By Vandana Gombar, Senior Editor, BloombergNEF

Tesla’s deal to share its fast-charging network for electric vehicles with Ford and General Motors could change the game in the US. It will lessen the one big anxiety for EV users – access to charging – which is often disguised as concern over range. That could lead to a bigger market for EVs over time if the alignment progresses smoothly.

The list of automakers coming around to Tesla’s charging vision continues to grow. Rivian announced its intention to incorporate Tesla’s charging ports into its future vehicles last week, while Volvo Car just unveiled its plan to do the same. That means select EVs will have more chargers that they can use.

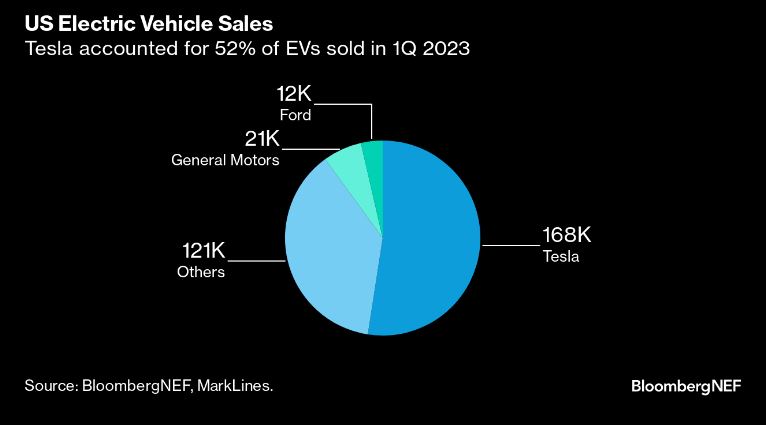

Over 60% of the EVs sold in the US in the first quarter of the year will now be on one standard – Tesla’s North American Charging Standard, or NACS. Charging service providers like ChargePoint Holdings, Blink and EVgo also intend to offer chargers compatible with this system.

It’s not certain NACS will dominate the future market though. “These automakers represent only a third of the overall car market, including EVs and non-EVs,” said Ryan Fisher, BloombergNEF’s charging infrastructure analyst. “Other automakers haven’t switched yet and are bringing many new models to market.”

Working out the nuts and bolts of this arrangement could end up adding to consumers’ anxiety over the transition period. “We don’t yet know how seamless this integration will be,” warned Corey Cantor, BNEF’s lead analyst tracking the US EV market.

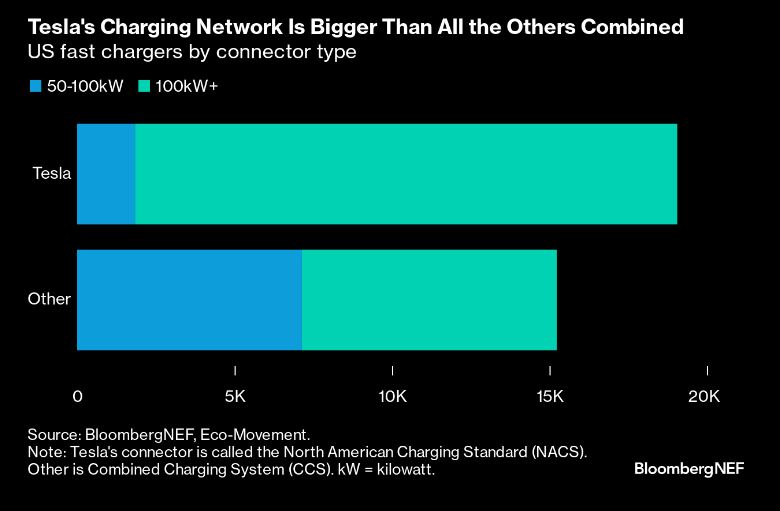

The US has the second-largest network of public chargers in the world behind China. The number of connectors installed in the country last year – 41,000 – was more than double those deployed in 2021.

Tesla already has the biggest fast-charging network and the recent spate of deals “gifts it a superior position to dominate US charging long term and increased leverage to set the terms of access,” said Fisher.

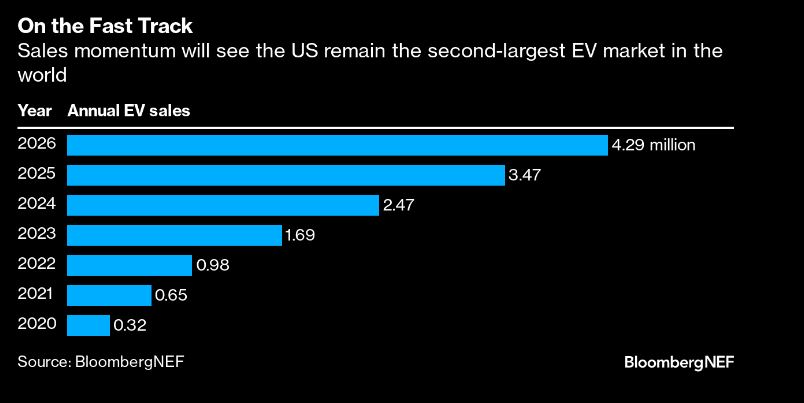

BNEF is projecting EV sales in the US will rise to 1.7 million this year, up from less than a million in 2022, in part due to the tax credit offered by the Inflation Reduction Act. The world’s second-largest EV market is on course to consolidate its position by 2026, with more than 4 million EVs expected to be sold in that year. That would represent close to 30% of the overall passenger vehicle market.

California is the nation’s leading EV market, with almost a fifth of passenger car sales in the state being electric – rapid progress from a mere 8% share in 2020.

The US EV market received another boost this month after the Department of Energy’s Loan Programs Office decided to award a record $9.2 billion to BlueOval SK – the joint venture between Ford and SK On – to support the construction of three battery plants in the US. This will help Ford onshore battery production and qualify for the IRA tax credit.