, and reports the highest average capacity factors globally, thanks to its blustery northeast. Generation from an average onshore wind turbine in Brazil is even greater than offshore generation in many markets.

This yields some of the cheapest green power in the world, giving it an edge in producing one of the world’s key clean fuels – green hydrogen. BloombergNEF estimates that in 2030, Brazil could produce the lowest cost green hydrogen globally.

A sizable ethanol industry spells opportunities in high-value, low carbon products of tomorrow, from sustainable aviation fuel or SAF to bioplastics.

The country’s natural capital means it will play a huge role in the evolution of the voluntary carbon market as well, potentially supplying over one fifth of all global carbon offset supply through 2050.