By Amar Vasdev, Energy Economics, BloombergNEF

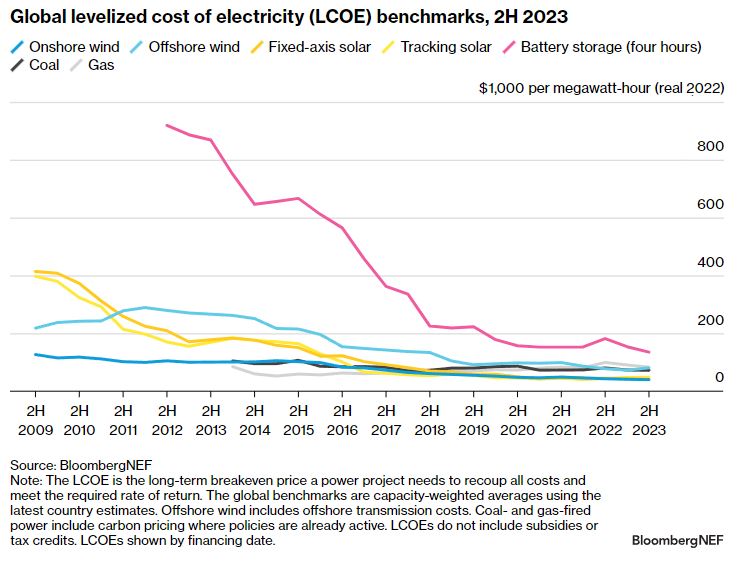

The cost of recently-financed projects is lower than twelve months ago for most major power-generating technologies. Input prices have fallen enough that they have offset higher financing costs. This is particularly the case for battery-storage projects, where costs have reached record lows. The cost recovery for new wind farms is uneven. European manufacturers and project developers are struggling with high costs.

- The benchmark levelized cost of electricity, or LCOE, for four-hour duration battery-storage projects is at the lowest since we began tracking project costs, and down 22% from the peak in 2H 2022. Lithium carbonate prices have fallen this year as a result of slower-than-expected demand growth and a rise of production capacity in 2023.

- Our benchmark fixed-axis solar LCOE has reached a record low of $41/MWh, $2/MWh below the previous bottom in 1H 2021. The long-term offtake price needed for such projects is 4% lower than this time last year. Polysilicon production capacity in mainland China has increased by 43%, resulting in module prices almost halving in the first 10 months of this year. BNEF expects prices to stabilize as producers are struggling to turn a profit in this period of excess supply.

- The cost of onshore and offshore wind projects in China continues to fall, but the same cannot be said for elsewhere. European wind project developers in particular are facing an uphill battle. European turbine manufacturers are reeling from high steel prices last year, meaning that project developers are paying 14% more on average compared to six months ago. This is in contrast to the 6% global average increase.

- The offshore wind sector has had a notoriously-difficult year with project delays and cancellations. Still, we expect the challenges the sector is facing to be short-lived, not an existential threat. Our current forward view is that LCOEs should fall by more than 10% in real terms for projects financed in 2025, and by one-third by 2035. Today’s fledgling markets, namely Japan and South Korea and the US, are expected to see LCOEs 39-44% lower in 2035 as these markets mature and costs drop.

BNEF clients can access the full report here.