By Nilushi Karunaratne, Editor, BloombergNEF

“A dead horse.” That’s what Germany’s Chancellor Olaf Scholz recently called the prospect of reviving nuclear power in his country.

Europe’s biggest economy had thrown its remaining three plants a lifeline in the wake of Russia’s invasion of Ukraine, postponing their phase-out to help stave off an energy crunch through the winter. But they finally shuttered in mid-April, bringing an end to more than half a century of atomic electricity feeding into the grid.

As Scholz dismisses calls from his junior coalition partner, the Free Democrats, to keep the horse alive, some countries still see a future for nuclear power in their quest to reach net-zero emissions and ensure energy security.

While solar and wind are leading the way, they can’t produce electricity round the clock or when the sun isn’t shining and the wind isn’t blowing. Batteries have yet to achieve the required breakthroughs in technology, profitability and scale to be able to store enough excess renewable energy and discharge it to the grid when needed. That means nuclear can act as a complementary source of reliable, low-carbon, “firm” power to underpin intermittent solar and wind.

For conventional nuclear fission being used today – which involves splitting atoms to release energy – there are two main barriers to it being considered a serious contender in the race to net zero: skepticism around the safety of reactors and radioactive waste disposal, and cost.

Nuclear has struggled to shake the legacy of a number of high-profile disasters and compete with cheaper and faster-to-install sources of zero-carbon power. The number of reactors in operation today has changed little since the immediate fallout of the 2011 Fukushima accident, as retirements have outpaced new facilities coming online.

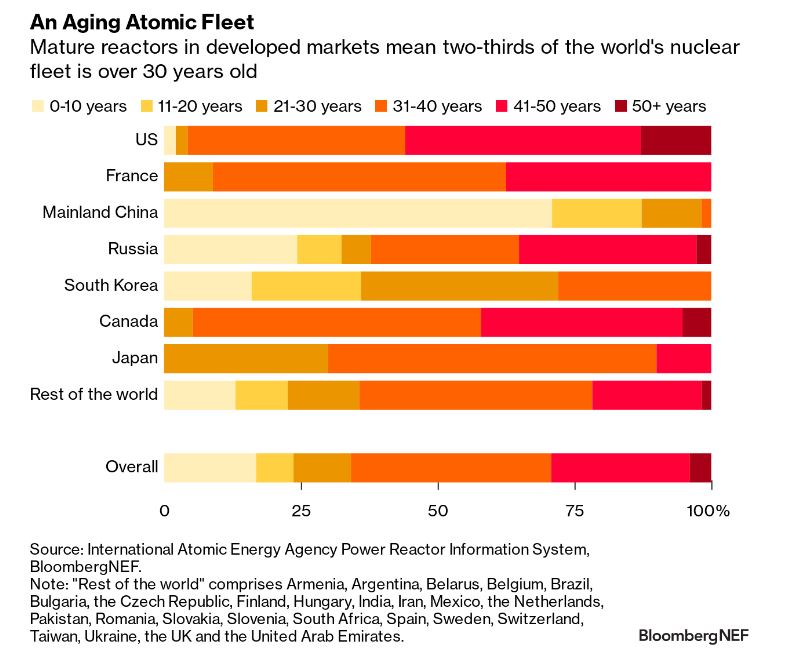

In the West, in particular, there has been a reluctance to expend political and financial capital on a controversial and expensive technology, and this has resulted in an aging atomic fleet. There are 410 active reactors spread out across the globe and two-thirds of these are more than 30 years old. For the US, home to the world’s largest fleet, that share is even higher at 96%.

Old doesn’t necessarily equate to bad, as reactors have been deemed safe to run for decades beyond their planned operating lifetimes. US regulators approved a 20-year extension for two of Dominion Energy’s rectors in Virginia to continue generating power into the 2050s. That gives them a lifespan of 80 years – longer than the average American.

Support to keep nuclear around in the US is growing. According to a survey conducted by the Pew Research Center, 57% of people are now in favor of more nuclear power plants to produce electricity, up from 43% in 2020. It’s a rare issue with consensus across the political spectrum. Government backing is there too, with the Bipartisan Infrastructure Law providing $6 billion of funding to prevent premature closures and the Inflation Reduction Act serving up a production tax credit for existing reactors.

But progress on new reactors in the US has been limited. Southern Company’s Vogtle Unit 3 in Georgia started delivering power to the grid at the end of July and was the first new reactor to be constructed in the US in more than three decades. Rather than being a shining beacon for the American nuclear industry, it serves as more of a cautionary tale, having arrived seven years late and billions of dollars over budget. BloombergNEF calculations put the cost of Vogtle 3 at around $15,200 per kilowatt-electric, more than five times higher than mainland China’s Fangchenggang 3 reactor, which entered into service in March.

Just one additional reactor is on the way in the US: Vogtle Unit 4, which is due to come online by early 2024. Still, headway is being made elsewhere around the world, with a further 56 reactors in the works. BNEF estimates a net 25 gigawatts of nuclear capacity will be added from this year to the end of the decade – roughly equivalent to the size of South Korea’s current fleet.

Asia is leading the charge, most notably mainland China, which has a pipeline of 21 new reactors. Momentum there is being aided by state support, lower interest rates, cheaper and more experienced labor, and less red tape.

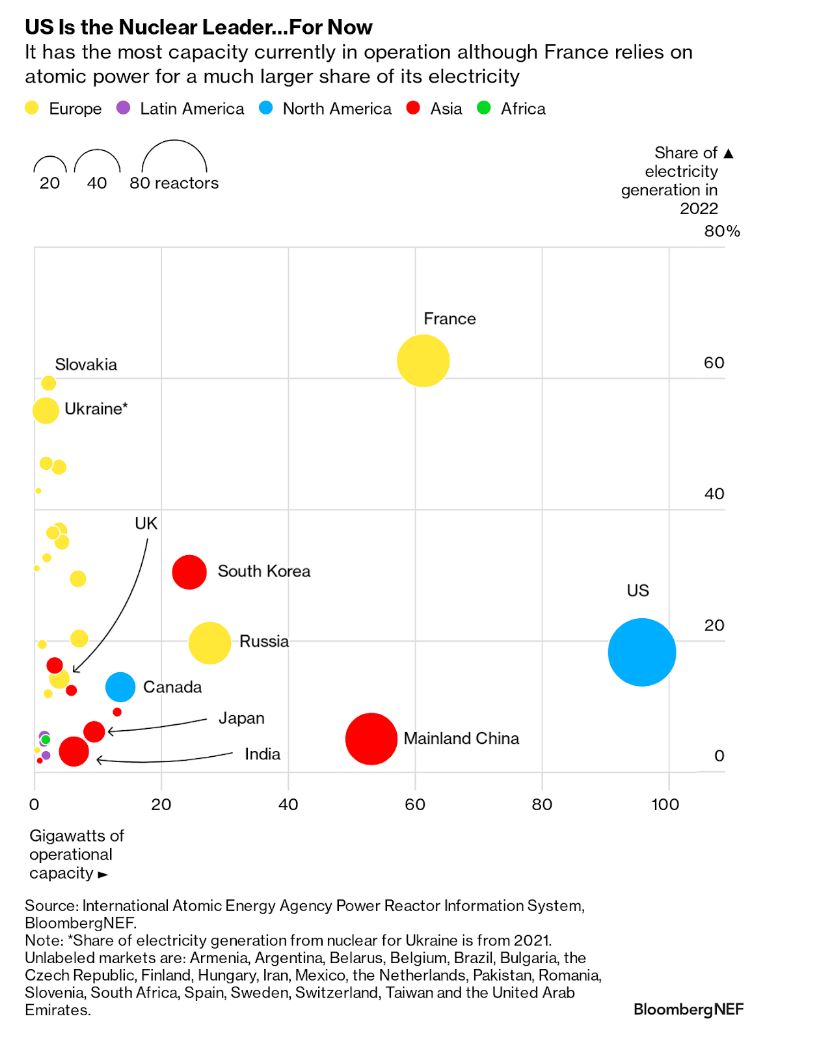

The rapidly growing fleet in mainland China puts it on track to chip away at the dominance of the US, although both are far less reliant on atomic energy than France, where nuclear typically supplies more than 60% of the country’s electricity.

At the global level, nuclear’s influence has been in decline amid the buildout of solar, wind and natural gas-fired plants. It provided around 17% of the world’s electricity back in 2000 and that has since fallen to 10%. Over that same period, wind and solar have progressed from less than a 0.5% share to 13%.

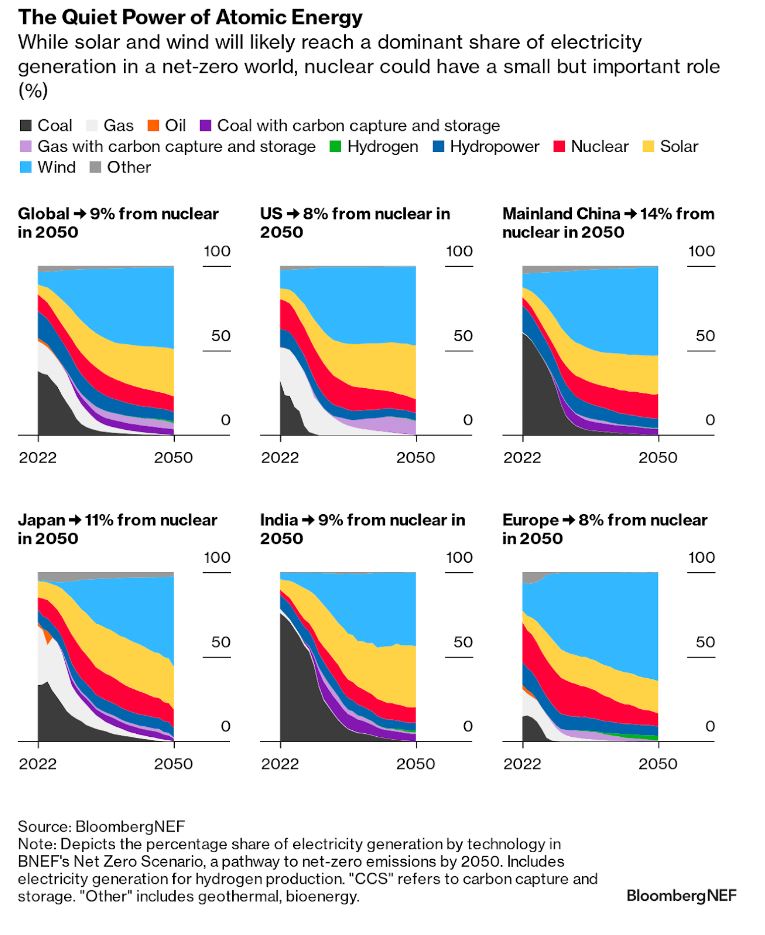

Looking ahead, BNEF’s scenario for the world to reach net-zero emissions sees nuclear dipping very slightly to 9% of power generation by 2050. It will need to sprint at breakneck speed to stay still, however – in terms of actual electricity output, the global fleet of reactors must more than double its production to 7,335 terawatt-hours. To put that number into context, total US power generation from all sources came in at around 4,300 terawatt-hours last year.

BNEF’s net-zero pathway sees nuclear as an also-ran against wind and solar, which stride ahead to provide more than 75% of the world’s electricity by mid-century. But while the share of nuclear is small, it is a valuable source of baseload power that helps solve the last piece of the electricity supply puzzle that variable wind and solar leave behind. Part of its role is in powering electrolyzers that split water to produce green hydrogen – a fuel that is seen being used in everything from steel production to aviation.

Life in the old horse yet

Not all the nuclear power envisaged in BNEF’s scenario is from the type of large-scale conventional reactors we’re familiar with today; the buildout to 2050 also partially leans on so-called small modular reactors. SMR technology is still being developed, but the principle is that they only have a capacity of up to 0.3 gigawatts, compared with more than 1 gigawatt for some current reactors. They are more compact in design and the intention is for prefabricated units to be made in factories, transported and installed on site, cutting down on costs and construction times.

In theory, mass production will enable economies of scale unlike the sporadic, one-off megaprojects that have been built to date. But this will hinge on sufficient demand to enable series production. High first-of-a-kind costs will likely mean subsidy support is needed to kickstart the deployment of SMRs. In the US, advanced reactors are also eligible for the lucrative tax credits included in the Inflation Reduction Act.

Rolls-Royce is one of the corporate heavyweights developing SMRs, but this sector has attracted the financial heft of billionaires too. Bill Gates-founded TerraPower is developing a demonstration project near a retiring coal plant in Wyoming, which is set to become operational in 2030.

Meanwhile, Oklo, a startup backed by Sam Altman, chief executive officer of OpenAI, the creator of ChatGPT, is set to go public via a merger with a special purpose acquisition company, raising as much as $500 million. The company is aiming for its first commercial-scale advanced fission power plant to come online in Idaho in 2026 or 2027.

Fusion to the rescue?

If nuclear fission is a horse – be it dead or an also-ran in the race to net zero, depending on your point view – fusion is more like a unicorn. It’s the process that powers the Sun and scientists have been looking to recreate it here on Earth for decades to provide a near-limitless source of energy.

For all the jokes that “fusion is 20 years away and always will be”, progress has been made. Researchers at the Lawrence Livermore National Laboratory’s National Ignition Facility in California repeated their breakthrough of “scientific net energy gain” at the end of July, meaning more energy was produced from a fusion reaction than the laser energy used to drive it. But there are still many steps – and likely many years – before fusion is anywhere near ready for the commercial stage.

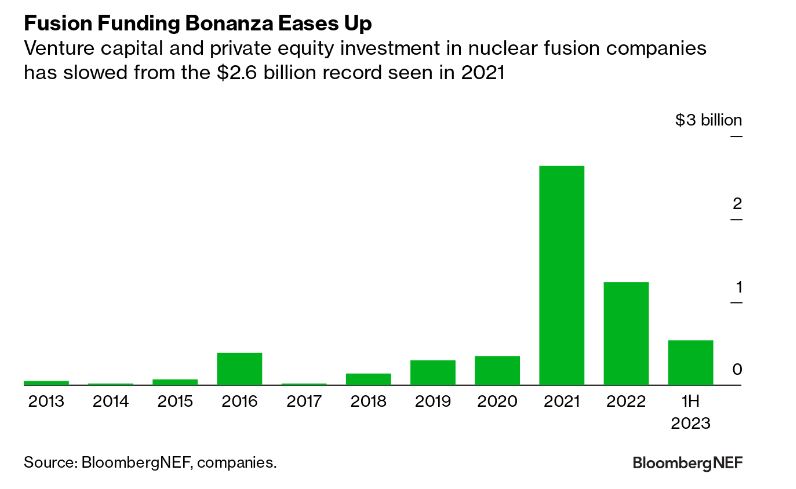

Money is pouring in to help speed things up, with venture capital and private equity investment in fusion companies nearing the $6 billion mark. While enthusiasm has retreated from a record year in 2021, this may not be a permanent drop.

Rick Needham, chief commercial officer at US-based Commercial Fusion Systems, told BNEF earlier this year “that when we get to proof of a significant energy gain, one that you could very easily imagine making a power plant from…there will likely be investors lining up because the market size here is literally in the trillions for energy infrastructure to meet our goals of a zero-carbon grid.”

There’s still much debate over whether it’s truly a case of “when, not if” for fusion, and in the event it does become a reality, whether the technology will arrive in time to make a difference in the fight against climate change.

Helion, also backed by Sam Altman, sees the revolution starting this decade. It expects its first fusion power plant to come online by 2028 and has inked a deal to sell at least 50 megawatts of electricity to Microsoft after a one-year ramp-up period.

Even if the star power of a unicorn doesn’t arrive, the plain old fission horse looks to have the legs to make it to net zero.