BloombergNEF publishes an annual Industrial Analytics Pricing Survey to help clients understand the pricing and business model trends for internet-of-things (IoT) and artificial intelligence (AI) software. The 2020 survey, published on December 15, aggregates and analyzes the business models of 35 industrial analytics companies surveyed globally. The surveyed companies span seed stage to established public firms, and the survey results are presented as an industry average or anonymous distribution.

Digital technologies are bringing significant benefits to the power, oil and gas and manufacturing sectors. However, many companies are still cautious about investing because of the uncertain as to the costs and business models of new software technologies.

The report also profiles eight companies successfully leveraging new and novel business models to create customer value. These include deploying value-based pricing to win customer trust, progressing their business models through a multi-phased contract, upgrading enterprise customers to a fixed yearly plan and forging strategic partnerships with customers.

New price trends indicate a maturing industrial analytic market

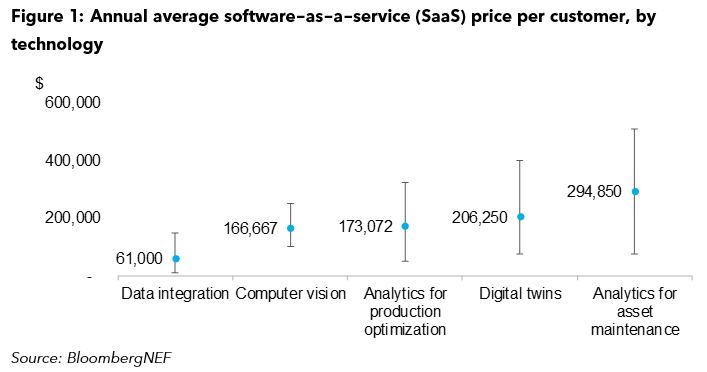

The prices of IoT and AI software for industrial assets are converging in 2020, an indicator of market maturity. Depending on the type of technology, a medium-size customer might spend $10,000 to $510,000 on industrial analytics software annually (Figure 1). Analytics for asset maintenance seems to be priced higher due to the expensive downtime it helps avoid. The software companies surveyed are converging around the average price of $200,000 for each medium-size customer.

The most common pricing strategy for software-as-a-service (SaaS) is still to charge per asset or device connected and analyzed. Almost 50% of surveyed companies set their prices by the number of assets connected, compared to 41% in 2019. However, companies are making their pricing more granular this year, to cover smaller assets and to help upsell customers. Digitalizing large-scale assets such as industrial gas turbines can cost four times more than small-scale assets such as motors.

The survey has shown that as digital technologies mature, software companies are able to lower the upfront installation and tailoring fee and offer more discounts for customers who scale their purchasing. The automation of data integration and model development could significantly reduce upfront costs required to tailor for each customer. The survey found that the average upfront fee companies charged is only 21% of the annual SaaS subscription fee this year, compared to 26% in 2019. Companies also give a discount of 10% to 50% to customers that either scale the software deployment to more assets, or commit for a longer term.

Covid-19 did not alter pricing strategies significantly

The survey shows that companies did not change their pricing strategies dramatically after the Covid-19 outbreak. Of the surveyed companies, 53% said they have maintained their baseline prices as a result of strong customer demand, while giving customers more benefits such as upgrading software functions or offering discounts. Fifteen percent of the companies have reduced prices as they want to grab a larger market share and squeeze competition.

Companies are exploring diversified business models beyond SaaS

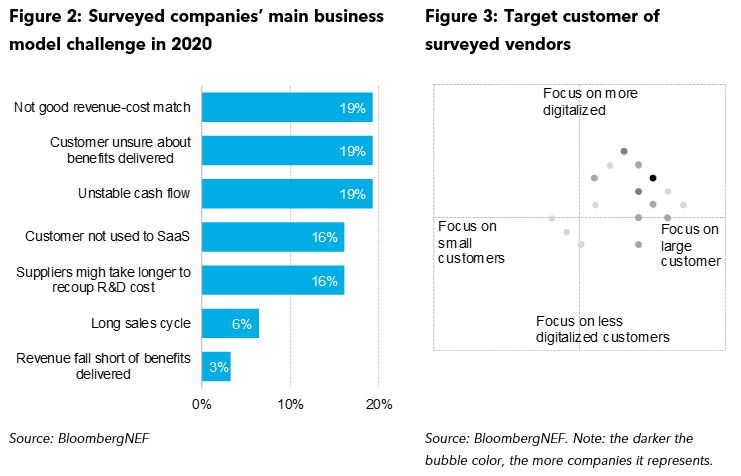

While cloud-based SaaS subscription is fast becoming the most popular way of selling industrial analytics using IoT or AI, it is not the only option. Of the surveyed companies, 35% said SaaS subscription does not provide them with a good revenue-cost match or prolong the time taken to recoup their R&D costs (see chart below). Another 19% said it might lead to unstable cash flow for their future planning. As a result, companies are exploring more diversified business models, with 24% of those surveyed selling a mixture of upfront licenses and SaaS subscription, compared to only 17% in 2019. Another 23% expressed an interest in an outcome-based model, where they can either reduce the downside risks for customers, or capture more upside benefits the software delivers.

Companies also adapted their SaaS models this year for a better revenue-cost match and cash-flow predictability. Hardware, such as sensors, are sometimes offered alongside the software deal to either collect or analyze data, but they can add to the overall cost of the software companies. While 56% of the companies surveyed in 2019 said they included the hardware cost in the SaaS subscription fee, 64% of companies this year charge separately for the hardware package. Companies have also been extending their contract terms with customers to ensure future revenues. Of the surveyed companies, 37% have a minimum 2-year commitment term, compared to 25% in 2019.

In 2020, software sales cycles are shorter…

Sales are taking less time this year; 55% of the surveyed companies said they had a shorter sales cycle this year despite Covid-19, and the average sales cycle is around 8 months. As companies get more validations from existing customers and refine their pricing models, it helps to shorten the sales time. While most of the surveyed companies said they aim to sell to larger and more digitalized customers, 35% said less digitalized customers are as good as, or even better, customers (see chart). Less digitalized customers tend to be more open toward different technology options and the value creation from software could be higher.

… and new technologies such as automation and low code help get the product up and running faster

The most commonly mentioned technology trends this year are automation, low-code tools and flexible deployment. Companies are working to automate not only data integration, but also AI model development that might otherwise require a lot of data scientist work. Almost 80% of the surveyed companies have some form of prebuilt or semi-standardized models. Another approach is to allow customers to tailor their model inputs or outputs; 44% of companies provide low-code tools for customers to tweak the data or AI models. Companies are open to deploying the software in the cloud as well as on the edge, and over half of surveyed companies said cloud expenses account for less than 10% of the overall cost.