By Vandana Gombar, BloombergNEF. This article first appeared on the Bloomberg Terminal.

A division of Royal Dutch Shell Plc recently acquired a 20% stake in India’s Orb Energy Pvt Ltd., a provider of rooftop solar systems to small and medium-sized enterprises. This followed a move earlier this year by Malaysia’s Petroliam Nasional Bhd. (Petronas) to buy 100% of Amplus Solar – a company providing rooftop solar to commercial and industrial customers – for about $390 million. CleanMax Solar, which provides solar systems to the same market segment, is also being approached by investors, Kuldeep Jain, the managing director of the company said in an interview.

“We don’t immediately need money, since we just concluded our round with U.K. Climate Investments, but global investors seeking a play in the commercial and industrial story are always reaching out to us,” Jain said.

Commercial and industrial users present an especially appealing use case for solar power. Since they pay India’s highest electricity tariffs, they can see an immediate saving when they switch to solar. This saving is at least 30%, despite surcharges and other levies imposed to protect the incumbent suppliers, according to Jain. “Everywhere in the world, distribution companies have lost market share. That will happen in India as well, ultimately. Protecting monopolies is a game of the past. It will not last.”

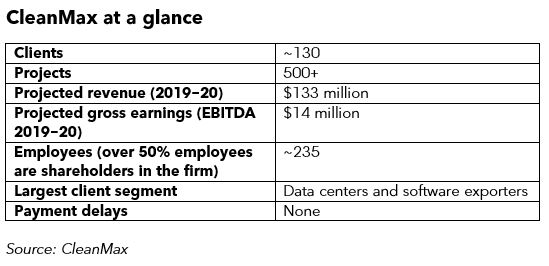

CleanMax, formally known as Clean Max Enviro Energy Solutions Pvt Ltd., claims to be the largest rooftop solar company in the country, with 190 megawatts installed, and also has a substantial portfolio (330 megawatts) of ground-mounted megawatt-scale plants. Its revenue is expected to almost triple to 9.5 billion rupees ($133 million) this financial year, ending March 2020, while gross earnings are projected to cross 1 billion rupees.

India’s rooftop solar installations currently total 2.2 gigawatts, according to government estimates. The target for 2022 is 40 gigawatts.

The Q&A with Kuldeep Jain is below.

Q: You started CleanMax Solar in 2011, and identified rooftop as a focus area in 2012, and then moved on to grid-scale ground-mounted solar a few years later. Did the rooftop market not evolve – or boom – as you expected it to, and that is what pushed you to non-rooftop projects?

A: Our mission is to be sustainability partners to private consumers of electricity. When we began in January 2011, we were piloting a gas-based cogeneration plant, and as natural gas prices went up, we transitioned to rooftop solar. One of the largest data center companies in India was a client of ours for rooftop solar. They called us and said that the impact of our work on their overall carbon footprint was almost negligible as a share of their overall power consumption. That was the trigger for our move to larger, grid-scale ground-mounted projects. The first one was commissioned in 2016. Our objective is to help clients meet 100% of their electricity requirement from clean energy, with a material cost saving.

We are focused on the commercial and industrial segment of the market, and are in a phenomenal period of growth.

Q: Would you agree that the Indian rooftop market has not really taken off, with current installations at a mere 2.1 gigawatts, against a target of 40 gigawatts by 2022?

A: Rooftop solar is a phenomenal product, because it has no cost of transmission and distribution. You make energy where you consume it. It is a very Gandhian concept, in its emphasis on self-reliance. For most of our clients however, rooftop solar cannot solve for more than 15% of their power consumption. A client with a 100% renewables ambition would need more than rooftop installations. There may be exceptions, for example one of our clients who manufactures cranes is meeting 80% of their load due to [having] massive roof sizes in comparison to their electrical load. Some sectors with very high and fast-growing power consumption, like data centers and software development parks, cannot even meet 2% of their power needs through rooftop solar, so you need alternative solutions. We are the largest company in India, in terms of rooftop solar installations, but we provide non-rooftop solutions too.

Q: Aside from a physical rooftop limitation, what is the biggest obstacle to expansion of this segment? What policy change can give a big boost to the market?

A: There are two recommendations, one of which I believe the government is already contemplating, and it has to do with finance. Companies like ours make the investment for setting up the solar plant, and are paid over a 20-year period. This is the opex [operating expenditure] model. Hence, we need to be careful about clients’ credit ratings and hence, the micro, small and medium enterprise or MSME segment cannot be serviced by us. We are targeting only the top 5% of the corporate universe, which is about 800 companies. That significantly limits the size of the market all players are focused on. If the government comes out with some form of a first-loss protection policy for rooftop solar built on an opex basis for clients with, say, a credit rating below A for the MSME segment, it would throw open the rooftop solar market to all corporates in India, which means thousands of new clients. That will create a huge market, and the industry will boom.

[My] second policy recommendation is to remove limits on net metering capacity, which allows credit for surplus rooftop solar generation fed into the grid. It is great that most states have a net metering policy, but the capacity is capped at 1 megawatt or less. There is an artificial ceiling on the installation size, so large rooftop installations are not able to be benefit.

Q: What if a company installs 10 megawatts of solar, and only net-meters 1 megawatt?

A: The economics will not work out. There will be a lot of wastage, for instance on a Sunday, when the factory is not working, and the power being generated goes to waste. The idea of net metering and power banking is to eliminate that wastage as a society. The 1-megawatt limit is preventing the growth of the industry. The limit should ideally be linked to the technical limitation, which typically is the contract demand.

Q: I guess this has been done to protect the revenue of the power distribution firms? It pits the new entrants versus incumbents…

A: This is a global trend. Consumers want to switch to cheaper and greener electricity. In any business, consumers have a right to switch to a cheaper and better alternative. By law, the same right is available to large consumers of electricity in India (via open access). Everywhere in the world, distribution companies have lost market share. That will happen in India as well, ultimately. Protecting monopolies is a game of the past. It will not last.

Q: Do you think the 40-gigawatt target for 2022 is too ambitious? Unachievable?

A: We have made massive investment plans of our own in support of these targets. In terms of potential, I would say 40 gigawatts is understating the potential. We can do a lot more if these policy prescriptions are implemented.

Q: What is the driver of your international expansion?

A: We are moving with our clients. We have begun operations in markets like the U.A.E. and Thailand. Further international expansion is definitely on the cards.

Q: Are your investors patient?

A: All our investors – Warburg Pincus, IFC, and more recently, Macquarie-managed U.K. Climate Investments – are long-term and fair minded investors in this region. We are well aligned with the investor community.

Q: Would you be looking at new investors at some point?

A: Our capital spend is around 12-15 billion rupees ($169-212 million) annually. We don’t immediately need money, since we just concluded our round with U.K. Climate Investments, but global investors seeking a play in the commercial and industrial story are always reaching out to us. At some point in the next 9-12 months, we shall surely raise more equity.

Q: The rooftop solar industry is probably waiting as keenly as the electric vehicle players for storage costs to come down. That would be a game changer? Do you see a serious flight from the grid soon?

A: We have done our first pilot in energy storage at one site. I think storage prices will fall sooner than predicted, as they did for solar. Going off-the-grid is extreme, and has reliability challenges. However, going 100% green is very much possible today for most corporates in India – 100% green at a 30% cost reduction. We are delivering renewable energy 30% cheaper than grid power, despite the surcharges.