By Jenny Chase, Solar, BloombergNEF

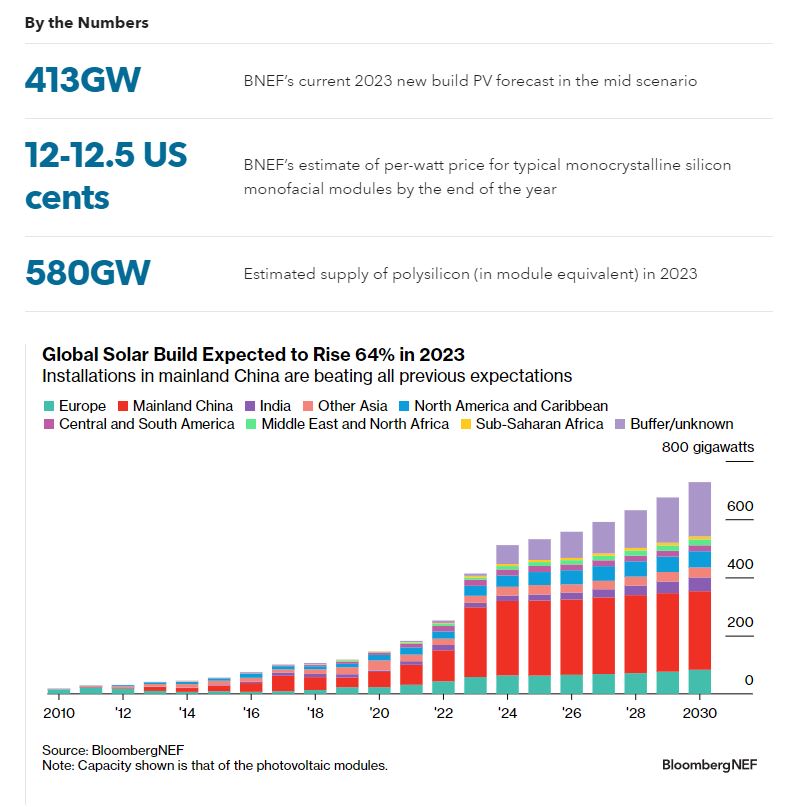

As 2023 draws to a close, the solar industry is installing record volumes worldwide and selling at record-low prices. BloombergNEF has increased its build forecast yet again for this year to 413 gigawatts, largely due to mainland China, as there are some signs that build in a few other markets is weaker than expected. This could reflect a ‘hangover’ from demand pulled forward into 2022 by the energy crisis.

- Installed volumes in the solar market are up about 64% from 2022 to 2023, exceeding our previous estimates. The biggest upward revision was in mainland China, which looks set to build 240 gigawatts this year, but there are now 33 markets installing over 1GW each year.

- However, demand is being dwarfed by the scale-up of manufacturing capacity across the value chain. Total module capacity of Tier 1 manufacturers is 839GW. Inventory buildup is severe in Europe, where some residential markets are slightly weaker than in 2022 on lower electricity prices.

- Module prices are at their lowest level ever, reaching $0.128 per watt in the third week of November. Nonetheless, most manufacturers plan to continue production, buoyed by strong cash positions, which allow them to play a game of chicken with their competitors over who will succumb to the pressure and exit the market first.

- BNEF expects module prices to drop to 1 yuan/W or even lower by the end of the year in mainland China and 12-12.5 US cents per watt in other markets without trade barriers.

- (Runergy has been added to the Tier 1 list on page 15, and total Tier 1 module capacity on page 1 was corrected to 839GW, on November 22, 2023. On November 24, the excel for Figure 2 was updated with 4Q 2023 figures instead of the old 3Q 2023 ones.)

BNEF clients can access the full report here.