By Colin McKerracher, Head of Advanced Transport, BloombergNEF

As the US ramps up its efforts to onshore the lithium-ion battery supply chain, an uncomfortable truth is emerging: The world is awash in battery manufacturing capacity, and it’s going to make life very difficult for new entrants.

BloombergNEF estimates that lithium-ion battery demand across EVs and stationary storage came in at around 950 gigawatt hours last year. Global battery manufacturing capacity was more than twice that, at close to 2,600 GWh. China’s battery production in 2023 alone was similar to global demand.

The US is not alone in trying to increase its share of the global battery market. Canada is matching US incentives, while Europe, India and others also are awarding subsidies to grow their battery industries. This means the oversupply picture is going to get worse before it gets better.

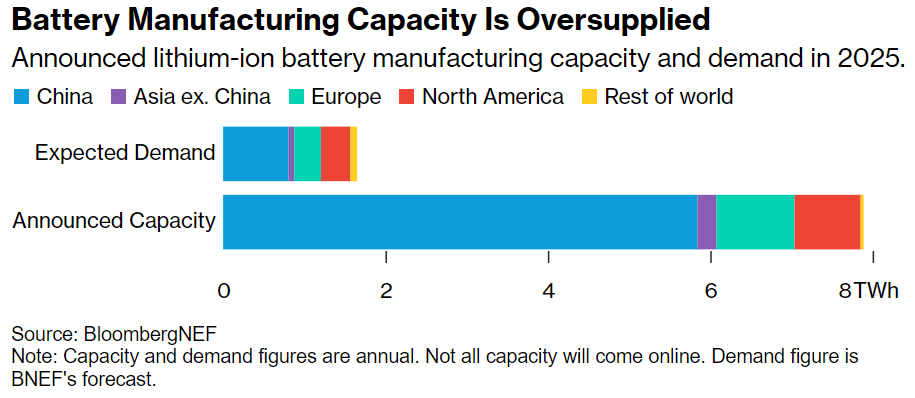

BNEF is tracking 7.9 TWh of annual battery manufacturing capacity announced for the end of 2025. That’s compared to demand projections of 1.6 TWh, and even that assumes steady EV demand growth and very rapid growth in batteries for storage applications. Even half that total announced capacity would be enough to equip almost every car sold in the world next year with a 50 kWh battery pack.

Now, quite a lot of that announced capacity simply won’t come online. Much of it will either be behind schedule or outright cancelled as the realities of scaling up become clearer and the list of contenders thins out. Other parts of the supply chain are not able to deliver at that level, and we can’t perfectly match supply to demand anyway, because EV batteries are not yet a commodity product. There are different formats, chemistries and other factors to consider, including automaker preferences and planned model launches. Plants also don’t typically run at their intended capacity, and utilization rates have been falling for the last few years.

Still, even with a hefty de-rating factor for how much actually comes online, the market is heading for even more serious oversupply.

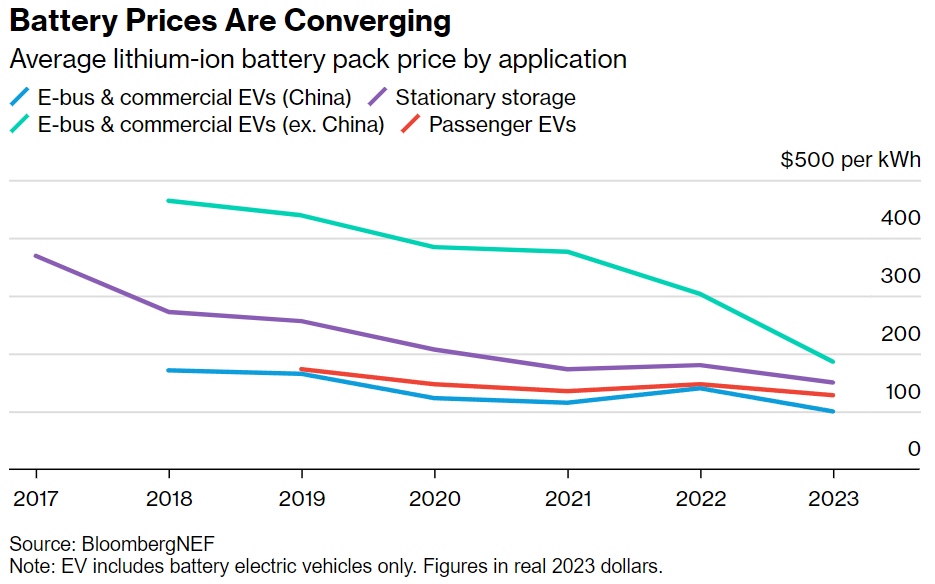

There are several big implications here. The first is that prices will fall and margins will get squeezed. That’s already happening, with a 14% dip in average battery pack prices in 2023, and China’s CATL announcing that it expects to be able to sell battery cells at the equivalent of less than $60 per kWh this year. Average capacity utilization of existing plants also will continue to fall after dropping in 2023.

Battery prices also are converging across sectors as manufacturers look for new markets for their products. A few years ago, commercial-vehicle batteries cost much more than those going into passenger cars, since trucks and vans represented much lower volumes and therefore had less buying power. But that gap has narrowed as the market has swung in favor of buyers and should continue to close as the overcapacity issue grows. That’s good news for electric-truck makers.

Low prices will make it difficult for new entrants to compete, even with generous support provided by the US Inflation Reduction Act and other means. Getting a factory built is one thing, but the production phase involves a whole new set of challenges, including cutting down scrappage rates, which typically start out high and then gradually come down over time. There’s a scenario that even those battery makers receiving generous support in the US and Europe are undercut by their Chinese rivals.

Part of this is because the current market leaders don’t really fit the bill of the complacent incumbent waiting to be disrupted. Quite the contrary — China’s BYD and CATL both continue to invest billions in R&D, are steadily launching new and better products, and in general are behaving more like scrappy startups than bloated corporate fiefdoms.

All this should be good for consumers, with lower prices starting to reach EVs in time for many cheaper models planned for launch in 2025 and 2026. Even models this year are looking very compelling, with the recently released Xiaomi SU7 EV using CATL’s new battery technology boasting up to 830 kilometers (516 miles) of range for the equivalent of $34,000 in China. The stationary storage market is already growing very rapidly and also will benefit.

Taken together, battery supply dynamics are now acting as a moderating factor for what happens on the demand side of the equation. When EV demand slows, battery prices fall, leading to lower prices and helping spur a recovery in demand.

The biggest question is how sustainable the low battery prices will be after the industry shakeout that invariably comes from overcapacity. Some of the current prices are simply driven by lower raw material costs for things like lithium, which is also oversupplied right now. That may not hold for long, since it’s easier to build a battery plant than it is to bring on new mining or refining capacity. Some of the price cuts are also likely due to established players looking to protect market share and force smaller ones out. But there’s definitely an element of technology and manufacturing improvement at play, as well.

Overcapacity is a boon for potential EV buyers, but marks a challenging time ahead for new entrants to the battery industry.